FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

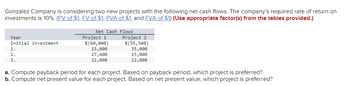

Transcribed Image Text:Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on

investments is 10%. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

Year

Initial investment

1.

2.

3.

Net Cash Flows

Project 1

$(60,000)

15,000

27,400

22,000

Project 2

$(55,500)

35,000

15,000

22,000

a. Compute payback period for each project. Based on payback period, which project is preferred?

b. Compute net present value for each project. Based on net present value, which project is preferred?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on investments is 10%. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Initial investment 1. 2. 3. Required A Required B a. Compute payback period for each project. Based on payback period, which project is preferred? b. Compute net present value for each project. Based on net present value, which project is preferred? Complete this question by entering your answers in the tabs below. Net Cash Flows $ Project 1 $(42,000) 10,500 27,800 18,500 Compute payback period for each project. Based on payback period, which project is preferred? Note: Cumulative net cash outflows must be entered with a minus sign. Do not round your intermediate calculations. Round your Payback Period answer to 2 decimal places. $ $ $ Project 1 Year 1 Year 2 Year 3 Totals Initial investment Net present value Project 2 Year 1 Year 2…arrow_forwardYou've estimated the following cash flows (in $) for a project: A B 1 Year Cash flow The required return for the project is 8%. Part 1 What is the IRR for the project? 3+ decimals Submit 2 0 -5,200 3 1 1,300 4 2 2,100 5 3 4,000 2 Attempt Attemparrow_forwardGonzalez Company is considering two new projects with the following net cash flows. The company’s required rate of return on investments is 10%. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Year Net Cash Flows Project 1 Project 2 Initial investment $(46,000) $(74,000) 1. 11,500 35,000 2. 25,900 20,000 3. 21,500 25,000 Compute payback period for each project. Based on payback period, which project is preferred? Compute net present value for each project. Based on net present value, which project is preferred? Complete this question by entering your answers in the tabs below. Required A Required B Compute payback period for each project. Based on payback period, which project is preferred?Note: Cumulative net cash outflows must be entered with a minus sign. Do not round your intermediate calculations. Round your Payback Period answer to 2 decimal places.…arrow_forward

- Newland Company is considering investing in one of two projects – A or B. The initial cost and net cash inflows from each project are shown below. The discount rate for both projects is 18% per cent. Cash Flow Project A Project B $ $ Initial Cost 3,000,000 3,500,000 Net Cash Inflows Year 1 800,000 1,000,000 Year 2 800,000 1,000,000 Year 3 1,200,000 700,000 Year 4 1,200,000 800,000 Year 5 1,200,000 800,000 Year Factor 1 0.8475 2 0.7182 3 0.6086 4 0.5158 5 0.4371 Discount factors for the projects @18% per annum are as follows: Required: Calculate the payback period for each project and identify the project in which the company should invest, giving ONE reason for your choice. Calculate the Accounting Rate of Return on initial capital for each projectarrow_forwards. Subect :- Accountingarrow_forwardFollowing is information on two alternative investments being considered by Jolee Company. The company requires a 12% return from its investments. Project A Project B Initial investment $ (187,325 ) $ (156,960 ) Expected net cash flows in: Year 1 55,000 35,000 Year 2 49,000 48,000 Year 3 79,295 55,000 Year 4 95,400 66,000 Year 5 55,000 27,000 a. For each alternative project compute the net present value.b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose?arrow_forward

- Following is information on two alternative investment projects being considered by Tiger Company. The company requires a 5% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project X1 Project X2 Initial investment $ (102,000) $ (164,000) Net cash flows in: Year 1 36,000 76,500 Year 2 46,500 66,500 Year 3 71,500 56,500 a. Compute each project’s net present value.b. Compute each project’s profitability index.c. If the company can choose only one project, which should it choose on the basis of profitability index? Please answer "C" as well. I wasn't able to include that in the imagesarrow_forwardFollowing is information on two alternative investments projects being considered by Tiger Company. The company requires a 15% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project X1 Initial investment $ (100,000) Net cash flows in: Year 1 37,000 Year 2 Year 3 47,500 72,500 Project X2 $ (150,000) 78,000 68,000 58,000 a. Compute each project's net present value. b. Compute each project's profitability index. If the company can choose only one project, which should it choose on th basis of profitability index? Complete this question by entering your answers in the tabs below. Required A Required B Compute each project's net present value. (Round your answers to the nearest whole dollar.) Net Cash Present Value of Present Value of Flows 1 at 15% Net Cash Flows Project X1 Year 1 Year 2 Year 3 Totals Initial investment Net present value $ 0 $ 0 $ 0 Project X2 Year 1 Year 2 Year 3 Totals $ 0 $ EA Initial…arrow_forwardNote: Question 12, 13, 14 and 15 are based on the same two projects A and B. Your firm has estimated the following cash flows for two mutually exclusive capital investment projects. Firm uses 4.9 years as the cutoff for the discounted payback period. The firm's required rate of return is 11%. What is the Pl of project B? Project A Cash Flow Year Project B Cash Flow -$80,000 -$180,000 1 $23,000 $53,000 $23,000 $53,000 3 $23,000 $47,000 4 $20,000 $47,000 5 $20,000 $40,000 6 $20,000 $27,000 1.21 2.21 1.36 1.08 1.15arrow_forward

- Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on investments is 10%. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net Cash Year Project 1 Flows Project 2 Initial investment $ (60,000) $ (60,000) 1. 30,000 35,000 2. 3. 30,000 5,000 20,000 20,000 a. Compute payback period for each project. Based on payback period, which project is preferred? b. Compute net present value for each project. Based on net present value, which project is preferred? Complete this question by entering your answers in the tabs below. Required A Required B Compute net present value for each project. Based on net present value, which project is preferred? (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) Net Cash Flows Present Value Factor Present Value of Net Cash Flows Project 1 Year 1 Year 2arrow_forwardNote: Question 12, 13, 14 and 15 are based on the same two projects A and B. Your firm has estimated the following cash flows for two mutually exclusive capital investment projects. Firm uses 4.9 years as the cutoff for the discounted payback period. The firm's required rate of return is 11%. What is the IRR of project B? Project A Cash Flow Year Project B Cash Flow -$80,000 -$180,000 1 $23,000 $53,000 2 $23,000 $53,000 3 $23,000 $47,000 4 $20,000 $47,000 $20,000 $40,000 6 $20,000 $27,000 O 16.21% 10.55% 13.98% O 13.65% 12.22%arrow_forwardappy Dog Soap Company is considering investing $3,000,000 in a project that is expected to generate the following net cash flows:YearCash FlowYear 1 $275,000Year 2 $400,000Year 3 $425,000Year 4 $475,000Happy Dog Soap Company uses a WACC of 7% when evaluating proposed capital budgeting projects. Based on these cash flows, determine this project’s PI (rounded to four decimal places): 0.5263 0.4167 0.4605 0.4386arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education