Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I want to this question answer general accounting

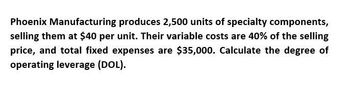

Transcribed Image Text:Phoenix Manufacturing produces 2,500 units of specialty components,

selling them at $40 per unit. Their variable costs are 40% of the selling

price, and total fixed expenses are $35,000. Calculate the degree of

operating leverage (DOL).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Manatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: The current product mix is 4:3:2. The three models share total fixed costs of $430,000. Calculate the sales price per composite unit. What is the contribution margin per composite unit? Calculate Manatoahs break-even point in both dollars and units. Using an income statement format, prove that this is the break-even point.arrow_forwardPolaris Inc. manufactures two types of metal stampings for the automobile industry: door handles and trim kits. Fixed cost equals 146,000. Each door handle sells for 12 and has variable cost of 9; each trim kit sells for 8 and has variable cost of 5. Required: 1. What are the contribution margin per unit and the contribution margin ratio for door handles and for trim kits? 2. If Polaris sells 20,000 door handles and 40,000 trim kits, what is the operating income? 3. How many door handles and how many trim kits must be sold for Polaris to break even? 4. CONCEPTUAL CONNECTION Assume that Polaris has the opportunity to rearrange its plant to produce only trim kits. If this is done, fixed costs will decrease by 35,000, and 70,000 trim kits can be produced and sold. Is this a good idea? Explain.arrow_forwardA company expects to sell 75,000 widgets at a price of $10.00. The unit variable costs are estimated at $8.00, and the fixed costs are estimated at $125,000. On the basis of this information, calculate the following: 1. Contribution margin 2. PV ratio 3. Revenue break-even by using the PV ratio 4. Profit generatedarrow_forward

- Crane Designs has fixed costs of $229,600 and produces one graphic arts product with a selling price of $85 and variable costs of $45 per unit. Crane is currently selling 10,865 units. (a) What is Crane Design's degree of operating leverage (DOL)? (Round answer to 2 decimal places, e.g. 5.25.) Your answer is correct. (b) Degree of operating leverage (DOL) (c) eTextbook and Media Your answer is correct. If sales revenues are expected to increase by 10%, what will be the expected operating profit? Expected operating profit $ eTextbook and Media * Your answer is incorrect. Expected net income Based on the above, what would be Crane's expected net income if its effective tax rate is 30%? eTextbook and Media 248,460 Save for Later 212 1,017,151 Attempts: unlimited Attempts: unlimited Attempts: unlimited Submit Answerarrow_forwardNatasha Industries has a product with a selling price per unit of $136, the unit variable cost is $46, and the total monthly fixed costs are $300,000. How much is Natasha contribution margin ratio?arrow_forwardWillie Company sells 30,000 units at $29 per unit. Variable costs are $20.30 per unit, and fixed costs are $138,300. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income.arrow_forward

- Bluegill Company sells 10,000 units at $400 per unit. Fixed costs are $200,000, and operating income is $1,800,000. Determine the following: a. Variable cost per unit $ b. Unit contribution margin $ per unit c. Contribution margin ratio %arrow_forwardRitchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $60 per unit. Variable selling expenses are $18 per unit, annual fixed manufacturing costs are $ 480,000, and fixed selling and administrative costs are $240, 000 per year. Required: Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Confirm your results by preparing a contribution margin income statement in excel for the break - even sales volume.arrow_forwardPorter Corporation has fixed costs of $500,000, variable costs of $32 per unit, and a contribution margin ratio of 20 percent. Compute the following. Unit sales price and unit contribution margin for the given product. The sales volume in units required for Porter Corporation to earn an operating income of $900,000. The dollar sales volume required for Porter Corporation to earn an operating income of $900,000.arrow_forward

- What is the unit variable cost ?arrow_forwardBerea Company expects to sell 9,000 units. Total fixed costs are $84,000 and the contribution margin per unit is $16.00. Berea's tax rate is 40%. What is the margin of safety in units? allallationearrow_forwardRitchie Manufacturing Company makes a product that it sells for $180 per unit. The company incurs variable manufacturing costs of $100 per unit. Variable selling expenses are $17 per unit, annual fixed manufacturing costs are $460,000, and fixed selling and administrative costs are $195,200 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Use the contribution margin ratio approach. d. Prepare a contribution margin income statement for the break-even sales volume. Complete this question by entering your answers in the tabs below. Req A to C Req D Determine the break-even point in units and dollars using the equation method, the contribution margin per unit approach and the contribution margin ratio approach. a. Break-even point in units a. Break-even point in dollars b. Contribution margin per unit b. Break-even point in units b. Break-even point…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning