Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

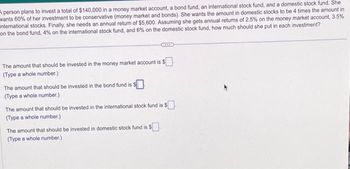

Transcribed Image Text:A person plans to invest a total of $140,000 in a money market account, a bond fund, an international stock fund, and a domestic stock fund. She

wants 60% of her investment to be conservative (money market and bonds). She wants the amount in domestic stocks to be 4 times the amount in

international stocks. Finally, she needs an annual return of $5,600. Assuming she gets annual returns of 2.5% on the money market account, 3.5%

on the bond fund, 4% on the international stock fund, and 6% on the domestic stock fund, how much should she put in each investment?

The amount that should be invested in the money market account is $

(Type a whole number.)

The amount that should be invested in the bond fund is $

(Type a whole number.)

The amount that should be invested in the international stock fund is $

(Type a whole number.)

The amount that should be invested in domestic stock fund is $

(Type a whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Jeffersons want to start investing $600 monthly to achieve their stated short- and long-term objectives. Which of the following monthly investments is most appropriate for them at this time and why? Provide two pros for the investment allocation you selected and one con for each of the investment allocations you did not select. $600 in a Roth IRA account for Jaylen, allocated as $300 in large cap domestic growth stocks, and $300 in an international growth fund $600 in a AAA-rated municipal bond fund $600 in a high yield, long-term bond fund $100 in a money market account, and $500 in a Roth IRA global balanced mutual fundarrow_forwardAn investor has $80,000 to invest in Certificates of Deposit (CD) and a mutual fund. The CD yields 7% and the mutual fund yields 8%. The mutual fund requires a minimum investment of $8,000 and the investor requires at least twice as much should be invested in CDs as in the mutual fund. How much should be invested in each to maximize the return? What is the maximum return? Show your work and explanations setting this problem up. Variables should clearly be defined. Show all your work.arrow_forwardQUESTION: Sandra has at most $200,000 to invest in stocks, bonds, and money market funds. She expects annual yields of 15%, 10%, and 8%, respectively, on these investments. If Sandra wants at least $50,000 to be invested in money market funds and requires that the amount invested in bonds be greater than or equal to the sum of her investments in stocks and money market funds, determine how much she should invest in each vehicle to maximize the return on her investments. Stocks=?__________ Bonds=?_________ Money Market Funds=?________ What is the Maximum Return?_________ PLEASE MAKE SURE, I ONLY HAVE 1 CHANCE!arrow_forward

- A man would like to invest $50,000 in government bonds and stocks that will give an overall annual return of about 5%. The money to be invested I government bonds will give an annual return of 4.5% and the stock of about 6%. The investments are in units of 100 each. If he desires to keep his stock investment to minimum order to reduce his risk, determine how many government bonds and how stocks should he purchase?arrow_forwardA person has $30,000 to invest. As the person's financial consultant, you recommend that the money be invested in Treasury bills that yield 2%, Treasury bonds that yield 4%, and corporate bonds that yield 6%. The person wants to have an annual income of S1160, and the amount invested in corporate bonds must be half that invested in Treasury bills Find the amount in each investment What is the solution? Select the correct choice below and fil in any answer boxes within your choice and the amount in corporate bonds is S O A. There is one solution The amount in treasury bils is S (Type integers or decimals) the amount in treasury bonds is S O B. There are infinitely many solutions The amount in treasury bills is S where z is any real number (Simplify your answers) the amount in treasury bonds is S and the amount in corporate bonds is Sz. O C. There is no solutionarrow_forwardAn investor has $80,000 to invest in a CD and a mutual fund. The CD yields 8% and the mutual fund yields 7%. The mutual fund requires a minimum investment of $9,000, and the investor requires that at least twice as much should be invested in CDs as in the mutual fund. How much should be invested in CDs and how much in the mutual fund to maximize the return? What is the maximum return? To maximize income, the investor should place $ in CDs and $ in the mutual fund. (Round to the nearest dollar as needed.)arrow_forward

