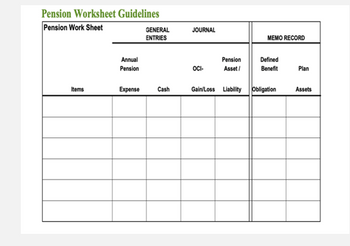

complete the below in same table - show journal entries in the table and ensure that they matches - FlagStaff Ltd has a defined benefit pension plan for its employees. The company is

considering introducing a defined benefit contribution plan, which will be available to

all incoming staff. Although the defined benefit plan is now closed to new staff, the

fund is active for all employees who have tenure with the company. In 2020, the

following actuarial report was received for the defined benefit plan:

2020/$

Present value of the defined benefit obligation 31 December 2019 18 000 000

Past Service Cost 4 000 000

Net interest ?

Current service cost 600 000

Benefits paid 2 000 000

Actuarial gain/loss on DBO ?

Present value of the defined benefit obligation 31 December 2020 21 000 000

Fair value of plan assets at 31 December 2019 17 000 000

Return on plan assets ?

Contributions paid to the plan during the year 1 500 000

Benefits paid by the plan during the year 2 000 000

Fair value of plan assets at 31 December 2020 27 500 000

Additional information

(a) All contributions received by the plan were paid by Flagstaff Ltd.

(b) The interest rate used to measure the present value of the defined benefit

obligation was 9% at 31 December 2019 and 31 December 2020.

(c) The asset ceiling was nil at 31 December 2019 and 31 December 2020.

Step by stepSolved in 2 steps

- Which of the following journal entries would be recorded when an entity contributes cash to its defined benefit pension plan? Select one: а. DR Cash; CR Net defined benefit liability O b. DR Pension assets; CR Cash Ос. DR Cash in trust; CR Cash O d. DR Net defined benefit liability; CR Casharrow_forwardQuestion Content Area ERISA (Pension Reform Act of 1974) provides guidance for actual return on plan assets minimum funding during the year accumulated benefit obligation projected benefit obligationsarrow_forwardQuestion text The computation of pension expense includes all the following except Select one: 13 a. interest on plan assets b. all of these are included C. service cost component measured using current salary levels. d. interest on defined benefit obligation.arrow_forward

- Access the FASB Accounting Standards Codification at the FASB website ( asc.fasb.org ). Determine the specific citation for accounting for each of the following items: 1. The disclosure required in the notes to the financial statements for pension plan assets. 2. Recognition of the net pension asset or net pension liability. 3. Disclosures required in the notes to the financial statements for pension cost for a defined contribution plan.arrow_forwardPlease do not give image formatarrow_forwardWhat are the four basic components of pension expense? Select one: A. Service cost, benefits paid, expected return on plan assets, and amortization of deferred amounts B. Service cost, benefits paid, actual return on plan assets, and amortization of deferred amounts C. Service cost, interest cost, actual return on plan assets, and amortization of deferred amounts D. Service cost,interest cost, expected return on plan assets, and amortization of deferred amounts E. None of the abovearrow_forward

- Describe the requirements for reporting pension plans in financial statements.arrow_forwardJones Manufacturing Inc. sponsored a defined benefit pension plan effective 1 January 20X7. The company uses the projected unit credit actuarial cost method for funding and accounting. Long-term corporate bonds have a yield of 4%. Employees were granted partial credit for past service. The past service obligation has been measured at $1,640,000 as of 1 January 20X7. The company will pay $200,000 (for past service) plus all current service cost to the pension plan trustee each 31 December beginning 31 December 20X7. This funding arrangement will continue for five years and then be re-evaluated. Data for 20X7 and 20X8 20X7 20X8 Current service cost $117,000 $157,000 Actual return on fund assets 6,800 Decrease in defined benefit obligation at year-end due to change in assumptions Payments to pensioners at end of year 37,000 41,400 Required: Prepare a spreadsheet containing all relevant pension information for 20X7 and 20X8.arrow_forwardWhat was the dollar amount of loss (gain) on plan assets that was recognized in OCI during 20X1? Prepare the journal entries to record pension expense, the contribution, and the OCI effects.arrow_forward

- Describe the Components of Pension Expense.arrow_forwardUnder IFRS, any difference between the pension expense and the payments into the pension fund plan assets should be reflected in Select one: a. a contra account to the net defined benefit liability/asset. b. an accrued actuarial liability. c. the net pension liability/asset. d. a note to the financial statements only. e. None of the above.arrow_forwardFor a defined benefit pension plan, pension expense consists of five components, for which the formula is Service Cost – Interest Cost + Expected Return on Plan Assets – Amortization of Prior Service Cost +(–) Gain (Loss). Service Cost + Interest Cost – Expected Return on Plan Assets + Amortization of Prior Service Cost +(–) Gain (Loss). Service Cost + Interest Cost + Expected Return on Plan Assets – Amortization of Prior Service Cost +(–) Gain (Loss). Service Cost – Interest Cost + Expected Return on Plan Assets + Amortization of Prior Service Cost +(–) Gain (Loss).arrow_forward

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning