FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:5:31

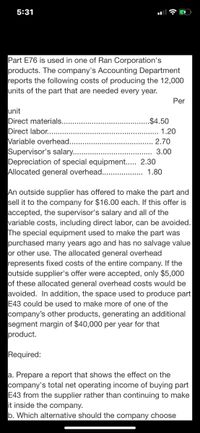

Part E76 is used in one of Ran Corporation's

products. The company's Accounting Department

reports the following costs of producing the 12,000

units of the part that are needed every year.

Per

unit

Direct materials.

Direct labor......

.$4.50

1.20

Variable overhead.

Supervisor's salary....

Depreciation of special equipment.. 2.30

Allocated general overhead...

2.70

3.00

1.80

An outside supplier has offered to make the part and

sell it to the company for $16.00 each. If this offer is

accepted, the supervisor's salary and all of the

variable costs, including direct labor, can be avoided.

The special equipment used to make the part was

purchased many years ago and has no salvage value

or other use. The allocated general overhead

represents fixed costs of the entire company. If the

outside supplier's offer were accepted, only $5,000

of these allocated general overhead costs would be

avoided. In addition, the space used to produce part

E43 could be used to make more of one of the

company's other products, generating an additional

segment margin of $40,000 per year for that

product.

Required:

a. Prepare a report that shows the effect on the

company's total net operating income of buying part

E43 from the supplier rather than continuing to make

it inside the company.

b. Which alternative should the company choose

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- alland Manufacturing Company makes two different products, M and N. The company's two departments are named after the products; for example, Product M is made in Department M. Yalland's accountant has identified the following annual costs associated with these two products: Financial data Salary of vice president of production division ................. $160,000 Salary of supervisor Department M .............................. 80,000 Salary Yalland Manufacturing Company makes two different products, M and N. The company's two departments are named after the products; for example, Product M is made in Department M. Yalland's accountant has identified the following annual costs associated with these two products:Financial dataSalary of vice president of production division ................. $160,000Salary of supervisor Department M .............................. 80,000Salary of supervisor Department N ................................. 60,000Direct materials cost Department M…arrow_forwardDigger Inc. sells a high-speed retrieval system for mining information. It provides the following information for the year. BudgetedActual Overhead cost$1,333, 2005 1, 307, 200Machine hours56, 30049, 000Direct labor hours101, 00097, 800Overhead is applied on the basis of direct labor hours. (a) Compute the predetermined overhead rate. (Round answer to 2 decimal places, e.g. 12.25.) Predetermined overhead rateSper direct labor hourarrow_forwardParker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Standard Standard Quantity 12 sq ft. $ 1.00 per sq. ft. 0.25 hr. Standard Price (Rate) Unit Cost $ 12.00 3.20 Direct materials (plastic) Direct labor $12.80 per hr. Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead $559, 200 + 932,000 units) 0.25 hr. $ 2.00 per hr. 0.50 0.60 Parker Plastic had the following actual results for the past year: Number of units produced and sold Number of square feet of plastic used Cost of plastic purchased and used 1, 260,000 12,500,000 $ 11, 250,000 330,000 4,026,000 $ 1,480,000 Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 387,000 Required: Calculate Parker Plastic's direct materials price and quantity variances. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for…arrow_forward

- Please do not provide answer in image formate thank you. Part U67 is used in one of Broce Corporation's products. The company's Accounting Department reports the following costs of producing the 16,300 units of the part that are needed every year. Per Unit Direct materials $ 3.50 Direct labor $ 4.20 Variable overhead $ 7.20 Supervisor's salary $ 7.90 Depreciation of special equipment $ 8.50 Allocated general overhead $ 5.50 An outside supplier has offered to make the part and sell it to the company for $31.00 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $22,300 of these allocated general overhead costs would be avoided. Required: a.…arrow_forwardTrying to find the activity based costing of the following for the allocated overheadarrow_forwardWalton Company incurred manufacturing overhead cost for the year as follows. Direct materials $ 39.00 /unit Direct labor $ 27.40 /unit Manufacturing overhead Variable $ 11.10 /unit Fixed ($18.80/unit for 1,900 units) $ 35,720 Variable selling and administrative expenses $ 10,360 Fixed selling and administrative expenses $ 15,500 The company produced 1,900 units and sold 1,400 of them at $182.00 per unit. Assume that the production manager is paid a 1 percent bonus based on the company’s net income. Required Prepare an income statement using absorption costing. Prepare an income statement using variable costing. Determine the manager’s bonus using each approach. Which approach would you recommend for internal reporting?arrow_forward

- Required information [The following information applies to the questions displayed below] Sedona Company set the following standard costs for one unit of its product for this year. Direct material (20 pounds @ $3.30 per pound) Direct labor (15 hours @ $6.00 per DLH) Variable overhead (15 hours @ $2.80 per DLH) Fixed overhead (15 hours @ $1.20 per DLH) Standard cost per unit The $4.00 ($2.80+ $1.20) total overhead rate per direct labor hour (DLH) is based on a predicted activity level of 43,500 units, which is 75% of the factory's capacity of 58,000 units per month. The following monthly flexible budget information is available. Flexible Budget Budgeted production (units) Budgeted direct labor (standard hours) Budgeted overhead. Variable overhead Fixed overhead Total overhead Actual variable overhead: Actual fixed overhead Actual total overhead $ 66.00 90.00 42.00 18.00 $ 216.00 $1,624,000 866,000 $ 2,490,000 Operating Levels (% of capacity) 75% 70% 40,600 609,000 $ 1,705, 200 783,000…arrow_forwardhelp mearrow_forwardWilmington Company has two manufacturing departments--Assembly and Fabrication. It considers all of its manufacturing overhead costs to be fixed costs. The first set of data that is shown below is based on estimates from the beginning of the year. The second set of data relates to one particular job completed during the year-Job Bravo. Estimated Data Manufacturing overhead costs Direct labor-hours Machine-hours Job Bravo Direct labor-hours Machine-hours Assembly $1,400,000 70,000 28,000 Assembly Fabrication 15 7 7 10 Fabrication Total $1,680,000 $3,080,000 Total 22 17 42,000 140,000 112,000 168,000 Required: 1. If Wilmington used a plantwide predetermined overhead rate based on direct labor-hours, how much manufacturing overhead would be applied to Job Bravo? 2. If Wilmington uses departmental predetermined overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much manufacturing overhead would be applied…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education