Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

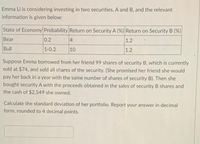

Transcribed Image Text:Emma Li is considering investing in two securities, A and B, and the relevant

information is given below:

State of Economy Probability Return on Security A (%) Return on Security B (%)

Bear

0.2

4

1.2

Bull

1-0.2

10

1.2

Suppose Emma borrowed from her friend 99 shares of security B, which is currently

sold at $74, and sold all shares of the security. (She promised her friend she would

pay her back in a year with the same number of shares of security B). Then she

bought security A with the proceeds obtained in the sales of security B shares and

the cash of $2,549 she owned.

Calculate the standard deviation of her portfolio. Report your answer in decimal

form, rounded to 4 decimal points.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Alecia is a financial investor who actively buys and sells in thesecurities market. Now she has a portfolio of all blue chips, including: $13 500of Share A, $7600 of Share B, $14 700 of Share C, and $5 500 of Share D.Required:a) Compute the weights of the assets in Rachel’s portfolio?b) Following is forecast for economic situation and Alecia’s portfolio returnsnext year, calculate the expected return, variance and standard deviationof the portfolio.State of economy Probability Rate of returnsMild Recession 0.35 - 5%Growth 0.45 15%Strong Growth 0.20 30%arrow_forwardSuppose your parents deposit $4,000 into an account at the end of each year for 11 years. The account earns an annual interest rate of 1.4%. After the final deposit, they move the accumulated savings to a brokerage account and invest in the stock market, where they earn an average annual return of 6.9% for the following 16 years. How much will they have in the account at the end? O a. $131,280 O b. $404,155 O c. $137,311 O d. $296,336 e. $302,138 f. $279,603 g. $496,270 h. $249,511arrow_forward

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education