FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

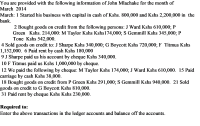

Transcribed Image Text:You are provided with the following information of John Mlachake for the month of

March 2014

March: 1 Started his business with capital in cash of Kshs. 800,000 and Kshs 2,200,000 in the

bank.

2 Bought goods on credit from the following persons: J Ward Kshs 610,000; P

Green Kshs. 214,000: M Taylor Kshs Kshs174,000; S Gemmill Kshs 345,000; P

Tone Kshs 542,000.

4 Sold goods on credit to: J Sharpe Kshs 340,000; G Boycott Kshs 720,000; F Titmus Kshs

1,152,000. 6 Paid rent by cash Kshs 180,000

9 J Sharpe paid us his account by cheque Kshs 340,000.

10 F Titmus paid us Kshs 1,000,000 by cheque.

12 We paid the following by cheque: M Taylor Kshs 174,000; J Ward Kshs 610,000. 15 Paid

carriage by cash Kshs 38,000.

18 Bought goods on credit from P Green Kshs 291,000; S Gemmill Kshs 940,000. 21 Sold

goods on credit to G Boycott Kshs 810,000.

31 Paid rent by cheque Kshs Kshs 230,000.

Required to:

Enter the above transactions in the ledger accounts and balance off the accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2a) You have an account at Bank A. Your last balance statement, which you can see on your bank account page, shows an ending balance of $520. This month you deposit $3120 in your account and withdrew $750. Then you had 3 withdrawals (from bills that were paid automatically) scheduled from your checking account, 3 of which clears. The amount that that have cleared totals $2300. The remaining transfer from checking account will total $180. You will pay a $35 monthly maintenance fee to the bank that month. What is the adjusted bank balance amount (accounting for the unclear transfers from checking as well)? Show work. 2b) What is the difference between a bank balance and an adjusted bank balance?arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $3.990 from a local bank on a note due in six months. b. Received $4,680 cash from investors and issued common stock to them. C. Purchased $1,100 in equipment, paying $250 cash and promising the rest on a note due in one year. d. Paid $350 cash for supplies. e. Bought and received $750 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginning balance of zero.arrow_forwardAfter researching the different forms of business organization, Natalie Koebel decides to operate “Cookie Creations” as a corporation. She then starts the process of getting the business running. In November 2022, the following activities take place. Nov. 8 Natalie cashes her U.S. Savings Bonds and receives $520, which she deposits in her personal bank account. 8 She opens a bank account under the name “Cookie Creations” and transfers $500 from her personal account to the new account in exchange for common stock. 11 Natalie pays $65 to have advertising brochures and posters printed. She plans to distribute these as opportunities arise. (Hint: Use Advertising Expense.) 13 She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for $125 cash. 14 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer…arrow_forward

- Journalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forwardOn April 5, Timothy established an interior decorating business, Tim’s Design, with a cash investment ofP200,000. Timothy completed the following transactions for April:6 Paid rent for the month, P8,000.7 Purchased from Delta Co. office equipment, P55,0008 Purchased a used car for P180,000, paying P80,000 cash and taking a bank loan for theremainder.10 Purchased supplies and materials for cash, P11,315.12 Received cash from Miss Laura for job completed in her condo, P57,500. Supplies were used upamounting to P8,250.20 Purchased materials and supplies on credit, P15,000.23 Recorded job completed for Ms. Ferrer. Term: on account 10 days, P14,950. Supplies were usedup amounting to P3,500.24 Received an invoice for repairs on car and paid P4,500.25 Paid utilities expense, P1,750.26 Paid P20,000 on the bank loan.27 Received cash from Ms. Ferrer, P10,000.28 Paid salary of worker, P5,00029 Paid Delta a portion of the amount owed for equipment, P5,000.30 Withdrew cash for personal use, P3,500.…arrow_forwardMr. Lim started the business a small groceries shop during the year. He is seeking your help to determine the financial results for the year ended 31.12.2020 with the following information extracted from the cash flows record: Opening Bank Inflows: 2,000 Capital 10,000 Cash Sales 30,000 Trable receivable 125,000 165,000 167,000 Outflows: Wages and Salaries 45,000 Rental 18,000 Suppliers 65,000 Office equipment 10,000 (138,000) Closing Cash 29,000 Additional information at the year end: 1. Closing inventory amounted to $8,000. 2. Wages owed amounted to $5,000. 3. Amount of $6,000 still owed to suppliers and amount of $4,000 not yet collected from customers. 4. Mr. Lim intends to use the office equipment for 5 years without any future scrap value. Required: Based on the information above, draft a Statement of Income for the year ended 31.12.2020 for Mr Lim.arrow_forward

