FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

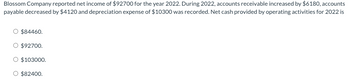

Transcribed Image Text:Blossom Company reported net income of $92700 for the year 2022. During 2022, accounts receivable increased by $6180, accounts

payable decreased by $4120 and depreciation expense of $10300 was recorded. Net cash provided by operating activities for 2022 is

$84460.

$92700.

$103000.

O $82400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cost of goods sold during the year was $341600. Inventory decreased by $11200 during the year and accounts payable decreased by $13400 during the year. Using the direct method of reporting cash flows from operating activities, cash payments for inventory total $355000. $343800. $366200. $317000.arrow_forwardSituation A: A company has revenues of P200,000 and operating expenses of P110,000 in its 1st year of operations, 2019. For the purpose ignore income taxes.Accounts receivable and accounts payable at year end were P71,000 and P29,000, respectively. Assume that the accounts payable related to operating expenses. Using the direct method, compute net cash provided by operating activities. Situation B:Cost of goods sold were at P310,000 and operating expenses (exclusive of depreciation) P230,000. The comparative balance sheet for the year shows that inventory increased P26,000, prepaid expenses decreased P8,000, accounts payable (related to merchandise) decreased P17,000, and accrued expenses payable increased P11,000. Compute (a) cash payments to suppliers and (b) cash payments for operating expenses.arrow_forwardAmes Company reported 2017 net income of $151,000. During 2017, accounts receivable increased by $13,000 and accounts payable increased by $9,500. Depreciation expense was $44,000. Prepare the cash flows from operating activities section of the statement of cash flows.arrow_forward

- Crane Company reported net income of $148,500. For 2020, depreciation was $45,100, and the company reported a gain on sale of investments of $12,100. Accounts receivable increased $25,100 and accounts payable decreased $23,100.Compute net cash provided by operating activities using the indirect method. Net cash provided by operating activitiesarrow_forwardCurrent Attempt in Progress Splish Brothers Inc. reported net income of $122400 for the year 2022. During 2022, accounts receivable increased by $8160, accounts payable decreased by $5440 and depreciation expense of $13600 was recorded. Net cash provided by operating activities for 2022 is A. $111520. B. $122400. C. $108800. D. $136000. eTextbook and Media Attempts: 0 of 1 usedarrow_forwardThe cash balance of Lalana Company is 434000OMR at the beginning of the year. The cash flows during the year are given as follows; Operating cash inflow:38490 Financing cash outflow: 22430 Investing inflow: 95800 Which of the following is the cash balance at the end of the year. Select one: a. 468890 b. 465760 C. 554520 d. 545860arrow_forward

- Windsor, Inc. reported net income of $76500 for the year 2022. During 2022, accounts receivable increased by $5100, accounts payable decreased by $3400 and depreciation expense of $8500 was recorded. Net cash provided by operating activities for 2022 is $69700. $85000. $68000. $76500.arrow_forwardNet cash flow from operating activities for 2021 for Vaughn Manufacturing was $497000. The following items are reported on the financial statements for 2021: Depreciation and amortization $ 31000 Cash dividends paid on common stock 18400 Increase in accounts receivable 35500 Based only on the information above, Vaughn’s net income for 2021 was:arrow_forwardThe net income reported on the income statement for the current year was $259000. Depreciation was $56000. Accounts receivable and inventories decreased by $5000 and $16000, respectively. Prepaid expenses and accounts payable increased, respectively, by $500 and $15000. Investments were sold at a loss of $21700. How much cash was provided by operating activities?arrow_forward

- The cost of goods sold during the year was $281200. Inventory increased by $9000 during the year and accounts payable decreased by $14100 during the year. Using the direct method of reporting cash flows from operating activities, cash payments for inventory total?arrow_forwardThe net income reported on the income statement for the current year was $255000. Depreciation was $39600. Account receivable and inventories decreased by $12300 and $35300, respectively. Prepaid expenses and accounts payable increased, respectively, by $1200 and $7600. How much cash was provided by operating activities? $305700 O $321100 $348600 O $333400arrow_forwardCurrent Attempt in Progress In the Crane Corporation, cash receipts from customers were $135000, cash payments for operating expenses were $101000, and one-third of the company's $8400 income taxes were paid during the year. Net cash provided by operating activities is: O $25600. O $28400. O $34000. O $31200.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education