FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

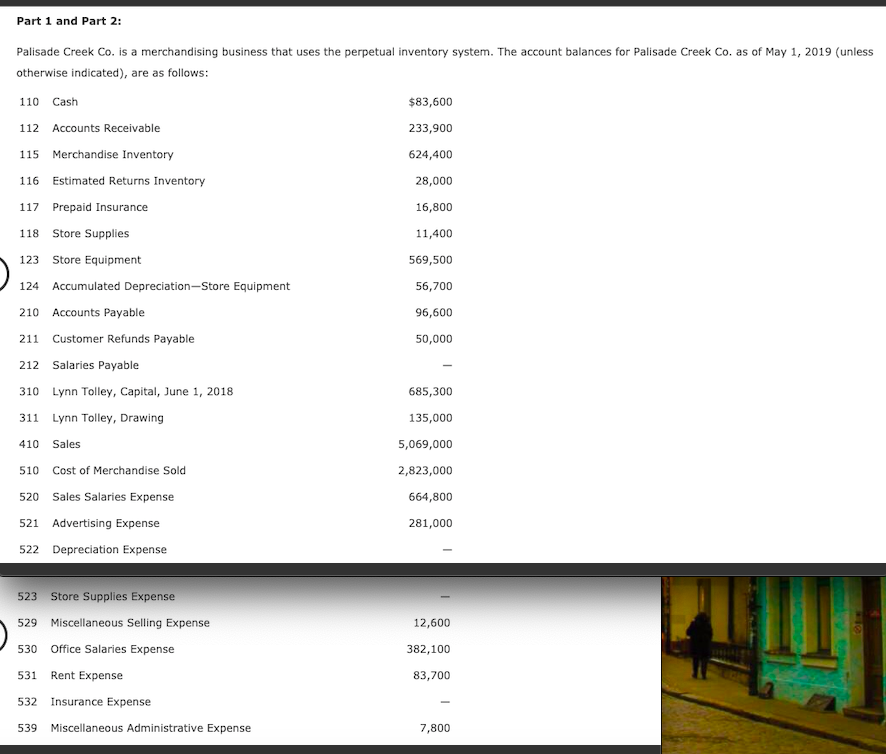

Transcribed Image Text:Part 1 and Part 2:

Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless

otherwise indicated), are as follows:

110

Cash

$83,600

112 Accounts Receivable

233,900

115

Merchandise Inventory

624,400

116

Estimated Returns Inventory

28,000

117 Prepaid Insurance

16,800

118

Store Supplies

11,400

123

Store Equipment

569,500

124 Accumulated Depreciation-Store Equipment

56,700

210

Accounts Payable

96,600

211

Customer Refunds Payable

50,000

212

Salaries Payable

310 Lynn Tolley, Capital, June 1, 2018

685,300

311 Lynn Tolley, Drawing

135,000

410

Sales

5,069,000

510

Cost of Merchandise Sold

2,823,000

520 Sales Salaries Expense

664,800

521 Advertising Expense

281,000

522 Depreciation Expense

523

Store Supplies Expense

529

Miscellaneous Selling Expense

12,600

530

Office Salaries Expense

382,100

531

Rent Expense

83,700

532

Insurance Expense

539

Miscellaneous Administrative Expense

7,800

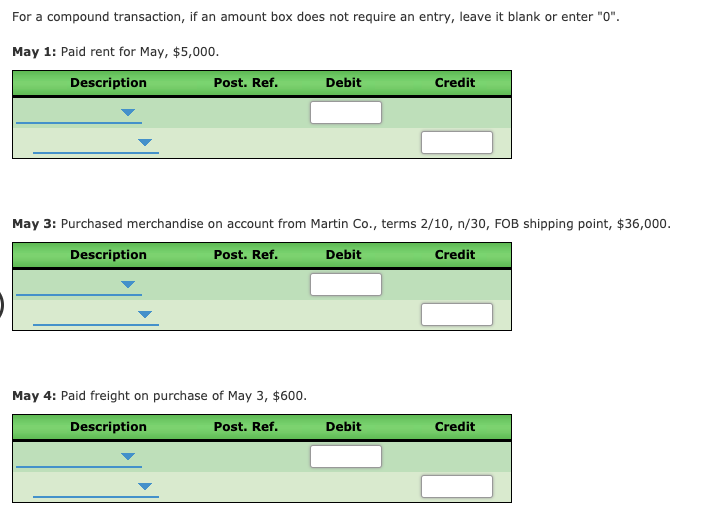

Transcribed Image Text:For a compound transaction, if an amount box does not require an entry, leave it blank or enter "0".

May 1: Paid rent for May, $5,000.

Description

Post. Ref.

Debit

Credit

May 3: Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000.

Description

Post. Ref.

