Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give me correct answer and explanation.

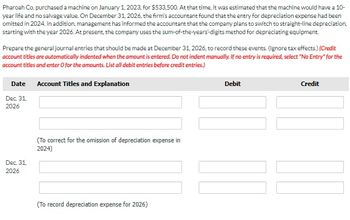

Transcribed Image Text:Pharoah Co. purchased a machine on January 1, 2023, for $533,500. At that time, it was estimated that the machine would have a 10-

year life and no salvage value. On December 31, 2026, the firm's accountant found that the entry for depreciation expense had been

omitted in 2024. In addition, management has informed the accountant that the company plans to switch to straight-line depreciation.

starting with the year 2026. At present, the company uses the sum-of-the-years'-digits method for depreciating equipment

Prepare the general journal entries that should be made at December 31, 2026, to record these events. (Ignore tax effects.) (Credit

account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts. List all debit entries before credit entries.)

Date Account Titles and Explanation

Dec. 31,

2026

Debit

Credit

Dec. 31,

2026

(To correct for the omission of depreciation expense in

2024)

(To record depreciation expense for 2026)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.arrow_forwardDuring 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.arrow_forwardAt the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.arrow_forward

- Alpesharrow_forwardHeadland Co. purchased a machine on January 1, 2018, for $594,000. At that time, it was estimated that the machine would have a 10-year life and no salvage value. On December 31, 2021, the firm's accountant found that the entry for depreciation expense had been omitted in 2019. In addition, management has informed the accountant that the company plans to switch to straight-line depreciation, starting with the year 2021. At present, the company uses the sum-of-the-years-digits method for depreciating equipment. Prepare the general journal entries that should be made at December 31, 2021, to record these events. (Ignore tax effects.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 (To correct for the omission of depreciation expense in 2019.) Dec. 31, 2021 (To record depreciation…arrow_forwardWildhorse Co. purchased a machine on January 1, 2018, for $500,500. At that time, it was estimated that the machine would have a 10-year life and no salvage value. On December 31, 2021, the firm's accountant found that the entry for depreciation expense had been omitted in 2019. In addition, management has informed the accountant that the company plans to switch to straight-line depreciation, starting with the year 2021. At present, the company uses the sum-of-the-years-digits method for depreciating equipment. Prepare the general journal entries that should be made at December 31, 2021, to record these events. (Ignore tax effects.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts.) Account Titles and Explanation Date Dec. 31, 2021 Dec. 31. 2021 (To correct for the omission of depreciation expense in 2019.) (To record depreciation expense for…arrow_forward

- Teal Co. purchased a machine on January 1, 2018, for $588,500. At that time, it was estimated that the machine would have a 10-year life and no salvage value. On December 31, 2021, the firm’s accountant found that the entry for depreciation expense had been omitted in 2019. In addition, management has informed the accountant that the company plans to switch to straight-line depreciation, starting with the year 2021. At present, the company uses the sum-of-the-years’-digits method for depreciating equipment.Prepare the general journal entries that should be made at December 31, 2021, to record these events. (Ignore tax effects.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 (To correct for the omission of depreciation expense in…arrow_forwardJoy Cunningham Co. purchased a machine on January 1, 2018, for $550,000. At that time, it was estimated that the machine would have a 10-year life and no salvage value. On December 31, 2021, the firm's accountant found that the entry for depreciation expense had been omitted in 2019. In addition, management has informed the accountant that the company plans to switch to straight-line depreciation, starting with the year 2021. At present, the company uses the sum-of-the-years'-digits method for depreciating equipment. Instructions Prepare the general journal entries that should be made at December 31, 2021, to record these events. (Ignore tax effects.)arrow_forwardMetlock Corporation purchased a new machine for its assembly process on August 1, 2025. The cost of this machine was $141,600. The company estimated that the machine would have a salvage value of $15,600 at the end of its service life. Its life is estimated at 5 years, and its working hours are estimated at 20,000 hours. Year-end is December 31. Compute the depreciation expense under the following methods. Each of the following should be considered unrelated. (Round A depreciation rate per hour to 2 decimal places, e.g. 5.35 for computational purposes. Round your answers to O decimal places, e.g. 45,892.) (a) (b) (c) Straight-line depreciation for 2025 Activity method for 2025, assuming that machine usage was 850 hours Sum-of-the-years'-digits for 2026 (d) Double-declining-balance for 2026 eTextbook and Media Save for Later Search $ $ $ DELL Attempts: 0 of 3 used D Submit Answerarrow_forward

- Rayya Co. purchases and installs a machine on January 1, 2017, at a total cost of $134,400. Straight-line depreciation is taken each year for four years assuming a eight-year life and no salvage value. The machine is disposed of on July 1, 2021, during its fifth year of service. Prepare entries to record the partial year’s depreciation on July 1, 2021, and to record the disposal under the following separate assumptions: (1) The machine is sold for $67,200 cash. (2) An insurance settlement of $56,448 is received due to the machine’s total destruction in a fire.arrow_forwardConcord Corporation purchased a new machine for its assembly process on August 1, 2025. The cost of this machine was $129,600. The company estimated that the machine would have a salvage value of $12,600 at the end of its service life. Its life is estimated at 5 years, and its working hours are estimated at 20,000 hours. Year-end is December 31. Compute the depreciation expense under the following methods. Each of the following should be considered unrelated. (Round depreciation rate per hour to 2 decimal places, e.g. 5.35 for computational purposes. Round your answers to O decimal places, e.g. 45,892.) (a) Straight-line depreciation for 2025 (b) (c) (d) Activity method for 2025, assuming that machine usage was 800 hours Sum-of-the-years'-digits for 2026 Double-declining-balance for 2026 $ $ LA $ 9,750 4,680 31,200 43,200arrow_forwardLangley Corporation replaced an HVAC system in one of its warehouses in July, 2021, at a cost of $430,000. The accountant recording the purchase charged it to repairs and maintenance expense. The error was discovered late in 2022 while reconciling depreciation expense for 2022. The system should last about 7 years with no salvage value. What entry should be made before the 2022 books are closed if the company uses straight-line depreciation? (Round intermediate calculations to the nearest cent and your final answer to the nearest dollar.) Group of answer choices Warehouse 430,000 Depreciation Expense—Warehouse 61,429 Retained Earnings 491,429 Warehouse 430,000 Depreciation Expense (2022)—Warehouse 61,429 Accumulated Depreciation—Warehouse92,144 Retained Earnings—Prior Period Adjustment 399,285 Warehouse 430,000 Accumulated Depreciation -Warehouse 61,429 Retained Earnings—Prior Period Adjustment 368,571 Retained…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning