FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

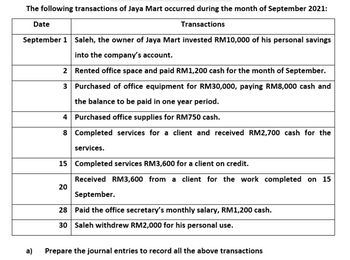

Transcribed Image Text:The following transactions of Jaya Mart occurred during the month of September 2021:

Transactions

Date

September 1 Saleh, the owner of Jaya Mart invested RM10,000 of his personal savings

into the company's account.

Rented office space and paid RM1,200 cash for the month of September.

Purchased of office equipment for RM30,000, paying RM8,000 cash and

the balance to be paid in one year period.

4

Purchased office supplies for RM750 cash.

8 Completed services for a client and received RM2,700 cash for the

services.

15 Completed services RM3,600 for a client on credit.

Received RM3,600 from a client for the work completed on 15

September.

28 Paid the office secretary's monthly salary, RM1,200 cash.

30 Saleh withdrew RM2,000 for his personal use.

a)

2

3

20

Prepare the journal entries to record all the above transactions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On May 8, 2015, Mrs. Siega borrowed php 100,000 from Mr. Singh at 6% payable in 90 days. If the amount is equivalent to 5% in a bank, find it’s present value on July 16, 2015.arrow_forwardB. Problem (please refer to the picture.)arrow_forward49. The accountant of Jepjep Holdings presented the following account balances as of December 31, 2021: Cash in bank – Checking,P2,600,000Cash in bank - Savings, P700,000 Cash on hand, P300,000 Cash in bank – restricted, P2,000,000 Treasury bills, P3,000,000 The restricted cash in bank account is opened specifically for building construction expected to be disbursed in Q1 2022. The cash on hand includes a P100,000 check payable to Jepjep, dated January 5, 2022. The Treasury bills are purchased December 1, 2021 and due on February 28, 2022. If you are the Accountant of Jepjep Holdings, what amount of "cash and cash equivalents" should be reported as of December 31, 2021?arrow_forward

- Mr. P's bank statement dated 31.12.2021 showed a balance with his Bank of $924, when checked with his Cash Book the following were noted :(a) During December, the Bank had paid $200 for a yearly contribution of Mr. P made to a local charity, as per his standing order. This amount appeared in the Bank statement but not in the Cash Book.(b) The Bank had credited his account with $28 interest and had collected on his behalf `$230 as dividends. No corresponding entries were made in the Cash Book.(c) A cheque of $65 deposited into the Bank on 28.12.2021 was not cleared by the Bank till after 31.12.2021(d) A cheque of $150 deposited into and cleared by the Bank before 31.12.2021 was not entered in the Cash Book, through an oversight.(e) Cheques drawn by and posted to parties by Mr. White on 31.12.2021 for $73, $119 and $46 were presented for payment to the Bank only on 3.1.2021.arrow_forwardBank Alfatih earned an annual profit amounting to USD1,500,000 through a Mudharaba Mutlaqah deposit account. The profit sharing ratio between the bank and the depositors of the Mudharaba deposit account is (40:60) respectively. The table below contains data on the deposit types that are available, average balance needed, and the weights that are used. Deposit Types Average balance Weights 1 month 300,000 0.5 3 months and less 400,000 0.8 6 months and less 600,000 1 12 months and less 800,000 1.25 Total 2,100,000 Calculate the total depositors’ share from the annual profit. Calculate the weighted average balance for each type of deposits.arrow_forwardOn 30 June 2023, Maximo’s cash book showed that he had an overdraft of K300 on his current account at the bank. A bank statement as at the end of June 2023 showed that Maximo was in credit with the bank by K65. On checking the cash book with the bank statement you find the following. (a) Cheques drawn, amounting to K500, had been entered in the cash book but had not been presented. (b) Cheques received, amounting to K400, had been entered in the cash book, but had not been credited by the bank. (c) On instructions from Maximo the bank had transferred interest received on his deposit account amounting to K60 to his current account, recording the transfer on 5 July 2023. This amount had, however, been credited in the cash book as on 30 June 2023. (d) Bank charges of K35 shown in the bank statement had not been entered in the cash book. (e) The payments side of the cash book had been undercast by K10. (f) Dividends received amounting to K200 had been paid direct to the bank and not…arrow_forward

- Diana Rene’s deposited an inheritance of 13,050 in a bank account and earned 435 in Simple bankers interest at a rate of 10.5% find the length of time the money was on depositarrow_forwardThe Richard’s Red Company maintains a checking account at the Bank of the North. The bank statement for the month of October 2024 indicated the following: balance on October 1, 2024 was $32,690, deposits for October totaled $86,000, checks paid in October totaled $75,200, service charges for October totaled $350; October NSF checks totaled $1,600; a monthly loan payment deducted by the bank directly from the company’s bank account totaled $3,400; and the ending balance on October 31, 2024 totaled $38,140. At the end of October 2024, Richard’s accounting records indicated a balance in its checking account of $42,544. October 31st deposits in transit were $4,224, and outstanding checks totaled $5,620. In addition, a check for $500 to purchase office furniture was incorrectly recorded by the company as a $50 disbursement. The bank correctly processed the check during October. Assuming the company has no other cash, the amount Richard’s Red would report for cash as a current asset on…arrow_forwardABC company are involved with the following transactions for 2021 from the books of the business. This company operates one bank account to reflect all cash and cheque transactions. You are now required to read these transactions carefully then prepare the relevant documents and books as outlined in the requirements below. 1 Aug 3 Aug 5 Aug 7 Aug 10 Aug 10 Aug 11 Aug 12 Aug Started business with $150, 000 in the bank Bought supplies on credit from Right Way Manufacturers 24 Boxes Air Filter 96 Bottles fuel injector cleaner 48 Boxes Spark Plug 36 Boxes Brake Shoe 24 Boxes Disc Pads Provided services for cash less 10% discount 12 small motorbike engines 6 large motorbike engines (full service) 8 medium size motorbike engines (full service) Paid Rent by cheque Paid Wages by cheque Bought Fixtures from CT Limited paying by cash Provided services on credit to Auto Care. 24 small motorbike engines 8 large motor bike engines (partial service) 12 medium size motorbike engine (partial service)…arrow_forward

- Mrs. Pores invested ₱150,000 in a bank that pays an 13% interest converted monthly. If her account balance today amounts to ₱168,900, approximately how many months did she invest her money? Group of answer choicesarrow_forwardA man borrowed $3700 from a bank for 6 months A friend was cosigner of the man's personal note. The bank collected 3 simple interest on the date of maturity a) How much did the man pay for the use of the money? b) Determine the amount he repaid to the bank on the due date of the note a) The man paid S for the use of the moneyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education