Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

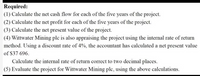

Transcribed Image Text:Required:

(1) Calculate the net cash flow for each of the fíve years of the project.

(2) Calculate the net profit for each of the five years of the project.

(3) Calculate the net present value of the project.

(4) Wittwater Mining plc is also appraising the project using the internal rate of return

method. Using a discount rate of 4%, the accountant has calculated a net present value

of $37 696.

Calculate the internal rate of return correct to two decimal places.

(5) Evaluate the project for Wittwater Mining plc, using the above calculations.

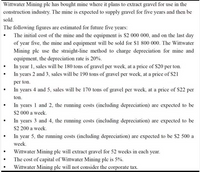

Transcribed Image Text:Wittwater Mining ple has bought mine where it plans to extract gravel for use in the

construction industry. The mine is expected to supply gravel for five years and then be

sold.

The following figures are estimated for future five years:

• The initial cost of the mine and the equipment is $2 000 000, and on the last day

of year five, the mine and equipment will be sold for $1 800 000. The Wittwater

Mining ple use the straight-line method to charge depreciation for mine and

equipment, the depreciation rate is 20%.

In year 1, sales will be 180 tons of gravel per week, at a price of S20 per ton.

In years 2 and 3, sales will be 190 tons of gravel per week, at a price of $21

per ton.

In years 4 and 5, sales will be 170 tons of gravel per week, at a price of $22 per

ton.

In years 1 and 2, the running costs (including depreciation) are expected to be

S2 000 a week.

• In years 3 and 4, the running costs (including depreciation) are expected to be

S2 200 a week.

In year 5, the running costs (including depreciation) are expected to be $2 500 a

week.

Wittwater Mining ple will extract gravel for 52 weeks in each year.

The cost of capital of Wittwater Mining ple is 5%.

Wittwater Mining plc will not consider the corporate tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Below is a summary of information related to an expansion project your company is considering: The required equipment for the project is expected to cost $1,200,000 including shipping and installation costs and have a useful life of 4 years, which is the estimated length of the project. • The equipment will be depreciated using the straight-line method, meaning depreciation will be the same each year. Inventory is expected to increase $100,000 at the beginning of the project. The company estimates that it will sell 3,000,000 units in Year 1, 2,750,000 units in Year 2, 2,700,000 units in Year 3, and 2,250,000 units in Year 4. The company expects to sell the units at $2.50 each. The company estimates variable costs to be $1.00 each unit in Year 1, $1.25 each unit in Year 2, $1.40 each unit in Year 3, and $1.65 each unit in Year 4. Fixed costs are estimated to be $1,000,000 each year of the project. The estimated tax rate is expected to be 25%. The company is expecting to salvage the…arrow_forwardNikularrow_forwardWildhorse's Custom Construction Company is considering three new projects, each requiring an equipment investment of $26,840. Each project will last for 3 years and produce the following net annual cash flows. Year AA BB CC 1 $8,540 $12,200 $15,860 2 10,980 12,200 14,640 3 14,640 12,200 13,420 Total $34,160 $36,600 $43,920 The equipment's salvage value is zero, and Wildhorse uses straight-line depreciation. Wildhorse will not accept any project with a cash payback period over 2 years. Wildhorse's required rate of return is 12%. Click here to view PV table. (a) Compute each project's payback period. (Round answers to 2 decimal places, e.g. 15.25.) AA BB years years CC yearsarrow_forward

- Esquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be appropriate are presently on the market. The company has determined the following: Machine A could be purchased for $22,000. It will last 10 years with annual maintenance costs of $800 per year. After 10 years the machine can be sold for $2,310. Machine B could be purchased for $20,000. It also will last 10 years and will require maintenance costs of $3,200 in year three, $4,000 in year six, and $4,800 in year eight. After 10 years, the machine will have no salvage value. Required: Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the end of each year. Ignore income tax considerations. Calculate the present value of Machine A & Machine B. Which machine Esquire should purchase? Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round…arrow_forwardInformation for Terra Corp. Terra Corp is considering the purchase of a machine that is expected to cost $180,000. The machine will require an additional $40,000 to have it shipped, modified, and installed. The purchase of this machine is expected to require additional working capital of $20,000 upfront, which will be liquidated when the machine is sold off. Terra expects to use the machine for 4 years, and then sell it for $95,000. The machine will be fully depreciated over the four years, at a constant rate. In each of the four years, Terra’s revenues are expected to be $85,000 higher than they would be without the machine. Annual operating costs (not including depreciation) will also be higher, however, to the extent of $19,000. The firm pays a 30% rate in taxes, and its cost of capital is 7.5%. The initial outflow of cash for the proposed project is expected to be: $220,000 $200,000 $180,000 $190,000 $240,000arrow_forwardOne of two methods will produce solar panels for electric power generation. Method 1 will have an initial cost of $550,000, an annual operating cost of $160,000 per year, and a $125,000 salvage value after its three-year life. Method 2 will cost $830,000 with an annual operating cost of $120,000, and a $240,000 salvage value after its five-year life. The company has asked you to determine which method is economically better, but it wants the analysis done over a three-year planning period. The salvage value of Method 2 will be 35% higher after 3 years than it is after 5 years. If the company’s MARR is 10% per year, which method should the company select?arrow_forward

