FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

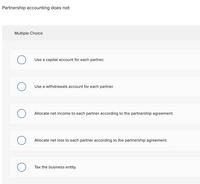

Transcribed Image Text:Partnership accounting does not:

Multiple Choice

Use a capital account for each partner.

Use a withdrawals account for each partner.

Allocate net income to each partner according to the partnership agreement.

Allocate net loss to each partner according to the partnership agreement.

Tax the business entity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net income for a partnership has to be allocated based on stated ratios. Question 2 options: True Falsearrow_forwardTax Drill - Effect of Partnership Operations on Basis Indicate whether the following items "Increase" or "Decrease" a partner's basis in the partnership. a. A partner's proportionate share of nondeductible expenses. b. A partner's proportionate share of any increase in partnership liabilities. c. A partner's proportionate share of partnership income. d. A partner's proportionate share of any reduction in partnership liabilities.arrow_forwardOne of the final steps in terminating a partnership is the distribution of remaining assets to the partners after all obligations have been met. What is the basis for distributing any remaining assets/cash among the partners? How would loans from partners affect the distribution of partnership assets?arrow_forward

- A partnership * has only one owner. pays taxes on partnership income. must file an information tax return. is not an accounting entity for financial reporting purposes.arrow_forwardAccounting In the liquidation of a partnership, a loan from a partner a. Will be paid off at the same time as payment of other liabilities of the partnership b. Will be paid off before distribution of cash to partners for their capital investments c. Will be closed to the partner's drawing account d. Will be written offarrow_forwardBlue and Grey are discussing how income and losses should be divided in a partnership they plan to form. What factors should be considered in determining the division of net income or net loss?arrow_forward

- Assess the truth of this statement: One of the rules of debits and credits and account balances for a partnership is that increases in expense accounts are always debited to the expense account. This statement is true. O This statement is false. O There is not enough information to determine whether or not this statement is true. O This statement is not applicable to accounting concepts.arrow_forwardWhich statement is FALSE when describing the withdrawal of a partner? O It can be paid for from partners' personal assets. O It can be paid for from partnership assets. O Paying with partnership assets affects only the remaining partners' capital accounts. O Paying with partners personal assets affects only the remaining partners' capital accounts.arrow_forwardWhich of the following is an election or calculation made by the partner rather than the partnership? Calculation of a section 199A(qualified business income) deduction amount. Claiming a section 179 deduction related to property acquired by the partnership. Tax treatment (e.g., credit, amortization) of research and experimental costs. The partnership's accounting method (e.g.. cash, accrual).arrow_forward

- For partnerships, the qualified business income (QBI) items reported on Schedule K-1 should include the Section 199A business income, the W-2 wages of any qualified trade or business, and: Guaranteed payments made to the partners in lieu of salary. Recapture of investment credit. The unadjusted basis of qualified property. The adjusted basis of qualified property.arrow_forwardWhich of the following statements regarding partnerships is true? a. Partnership income is taxed in the partnership. b. Partnership losses cannot be offset against the partners other income c. Partnership income is included in a partners income in the year of disbursement. d. Partnerships may earn business income, property income, and capital gains.arrow_forwardNOTE AI ANSWER EXPERT SOLUTIONarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education