- As a junior investment manager, your boss instructs you to help a client to invest $100,000 for the next year. Particularly, you are asked to form an investment portfolio for the client by investing in risk-free assets like 90-day bank bill and two stocks: A and B. Stock A has a beta value of 0.8, an expected return of 7% and a standard deviation of 10%; and stock B has a beta value of 1.2, an expected return of 12% and a standard deviation of 15%. The correlation coefficient between the returns for the two stocks is 0. The risk-free rate is 2%. (a) What is the expected return of the risky portfolio with the two stocks that has the least amount of risk? (b) Suppose that the optimal risky portfolio with the two stocks has a weight of 53% in A and 47% in B, and has the expected return of 9.4% and standard deviation of 8.8%. If this client is willing to take a risk measured by standard deviation of 5% for his overall investment portfolio, how much would you recommend to the client to…arrow_forward(Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents when she turmed 21 years of age. The portfolio is comprised of Treasury bills and stock in Ford (F) and Harley Davidson (HOG) a. Based on the current portfolo composition and the expected rates of return, what is the expected rate of retum for Penny's portfolio? b. If Penny wants to increase her expected portfolio rate of retur, she can increase the alocated weight of the portfolio she has invested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury bills if Penny moves all her money out of Treasury bills and spits it evenly between the two stocks, what will be her expected rate of return? c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? a. Based on the current…arrow_forwardYour bank account pays an interest rate of 8 percent. You are considering buying a share of stock in XYZ Corporation for $110. After 1, 2, and 3 years, it will pay a dividend of $5. You expect to sell the stock after 3 years for $120. Is XYZ a good investment? Support your answer with calculationsarrow_forward

- A Client with a wealth of £100 000 wants her wealth managed by allocating 60% in Bonds and 40% in Equities. The manger allocates the client’s wealth accordingly, but actively manages the Equity fund. The Bonds fund performs in line with the benchmark which grows by 4.5%. The Equity fund grows to a value £42 300. The FTSE 100 Index increases from 6750 to 7255. Find the growth rates of the Equity benchmark and the managed Equity fund. Then, explain how successful was the manager’s decision to actively manage the equity fund.arrow_forwardAn investment advisor currently has two types of investments available for clients: a conservative investment A that pays 8% per year and investment B of higher risk that pays 14%. Clients may divide their investments between the two to achieve any total return desired between 8% and 14%. However, the higher the desired return, the higher the risk. How should each client listed in the table invest to achieve the desired return? Client 1 Client 2 Client 3 k $21000 $40000 $31000 k, Annual Return Desired $2460 $3860 $3740 k2 Total Investment How much money should Client 1 invest in each account to achieved the desired return? Amount in investment A: Amount in investment B: How much money should Client 2 invest in each account to achieved the desired return? Amount in investment A: Amount in investment B: How much money should Client 3 invest in each account to achieved the desired return? Amount in investment A: Amount in investment B:arrow_forwardA client wants to make a yearend charitable donation of $10,000 from her portfolio of stocks and bonds which is worth $400,000 on June 30, but she wants to be able to make the donation without invading the current principle of $400,000. You estimate from her current allocations that the mean expected return on her portfolio over six months would be 5.7% with a standard deviation of 4.0%. You consider two possible reallocations. The more aggressive reallocation would have an expected return of 8.9% with a standard deviation of 9.6%, while the more conservative reallocation would have an expected return of 3.7% with a standard deviation of 1.6%. Given her desire to make the donation without invading her $400,000 principle, what is the shortfall level to use for the safety-first rule? According to the safety-first criterion, should you recommend the more aggressive reallocation, the more conservative reallocation, or the current allocation? For the portfolio that is optimal according…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning