FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

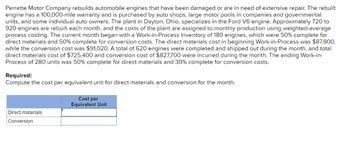

Transcribed Image Text:Perrette Motor Company rebuilds automobile engines that have been damaged or are in need of extensive repair. The rebuilt

engine has a 100,000-mile warranty and is purchased by auto shops, large motor pools in companies and governmental

units, and some individual auto owners. The plant in Dayton, Ohio, specializes in the Ford V6 engine. Approximately 720 to

920 engines are rebuilt each month, and the costs of the plant are assigned to monthly production using weighted-average

process costing. The current month began with a Work-in-Process Inventory of 180 engines, which were 50% complete for

direct materials and 50% complete for conversion costs. The direct materials cost in beginning Work-in-Process was $87,800,

while the conversion cost was $91,020. A total of 620 engines were completed and shipped out during the month, and total

direct materials cost of $725,400 and conversion cost of $827,700 were incurred during the month. The ending Work-in-

Process of 280 units was 50% complete for direct materials and 30% complete for conversion costs.

Required:

Compute the cost per equivalent unit for direct materials and conversion for the month.

Direct materials

Conversion

Cost per

Equivalent Unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Leach Finishing makes various metal fittings for the construction industry. Three of the fittings, models X-12, X-24, and X-30, require grinding on a patented machine of which Leach has only one. The cost of production information for the three products follow: X-12 Price per fitting Variable cost per fitting Units per hour of grinding The testing machine used for both models has a capacity of 2,870 hours annually. Fixed manufacturing costs are $484,000 annually. Required A Required B X-24 $29 $ 14 18.0 X-12 X-24 X-30 units units units $ 45 X-30 $21 12.5 Required: a. Suppose that Leach Finishing can sell at most 55,600 units of any one fitting. How many units of each fitting model should Leach Finishing produce annually? b. Suppose that Leach Finishing can sell at most 15,300 units of any one fitting. How many units of each fitting should Leach Finishing produce annually? 15 Complete this question by entering your answers in the tabs below. $ 64 $38 10.0 Suppose that Leach Finishing…arrow_forwardWexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $71,000 per ton, one-fourth of which is allocated to product X15. Six thousand five hundred units of product X15 are produced from each ton of clypton. The units can either be sold at the split-off point for $17 each, or processed further at a total cost of $8,800 and then sold for $22 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Product X15 should bearrow_forwardThompson Industrial Products Inc. (TIPI) is a diversified industrial-cleaner processing company. The company's Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 945,000 ounces of chemical input are processed at a cost of $213,000 into 630,000 ounces of floor cleaner and 315,000 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $244,200, Floor Shine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 315,000 ounces of another compound (TCP) to the 315,000 ounces of table cleaner. This joint process will yield 315,000 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $102,000. Both…arrow_forward

- Robo-Lawn is a lean manufacturer of robotic lawn mowers. The company budgets $800,000 of conversion costs and 10,000 production hours for this year. The manufacturing of each mower requires 5 production hours and $250 of raw materials. During a recent quarter, the company produced 600 mowers and sold 580 mowers. Each mower is sold for $1,000. Required: 1. Compute the conversion cost rate per mower. 2. Prepare journal entries to record (a) purchase of raw materials on credit, (b) applied conversion costs to production, (c) sale of 580 mowers on credit, and (d) cost of goods sold and finished goods inventory. I just need help on D. It needs Cost of goods sold, Finished goods inventory, and Work in process inventory.arrow_forwardThe Silver Center (TSC) produces cups and platters. TSC purchases silver and other metals that are processed into silver alloy that is used to make platters and cups. TSC incurred $74,000 of materials cost and $78,000 of labor cost to produce the silver alloy. Platters are made first and the residual alloy is remixed into a lower grade silver plated material that is used to make the cups. Remixing cost amount to $10,500. The recent batch contained 21,000 platters and 9,500 cups. TSC sold the platters for $270,000 and the cups for $46,000. 1.Based on this information the total amount of joint cost is what 2.If number of units is used to allocate the joint cost, what is the income earned for platters?arrow_forwardAdams Concrete Company pours concrete slabs for single-family dwellings. Lancing Construction Company, which operates outside Adams's normal sales territory, asks Adams to pour 50 slabs for Lancing's new development of homes. Adams has the capacity to build 360 slabs and is presently working on 210 of them. Lancing is willing to pay only $2,660 per slab. Adams estimates the cost of a typical job to include unit-level materials, $960; unit-level labor, $490; and an allocated portion of facility-level overhead, $1,300. Required Calculate the contribution to profit from the special order. Should Adams accept or reject the special order to pour 50 slabs for $2,660 each?arrow_forward

- Carla Vista Industrial Products Inc. is a diversified industrial-cleaner processing company. The company’s Dargan plant produces two products: a table cleaner and a floor cleaner from a common set of chemical inputs (CDG). Each week, 931,500 ounces of chemical input are processed at a cost of $207,300 into 621,000 ounces of floor cleaner and 310,500 ounces of table cleaner. The floor cleaner has no market value until it is converted into a polish with the trade name FloorShine. The additional processing costs for this conversion amount to $257,400.FloorShine sells at $20 per 30-ounce bottle. The table cleaner can be sold for $21 per 25-ounce bottle. However, the table cleaner can be converted into two other products by adding 310,500 ounces of another compound (TCP) to the 310,500 ounces of table cleaner. This joint process will yield 310,500 ounces each of table stain remover (TSR) and table polish (TP). The additional processing costs for this process amount to $106,000. Both table…arrow_forwardHaresharrow_forwardThe Silver Center (TSC) produces cups and platters. TSC purchases silver and other metals that are processed into silver alloy that is used to make platters and cups. TSC incurred $52,000 of materials cost and $56,000 of labor cost to produce the silver alloy. Platters are made first and the residual alloy is remixed into a lower grade silver plated material that is used to make the cups. Remixing costs amount to $5,000. The recent batch contained 10,000 platters and 4,000 cups. TSC sold the platters for $160,000 and the cups for $24,000. If relative market value is used to allocate the joint cost, what is the income earned for cups? Note: Round intermediate calculation to 2 decimal places. Multiple Choice $(4,840). $65,600. $4,840. $5,000. Skip [Ctrl+Space]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education