FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

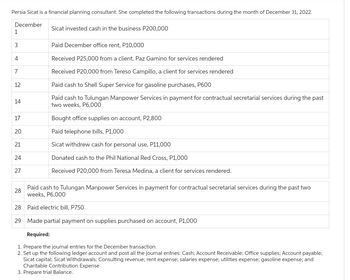

Transcribed Image Text:Persia Sicat is a financial planning consultant. She completed the following transactions during the month of December 31, 2022.

December

1

3

4

7

12

14

17

20

21

24

27

28

Sicat invested cash in the business P200,000

29

Paid December office rent, P10,000

Received P25,000 from a client, Paz Gamino for services rendered

Received P20,000 from Tereso Campillo, a client for services rendered

Paid cash to Shell Super Service for gasoline purchases, P600

Paid cash to Tulungan Manpower Services in payment for contractual secretarial services during the past

two weeks, P6,000

Paid cash to Tulungan Manpower Services in payment for contractual secretarial services during the past two

weeks, P6,000

28 Paid electric bill, P750

Made partial payment on supplies purchased on account, P1,000

Required:

1. Prepare the journal entries for the December transaction.

2. Set up the following ledger account and post all the journal entries: Cash; Account Receivable; Office supplies; Account payable;

Sicat capital; Sicat Withdrawals; Consulting revenue; rent expense; salaries expense; utilities expense; gasoline expense; and

Charitable Contribution Expense

3. Prepare trial Balance.

Bought office supplies on account, P2,800

Paid telephone bills, P1,000

Sicat withdrew cash for personal use, P11,000

Donated cash to the Phil National Red Cross, P1,000

Received P20,000 from Teresa Medina, a client for services rendered.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Please follow the same sample which I attachedarrow_forwardBelow were selected transactions of FDNACCT Services for the month of September: • Paid rent for the month, P43,000 • Received the electricity bill, P17,000 • Paid salary of the secretary, P29,000 • Paid water bill, $4,400 Based on these transactions alone, how much was the total amount credited to Cash account?arrow_forwardThe following transactions of Jaya Mart occurred during the month of September 2021: Transactions Date September 1 Saleh, the owner of Jaya Mart invested RM10,000 of his personal savings into the company's account. Rented office space and paid RM1,200 cash for the month of September. Purchased of office equipment for RM30,000, paying RM8,000 cash and the balance to be paid in one year period. 4 Purchased office supplies for RM750 cash. 8 Completed services for a client and received RM2,700 cash for the services. 15 Completed services RM3,600 for a client on credit. Received RM3,600 from a client for the work completed on 15 September. 28 Paid the office secretary's monthly salary, RM1,200 cash. 30 Saleh withdrew RM2,000 for his personal use. a) 2 3 20 Prepare the journal entries to record all the above transactionsarrow_forward

- Aggie Pool Guys, Inc. began operations on September 1, 2019 with an investment of $30,000 cash into the business. During the month of September, Aggie completed the following additional transactions: Sept 2 Sold a customer pool equipment on account, $2,500. Sept 4 Purchased supplies on credit for $1,000. Sept 8 Repaired a customer’s pool and collected the fee of $1,800. Sept 13 Received $500 from customers for payment on their account. Sept 15 Paid employee wages of $800. Sept 18 Repaired a customer’s pool and billed, but did not collect $2,200. Sept 21 Collected $1,000 from a customer for a job to be performed in October. What is the balance in the Accounts Receivable account on September 30, 2019? (hint: Use T account) A. $8,000 B. $4,200 C. $3,200 D. $7,000 E. $5,200 Do not give answer in image formatearrow_forwardp. On April 5, Timothy established an interior decorating business, Tim's Design, with a cash investment of P200,000. Timothy completed the following transactions for April: 6 Paid rent for the month, P8,000. Purchased from Delta Co Office equipment, P55,000, using his credit card. Purchased a used car for P180,000, paying PS0,000 cash and taking a bank loan For the remainder. 10 Purchased supplies and materials for cash, P11.315. Received cash from Miss Laura for a job completed in her condo, P57,500. Supplies were used amounting to PS,250. Purchased materials and supplies on credit, P15,000 12 20 23 Recorded job completed for Mr. Ferrer. Tem: on account 10 days, P14,950. Supplies were used up amounting to P3,500. Received an invoice for repairs on the car and paid P4,500. Paid utilities expense, P1,750. Paid P20,000 on the bank loan. Received cash from Mr. Ferrer, P10,000. 24 25 26 27 28 Paid Salary of worker, P5,000. Paid Delta a portion of the amount owed for equipment, P5,000.…arrow_forwardThe following entries are in the books of Moh Co. for the month of Jan,2021: 10th Jan Started up the business with a capital of 300,000. 12th Jan Purchase Goods costed 10,000. 13th Jan Sold goods for 7,000 on account. 17th Jan: Purchase printer costed 20,000 on account 18th Jan Bought Land for 50,000. 19th Jan: Received 3,000 from the client for goods sold on 13th Jan. 19th Jan Bought Land for 30,000 19th Jan: Withdraw a cash for personal use 2,000. 19th Jan: Paid 2,000 for printer purchased. 19th Jan Paid additional 10,000 for printer purchased. Write: a) Journal Entries. b) ledgers. c) Trial balance for the transactions.arrow_forward