- Information for Terra Corp. Terra Corp is considering the purchase of a machine that is expected to cost $180,000. The machine will require an additional $40,000 to have it shipped, modified, and installed. The purchase of this machine is expected to require additional working capital of $20,000 upfront, which will be liquidated when the machine is sold off. Terra expects to use the machine for 4 years, and then sell it for $95,000. The machine will be fully depreciated over the four years, at a constant rate. In each of the four years, Terra’s revenues are expected to be $85,000 higher than they would be without the machine. Annual operating costs (not including depreciation) will also be higher, however, to the extent of $19,000. The firm pays a 30% rate in taxes, and its cost of capital is 7.5% The net present value of the project is estimated to be: $34,774 $37,694 $23,976 $16,353 $1,337arrow_forwardA small strip mining cola company is trying to decide whether it should purchase or lease a new clamshell. If purchased, the shell will cost $150,000 and is expected to have a $65,000 salvage value after 6 years. Alternatively, the company can lease a clamshell for $20,000 per year, but the lease payment will have to be made at the beginning of each year. If the clamshell is purchased, it will be leased to other strip-mining companies whenever possible, an activity that is expected to yield revenue of $12,000 per year. If the company’s MARR is 15% per year, should the clamshell be purchased or leased on the basis of future worth analysis. (Enter the FW value of the selected alternative with proper positive or negative sign)arrow_forwardIn 2021, the Marion Company purchased land containing a mineral mine for $1,740,000. Additional costs of $676,000 were incurred to develop the mine. Geologists estimated that 400,000 tons of ore would be extracted. After the ore is removed, the land will have a resale value of $116,000. To aid in the extraction, Marion built various structures and small storage buildings on the site at a cost of $184,000. These structures have a useful life of 10 years. The structures cannot be moved after the ore has been removed and will be left at the site. In addition, new equipment costing $96,000 was purchased and installed at the site. Marion does not plan to move the equipment to another site, but estimates that it can be sold at auction for $4,000 after the mining project is completed. In 2021, 60,000 tons of ore were extracted and sold. In 2022, the estimate of total tons of ore in the mine was revised from 400,000 to 451,000. During 2022, 96,000 tons were extracted. Required: 1. Compute…arrow_forward

- McKnight Co. is considering acquiring a manufacturing plant. The purchase price is $1,100,000. The owners believe the plant will generate net cash inflows of $325,000 annually. It will have to be replaced in seven years. Use the payback method to determine whether McKnight should purchase this plant. Round to one decimal place. Select the formula, then enter the amounts to calculate the payback period for the plant. (Round payback to one decimal place, X.X.) = Payback + = The payback occurs the plant must be replaced, so the payback method purchasing the plant. ne 41 1 2 Q A exactly when well after well before (a 2 W S #t * 3 LU E D $ 4 % 5 R T FIL 40 6 W & years hp 7 Y H G 8 J ( 9 K fio ► 11 O BUD P [ . 4 pause L ? enter og uparrow_forwardOn March 1, 2024, a company entered into an agreement with the state to obtain the rights to operate a mineral mine for $6 million. The mine is expected to produce 155,000 tons of mineral. As part of the agreement, the company agrees to restore the land to its original condition after mining operations are completed in approximately five years. Management has provided the following possible outflows for the restoration costs that will occur five years from now: (PV of $1. PVA of $1) Cash Outflow $ 520,000 675,000 830,000 Probability 20% 30% 50% The company's credit-adjusted risk-free interest rate is 9%. During 2024, the company extracted 27,900 tons of ore from the mine. How much accretion expense will the company record in its income statement for the 2024 calendar year? Multiple Choicearrow_forwardRealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education