Debit

Credit

May 4: Paid freight on purchase of May 3, $600.

Description

Post. Ref.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Sales-Related Transactions After the amount due on a sale of $172,675, terms 2/10, n/30, is received from a customer within the discount period, the seller consents to the return of the entire shipment. The cost of the merchandise returned was $103,605. If required, round your answers to nearest whole value. a. What is the amount of the refund owed to the customer? b. Illustrate the effects on the accounts and financial statements of the return and the refund. If no account or activity is affected, select "No effect" from the dropdown and leave the correspondir number entry box blank. Enter account decreases, net cash outflows, and all negative effects on net income as negative amounts. Balance Sheet Stockholders' Assets Liabilities Equity Cash v + Inventory v Est. Returns Inventory = Customer Refunds Payable v + No effect v Statement of Cash Flows Income Statement Operating v No effect varrow_forwardPierce Company sold merchandise to Stanton Company on account FOB shipping point, 1/10, net 30, for $9,500. Pierce prepaid the $285 shipping charge. Which of the following entries does Pierce make to record this sale? a.Accounts Receivable—Stanton, debit $9,785; Sales, credit $9,785 b.Accounts Receivable—Stanton, debit $9,500; Sales, credit $9,500 c.Accounts Receivable—Stanton, debit $9,500; Sales, credit $9,500, and Delivery Expense, debit $285; Cash, credit $285 d.Accounts Receivable—Stanton, debit $9,405; Sales, credit $9,405, and Accounts Receivable—Stanton, debit $285; Cash, credit $285arrow_forwardJournalize the following merchandise transactions: (If an amount box does not require an entry, leave it blank.) a. Sold merchandise on account, $12,900, with terms 2/10, net 30. The cost of the merchandise sold was $8,385. Sale Cost b. Received payment within the discount period.arrow_forward

- 1. Merchandise with a list price of $7,425 is purchased on account, terms FOB shipping point, n/30. The seller prepaid transportation costs of $300. Prior to payment, $1,000 of the merchandise is returned. The correct amount is paid within the discount period.(net method) Record the foregoing transactions of the buyer in the sequence indicated below. a) Purchased the merchandise b) Recorded receipt of the credit memorandum for merchandise returned. c) Paid the amount owed.arrow_forwardDetermine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise Freight Paid by Seller Returns and Allowances a. $21,800 - FOB shipping point, 1/10, n/30 $1,100 b. 12,000 $500 FOB shipping point, 1/10, n/30 1,400 c. 6,500 - FOB destination, 1/10, n/30 600 d. 2,900 100 FOB shipping point, 1/10, n/30 400 e. 3,600 - FOB destination, 1/10, n/30 - a. $fill in the blank 1 b. $fill in the blank 2 c. $fill in the blank 3 d. $fill in the blank 4 e. $fill in the blank 5arrow_forwardShore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the goods sold is $67,200. Shore Co. paid freight of $1,800. Journalize the entries for Shore and Blue Star for the sale, purchase, and payment of amount due. Refer to the appropriate company’s Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Shore Co. General Ledger ASSETS 110 Cash 121 Accounts Receivable-Blue Star Co. 125 Notes Receivable 130 Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary…arrow_forward

- Determine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. If required, round the answers to the nearest dollar. a. b. a. S b. $ Merchandise (Invoice Amount) $5,550 2,600 Freight Paid by Seller $700 300 Freight Terms FOB destination, 2/10, n/30 FOB shipping point, 1/10, n/30 Returns and Allowances (Invoice Amount) $1,300 800arrow_forwardplease answer all with workingarrow_forwardprepare a journal entry to record transaction Buyer buys merchandise for 3,000, credit terms 2/10 n/30. Merchandise cost 1800arrow_forward

- Journalize the following merchandise transactions:c. Issued a credit memo to Wilson Company for returned merchandise that was sold for $4,000, terms n/30. The cost of the merchandise returned was $2,275arrow_forwardMerchandise with a list price of $3,900 and costing $2,000 is sold to a customer (MJ Co.) on account, subject to the following terms: 2/10, n/30. The seller (Stone Co.) prepays the transportation costs of $50, shipping terms are FOB Destination. The correct payment amount is received from the buyer within the discount period. Record the foregoing transactions of the SELLER (Stone Co.) in the sequence indicated below (omit the 4th journalizing step of providing an explanation): (a) Sold the merchandise, recognizing the sale and cost of merchandise sold. (b) Paid the $50 transportation charges. (c) Received payment from the customer. Record the foregoing transactions of the BUYER (MJ Co.) in the sequence indicated below (omit the 4th journalizing step of providing an explanation): (d) Bought the merchandise. (e) Sent payment to the vendor. JOURNAL Date Post.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education