FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

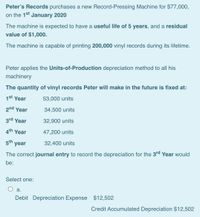

Transcribed Image Text:Peter's Records purchases a new Record-Pressing Machine for $77,000,

on the 1st January 2020

The machine is expected to have a useful life of 5 years, and a residual

value of $1,000.

The machine is capable of printing 200,000 vinyl records during its lifetime.

Peter applies the Units-of-Production depreciation method to all his

machinery

The quantity of vinyl records Peter will make in the future is fixed at:

1st Year

53,000 units

2nd Year

34,500 units

3rd Year

32,900 units

4th Year

47,200 units

5th year

32,400 units

The correct journal entry to record the depreciation for the 3rd Year would

be:

Select one:

а.

Debit Depreciation Expense $12,502

Credit Accumulated Depreciation $12,502

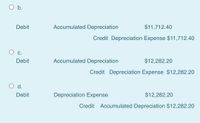

Transcribed Image Text:O b.

Debit

Accumulated Depreciation

$11,712.40

Credit Depreciation Expense $11,712.40

С.

Debit

Accumulated Depreciation

$12,282.20

Credit Depreciation Expense $12,282.20

d.

Debit

Depreciation Expense

$12,282.20

Credit Accumulated Depreciation $12,282.20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, reliable delivery service purchased a truck at a cost of $65,000. Before placing the truck in service, reliable spent $2500 painting it $2500 replacing tires, and $9500 over hauling the engine the truck should remain in service for five years and have a residual value of $6000. the trucks annual mileage is expected to be 23,000 miles in each of the first four years and 13,000 miles in the fifth year – 105,000 miles in total. And deciding which depreciation method to use Harold Parker, the general manager, requesting depreciation schedule for each of the depreciation methods.( straight line units of production and double declining balance.) prepare the schedules. arrow_forwardSpeed, Inc., is a shipping company. On 1/1/20, the company purchases a new commercial sleeper truck for $790,000 cash. The expected residual value of the truck is $60,000 and the expected useful life is 10 years. The company estimates that the truck will be used to drive 1,000,000 miles over its useful life (120,000 miles in 2020; 90,000 miles in 2021 & all subsquent years). For the units-of-activity method, round the depreciaiton-per-unit to two decimal places before using it. You PART A - STRAIGHT LINE DEPRECIATION Income StatementDepreciation Expense Year Ended 12/31/2020fill in the blank 1 Year Ended 12/31/2021 fill in the blank 2 Balance SheetAccumulated Depreciation As of 12/31/2020fill in the blank 3 As of 12/31/2021fill in the blank 4 PART B - UNITS-OF-ACTIVITY DEPRECIATION Income StatementDepreciation Expense Year Ended 12/31/2020fill in the blank 5 Year Ended 12/31/2021 fill in the blank 6 Balance SheetAccumulated Depreciation As of 12/31/2020fill in the…arrow_forwardJarrod has a small business where he produces ping pong balls. He has an opportunity to update his production process with a piece of equipment that costs $46,000 on June 10, 2023. A new trimming machine for when the ball is being formed. The equipment is expected to have a 12-year service life. The trimming machine also has an estimated residual value of $9,000. Determine for the year 2022 the depreciation expense for each of the methods listed. 1.Straight line 2. Sum-of-the-years'-digits 3. Double-declining balancearrow_forward

- At the beginning of 2020, your company buys a $30,400 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 6,000. The company expects to produce a total of 200,000 units. Actual production is as follows: 47,000 units in 2020, 50,000 units in 2021, 52,000 units in 2022, and 51,000 units in 2023.Required: Determine the depreciable cost. Calculate the depreciation expense per year under the straight-line method. Use the straight-line method to prepare a depreciation schedule. Calculate the depreciation rate per unit under the units-of-production method. Use the units-of-production method to prepare a depreciation schedule.arrow_forwardi need the answer quicklyarrow_forward8. On January 1, 2019, Sapphire Manufacturing Company purchased a machine for $40,000,000. The company expects to use the machine for 24,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $40,000. The schedule of usage of the machine is below. Year Usage 1 4,500 2 6,000 3 5,200 4 4,300 5 2,000 6 2,000 Prepare the depreciation schedule using the units-of-production method of depreciation.arrow_forward

- A machine that produces cellphone components is purchased on January 1, 2024, for $171,000. It is expected to have a useful life of four years and a residual value of $12,000. The machine is expected to produce a total of 200,000 components during its life, distributed as follows: 40,000 in 2024, 50,000 in 2025, 60,000 in 2026, and 50,000 in 2027. The company has a December 31 year end. (a) Calculate the amount of depreciation to be charged each year, using each of the following methods: i. Straight-line method Straight-line method depreciation Senter a dollar amount per year per year ii. Units-of-production method (Round depreciation per unit to 3 decimal places, e.g. 15.257 and depreciation expense to 0 decimal places, e.g. 125.) Units-of-production method depreciation Senter a dollar amount per unit rounded to 3 decimal places per unit Year Depreciation Expense 2024 Senter a dollar amount 2025 Senter a dollar amount 2026 Senter a dollar amount 2027 Senter a dollar amount iii.…arrow_forwardA photocopier bought at 5000 dollars was put to use as follows: First year 3000 hours Second year 4500 hours Third year 3900 hours. The trade in value of the photocopier is 1000 and it has a useful life that is estimated up yo 40000 hours. You are to calculate the depreciation at the end of the 3years and completing the book value and the remaining useful value of that periodarrow_forwardAndres Gimenez is considering purchasing the DoublePlay 3000 machine. The machine will cost Ahmed $100,000 and he estimates it will last two years after which he will sell the machine for $30,000. The machine is considered specialty equipment under MACRS depreciation and depreciated over 4 years as shown below. The tax rate is 40%. Revenue Fixed Costs SG&A expenses Depreciation I EBIT Taxes Year 1 Year 2 $125,000 $ 125,000 $ 40,000 $ 40,000 20,000 20,000 33,333 44,450 $ 31,667 $ 20,550 8,220 12,667 Net Income $19,000 $ 12,330 1. What is the net present value of the investment, assuming an interest rate of 10%? 2. What is the internal rate of return of the investment?arrow_forward

- Bart paid $150,000 for a piece of equipment for his business. Bart's income statement puts the straight line depreciation rate at 20%, and the equipment is expected to have a residual value of $1,000 at the end of its useful life, which is expected to be five years. Total Book Value Useful life $150,000 5 years 20% Straight line depreciation (%) Double declining balance (5) Double Declining Balance Depreciation Book Value Year (Beginning of Year) 1 2 5 Depreciation Rate Depreciation Expense Accumulated Depreciation Book Value (End of Year) Using double declining balance depreciation, what is the value of the piece of equipment at the end of year one? O $60,000 0 $90,000 $100,000arrow_forwardCrane Company bought a machine on January 1, 2022. The machine cost $166000 and had an expected salvage value of $20000. The life of the machine was estimated to be 4 years. The book value of the machine at the beginning of the third year would bearrow_forwardKenzie Company purchased a 3-D printer for $411,000. Although this printer is expected to last for ten years, Kenzie knows the technology will become old quickly and so she plans to replace this printer in three years. Kenzie Company will be able to sell the printer for $30,000. Using the double-declining-balance method, what amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded? Round final answers to nearest whole dollar amount. Depreciation Expense BookValue Year 1 $fill in the blank 1 $fill in the blank 2 Year 2 $fill in the blank 3 $fill in the blank 4 Year 3 $fill in the blank 5 $fill in the blank 6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education