- The following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $4,390 from a local bank on a note due in six months. b. Received $5,080 cash from investors and issued common stock to them. c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year. d. Paid $750 cash for supplies. e. Bought and received $1,150 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni Debit Beginning Balance Ending Balance Debit F Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Debit Supplies Accounts Payablearrow_forwardOn April 5, Timothy established an interior decorating business, Tim’s Design, with a cash investment ofP200,000. Timothy completed the following transactions for April:6 Paid rent for the month, P8,000.7 Purchased from Delta Co. office equipment, P55,0008 Purchased a used car for P180,000, paying P80,000 cash and taking a bank loan for theremainder.10 Purchased supplies and materials for cash, P11,315.12 Received cash from Miss Laura for job completed in her condo, P57,500. Supplies were used upamounting to P8,250.20 Purchased materials and supplies on credit, P15,000.23 Recorded job completed for Ms. Ferrer. Term: on account 10 days, P14,950. Supplies were usedup amounting to P3,500.24 Received an invoice for repairs on car and paid P4,500.25 Paid utilities expense, P1,750.26 Paid P20,000 on the bank loan.27 Received cash from Ms. Ferrer, P10,000.28 Paid salary of worker, P5,00029 Paid Delta a portion of the amount owed for equipment, P5,000.30 Withdrew cash for personal use, P3,500.…arrow_forwardBank Alfatih earned an annual profit amounting to USD1,500,000 through a Mudharaba Mutlaqah deposit account. The profit sharing ratio between the bank and the depositors of the Mudharaba deposit account is (40:60) respectively. The table below contains data on the deposit types that are available, average balance needed, and the weights that are used. Deposit Types Average balance Weights 1 month 300,000 0.5 3 months and less 400,000 0.8 6 months and less 600,000 1 12 months and less 800,000 1.25 Total 2,100,000 Calculate the total depositors’ share from the annual profit. Calculate the weighted average balance for each type of deposits.arrow_forward

- Mr.Karue started business on January 01, 2018, with cash of Kshs. 50,000, furniture of Kshs. 10,000, goods of Kshs.2, 000 and machinery worth Kshs.20, 000. During the year he further introduced Kshs. 20,000 in the business by opening a bank account. From the following information extracted from his books, you are required to prepare final accounts for the year ended December 31, 2018.Accounts from Incomplete Records Amount Kshs.Receipt from debtors. 57,500Cash sales 45,000Cash purchases 25,000Wages paid 5,000Salaries to staff…arrow_forwardOn June 30, Year 3, Rundle Company's total current assets were $501,000 and its total current liabilities were $274,000. On July 1, Year 3, Rundle issued a short-term note to a bank for $39,400 cash. Required a. Compute Rundle's working capital before and after issuing the note. b. Compute Rundle's current ratio before and after issuing the note. (Round your answers to 2 decimal places.) Before the After the transaction transaction a. Working capital b. Current ratio MacBook Air 80 DII DD F2 F3 F4 F5 F6 F7 F8 F9 F10 23 2$ & * 3 4 6. 7 E R Y D F G H J K この * COarrow_forwardIn November 2017, after having incorporated Cookie Creations Inc., Natalie begins operations. She has decided not to pursue the offer to supply cookies to Biscuits. Instead, she will focus on offering cooking classes. The following events occur. Nov. 8 Natalie cashes in her U.S. Savings Bonds and receives $520, which she deposits in her personal bank account. 8 Natalie opens a bank account for Cookie Creations Inc. 8 Natalie purchases $500 of Cookie Creations’ common stock. 11 Cookie Creations purchases paper and other office supplies for $95. (Use Supplies.) 14 Cookie Creations pays $125 to purchase baking supplies, such as flour, sugar, butter, and chocolate chips. (Use Supplies.) 15 Natalie starts to gather some baking equipment to take with her when teaching the cookie classes. She has an excellent top-of-the-line food processor and mixer that originally cost her $550. Natalie decides to start using it only in her new…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education