- On April 1, 2021, Betty Trout created a new self-storage company called Betty Storage Company. The following eventsoccurred during the company's first month:April1Betty invested $75,000 cash, land and buildings worth $300,000 and $225,000 respectively.2Rented equipment by paying $4,800 for the first month.5Purchased $5,200 of office supplies for cash.10Paid $10,800 for the premium on a one-year insurance policy effective today.14Paid an employee $2,000 for two weeks' salary.24Collected $22,500 of storage revenue from customers27Collected $2,400 on a rental agreement for storage from May 1, 2021 to April 30, 202228Paid an employee $2,000 for two weeks' salary.29Paid the month's $600 phone bill30Repaired a leak in the roof of the buidling for $2,000 on account31Betty withdrew $3,500 cash from the company for personal use.The following is the company's chart of accounts:101Cash301Betty Trout, Capital106Accounts Receivable302Betty Trout, Drawings124Office Supplies401Storage…arrow_forwardRamadhani is the owner of Adha Enterprise located in Shah Alam, Selangor. Adha Enterprise, a grocery shop started its operation in January 2023. The following transactions are selected from the business for the month of January 2023. Date January 2023 1 2 3 4 5 8 9 11 17 20 25 26 27 28 Transactions The owner contributed RM90,000 cash and office equipment valued at RM40,000 to start the business. Deposit RM70,000 cash into the business bank account. Purchased fax machine from Mala Trading costing RM4,700. The payment will be paid in two equal installments starting next month. Received a bank loan worth RM75,000 from LLH Bank. Purchased goods on credit worth RM7,500 from Senang Enterprise. Cash sales to Safuan amounting to RM4,500. Purchased goods worth RM8,000 from Adam Runcit and paid via online. transfer. A credit note of RM550 was received from Senang, Enterprise for damaged goods returned. Sold goods amounting RM5,500 to Kamisah on credit. Paid Senang, Enterprise for full settlement…arrow_forwardVikrambhaiarrow_forward

- Give its general ledgers and financial statementsarrow_forwardOn November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transactions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, $50,000. 1 Paid rent for period of November 1 to end of month, $4,000. 6 Purchased office equipment on account, $15,000. 8 Purchased a truck for $38,500 paying $5,000 cash and giving a note payable for the remainder. 10 Purchased supplies for cash, $1,750. 12 Received cash for job completed, $11,500. 15 Paid annual premiums on property and casualty insurance, $2,400. 23 Recorded jobs completed on account and sent invoices to customers, $22,300. 24 Received an invoice for truck expenses, to be paid in November, $1,250. Enter the following transactions on Page 2 of the two-column journal: Nov. 29 Paid utilities expense, $4,500. 29…arrow_forwardOn January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following transactions during the month: Jan. 1 Sharon Matthews transferred cash from a personal bank account to an account to be used for the business, $29,000. 2 Paid rent on office and equipment for the month, $2,350. 3 Purchased supplies on account, $2,250. 4 Paid creditor on account, $800. 5 Earned fees, receiving cash, $14,640. 6 Paid automobile expenses (including rental charge) for month, $1,520, and miscellaneous expenses, $890. 7 Paid office salaries, $2,000. 8 Determined that the cost of supplies used was $1,100. 9 Withdrew cash for personal use, $2,600. Required: 1. Journalize entries for transactions Jan. 1 through 9. Refer to the Chart of Accounts for exact wording of account titles. 2. Post the journal entries to the T accounts, selecting the appropriate date to the left of each amount to identify the transactions. Determine the account…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education