A bridge is to be constructed now as part of a new road. Engineers have determined that traffic density on the new road will justify a two-lane road and a bridge at the present time. Because of uncertainty regarding future

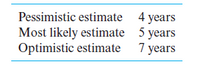

use of the road, the time at which an extra two lanes will be required is currently being studied. The two-lane bridge will cost $200,000 and the fourlane bridge, if built initially, will cost $350,000. The future cost of widening a two-lane bridge to four lanes will be an extra $200,000 plus $25,000 for every year that widening is delayed. The MARR used by the highway department is 12% per year. The following estimates have been made of the times at which the four-lane bridge will be required: In view of these estimates, what would you recommend? What difficulty, if any, do you have in interpreting your results? List some advantages and disadvantages of this method of preparing estimates.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- please go step by step or explain how you got the answerarrow_forwardA site on a major river is being evaluated for a new lock and dam for navigation purposes. Two options are considered: (a) single 1200-foot lock or (b) single 1200-foot lock and a single 600-foot lock (two locks, side by side). Benefits and costs of the two options are indicated in the table. Interest rate to be used is 7%, and the planning period is 50 years. Initial cost Annual operating cost Annual benefit Single Lock ($ million) 60.0 1.0 12.0 Double Locks ($ million) 85.0 1.5 16.0 (a-5 pts) Show the cash flow table for both options. (You may show only for the first three years as the same numbers will repeat for the remaining planning period.) (b-10 pts) Solve by the present worth method. (c-10 pts) Solve by the annual cash flow method. (d-10 pts) Solve by the incremental benefit-cost ratio method. (e-5 pts) Check your solutions for (b), (c), and (d). Are they different? Explain.arrow_forwardA toll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be $17,500,000, and $334,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fifth year of its 25-year projected life at a cost of $1,200,000 per occurrence (no resurfacing cost in year 25). Revenues generated from the toll are anticipated to be $2,500,000 in its first year of operation, with a projected annual rate of increase of 1.75% per year due to the anticipated annual increase in traffic across the bridge. Assuming zero market (salvage) value for the bridge at the end of 25 years and a MARR of 11% per year, should the toll bridge be constructed? Also, assume that the initial surfacing…arrow_forward

- A toll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Investment costs of the structure are estimated to be $19,000,000, and $332,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fifth year of its 30-year projected life at a cost of $1,300,000 per occurrence (no resurfacing cost in year 30). Revenues generated from the toll are anticipated to be $2,400,000 in its first year of operation, with a projected annual rate of increase of 2% per year due to the anticipated annual increase in traffic across the bridge. Assuming zero market (salvage) value for the bridge at the end of 30 years and a MARR of 12% per year, should the toll bridge be constructed? Also, assume that the initial surfacing of…arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $9.66 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $57 million, and the expected cash inflows would be $19 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $20 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ IRR: % million Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forwardAn electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $269.87 million, and the expected cash inflows would be $90 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $93.62 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 16%. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not…arrow_forward

- A highway is to be built connecting Maud and Bowlegs. Route A follows the old road and costs $4 million initially and $210,000/year thereafter. A new route, B, will cost $6 million initially and $180,000/year thereafter. Route C is an enhanced version of Route B with wider lanes, shoulders, and so on. Route C will cost $9 million at first, plus $260,000 per year to maintain. Benefits to the users, considering time, operation, and safety, are $500,000 per year for A, $850,000 per year for B, and $1,000,000 per year for C. Using a 7% interest rate, a 15-year study period, and a salvage value of 50% of first cost, determine which road should be constructed.arrow_forwardThe Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 12%, and the projects' expected net costs are listed in the following table: a. What is the IRR of each alternative? The IRR of alternative 1 is -Select- Year 0 1 2 3 4 5 -Select- Expected Net Cost Forklift -$200,000 -160,000 -160,000 -160,000 -160,000 -160,000 Conveyor -$500,000 -120,000 -120,000 -120,000 -120,000 -20,000 The IRR of alternative 2 is-Select- b. What is the present value of costs of each alternative? Do not round Intermediate calculations. Round your answers to the nearest…arrow_forwardThe city of Columbia is considering extending the runways of its municipal airport so that commercial jets can use the facility. The land necessary for the runway extension is currently a farmland that can be purchased for $350,000. Construction costs for the runway extension are projected to be $600,000, and the additional annual maintenance costs for the extension are estimated to be $22,500. If the runways are extended, a small terminal will be constructed at a cost of $250,000. The annual operating and maintenance costs for the terminal are estimated at $75,000. Finally, the projected increase in flights will require the addition of two air traffic controllers at an annual cost of $100,000. Annual benefits of the runway extension have been estimated as follows (shown): Apply the B–C ratio method with a study period of 20 years and a MARR of 10% per year to determine whether the runways at Columbia Municipal Airport should be extended.arrow_forward

- A community is looking to build a dam over a stretch of river that is currently being used for recreation. The dam will generate electricity. The dam will have a useful life of 50 years after which its reservoir will be full of sediment and the dam will need to be removed. The following are the characteristics of the dam:Initial cost: $350,000,000Electricity produced: 200,000 MWh per year at $150/MWh Value of recreation lost: $20,000,000 per year a. If the social discount rate is a constant 2% per year, is the dam a good idea? Show your work and explain your rationale.arrow_forwardExample: It is proposed to construct a self-financing road tunnel. The criterion is that the toll paid by the vehicles over the life of the project must be sufficient to cover both the initial capital and the other costs which will be incurred over the project's life. Determine a suitable charge on each vehicle passing through the tunnel using the following estimated figures based on 1996 prices. 1. Capital cost Construction cost Land cost Professional fees 2. Annual OMR cost 3. Annual administration cost 4. Replacement cost of autopay ticket machine 5. Estimated annual traffic flow 6. Life of project 7. Required rate of return (real) 8. Estimated inflation rate in the next 20 years $100,000,000 $2,500,000 $5,000,000 $1,000,000 every 5 years 10,000 vehicles per day in the first five years; the growth rate of traffic flow is 30% every 5 years 20 years 12% 10% p.a. (average)arrow_forwardPlease see image for question.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education