FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

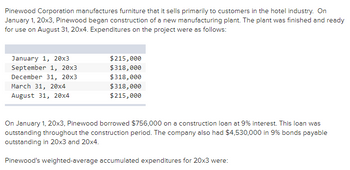

Transcribed Image Text:Pinewood Corporation manufactures furniture that it sells primarily to customers in the hotel industry. On

January 1, 20x3, Pinewood began construction of a new manufacturing plant. The plant was finished and ready

for use on August 31, 20x4. Expenditures on the project were as follows:

January 1, 20x3

September 1, 20x3

December 31, 20x3

March 31, 20x4

August 31, 20x4

$215,000

$318,000

$318,000

$318,000

$215,000

On January 1, 20x3, Pinewood borrowed $756,000 on a construction loan at 9% interest. This loan was

outstanding throughout the construction period. The company also had $4,530,000 in 9% bonds payable

outstanding in 20x3 and 20x4.

Pinewood's weighted-average accumulated expenditures for 20x3 were:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardA. If overhead for the year was $205,000, what were the profits of the residential and commercial services using labor-hours as the allocation base? B. Overhead consists of costs of traveling to the site, using equipment (including vehicle rental), and using supplies, which can be traced as follows.arrow_forwardWV Construction has two divisions: Remodeling and New Home Construction. Each division has an on-site supervisor who is paid a salary of $82,000 annually and one salaried estimator who is paid $46,000 annually. The corporate office has two office administrative assistants who are paid salaries of $50,000 and $37,000 annually. The president's salary is $153,000. How much of these salaries are common fixed expenses?arrow_forward

- WV Construction has two divisions: Remodeling and New Home Construction. Each division has an on-site supervisor who is paid a salary of $58,000 annually and one salaried estimator who is paid $52,000 annually. The corporate office has two office administrative assistants who are paid salaries of $38,000 and $31,000 annually. The president's salary is $127,000. How much of these salaries are common fixed expenses? $196,000 $306,000 $110,000 $127,000arrow_forwardBell Corporation manufactures computers. Assume that Bell: • allocates manufacturing overhead based on machine hours. • estimated 12,000 machine hours and $93,000 of manufacturing overhead costs. The predetermined overhead rate is $7.75 per machine hour. • actually used 15,000 machine hours and incurred the following actual costs: Indirect labor $14,000 Depreciation on plant 49,000 Machinery repair 17,000 Direct labor 75,000 Plant supplies 5,000 Plant utilities 10,000 Advertising 33,000 Sales commissions 23,000 How much manufacturing overhead would Bell allocate?arrow_forwardLoring Company incurred the following costs last year: Direct materials$216,000Sales salaries$65,000Factory rent24,000Advertising37,000Direct labor120,000Depreciation on the headquarters building10,000Factory utilities6,300Salary of the corporate receptionist30,000Supervision in the factory50,000Other administrative costs175,000Indirect labor in the factory30,000Salary of the factory receptionist28,000Depreciation on factory equipment9,000Sales commissions27,000 Required: Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, $216,000. Product CostPeriod CostCostsDirect MaterialsDirect LaborManufacturing OverheadSelling ExpenseAdministrative ExpenseDirect materials$216,000 What was the total product cost for last year? What was the total period cost for last year? If 30,000 units were produced last year, what was the unit product cost?arrow_forward

- I need the answer as soon as possiblearrow_forwardH6. Broduer Aquatics manufactures swimming pool equipment. Broduer estimates total manufacturing overhead costs next year to be $2,500,000 The company also estimates it will use 50,000 direct labour hours and incur $1,000,000 of direct labour cost next year. In addition, the machines are expected to be run for 30,000 hours. Compute the predetermined manufacturing overhead rate for next year under the following independent situations: 1. Assume that Brodeur uses direct labour hours as its manufacturing overhead allocation base. 2. Assume that Brodeur suses direct labour cost as its manufacturing overhead allocation base. 3. Assume that Brodeur uses machine hours as its manufacturing allocation basearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education