FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

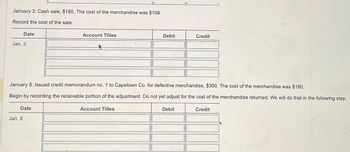

Transcribed Image Text:January 3: Cash sale, $180. The cost of the merchandise was $108.

Record the cost of the sale.

Date

Jan. 3

Date

Jan. 8

Account Titles

January 8: Issued credit memorandum no. 1 to Capetown Co. for defective merchandise, $300. The cost of the merchandise was $180.

Begin by recording the receivable portion of the adjustment. Do not yet adjust for the cost of the merchandise returned. We will do that in the following step.

Credit

Debit

Account Titles

Credit

Debit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following merchandise transactions. Refer to the Chart of Accounts for exact wording of account titles. Jan. 1 Sold merchandise on account, $18,000 with terms 1/10, n/30, using the net method under a perpetual inventory system. The cost of the goods sold was $10,800. Received payment less the discount. Refunded $600 to customer for defective merchandise that was not returned. 6 7arrow_forwardHider Company had a customer return merchandise purchased with cash with a sales price of $7,500. The cost of goods was $3,000. Hider refunded the cash to the customer. The journal entries to record the return, using the perpetual inventory system and assuming an adjusting entry was recorded for estimated sales returns would be:arrow_forward2 )arrow_forward

- A sales invoice included the following information: merchandise price, $11,800; terms 1/10, n/eom; FOB shipping point with prepaid freight of $560 added to the invoice. Assuming that a credit for merchandise returned of $2,400 is granted prior to payment and that the invoice is paid within the discount period, what is the amount of cash that should be received by the seller? O $11,800 O $12,236 O S2400 O $9,866 Previous Next 6:28 PM 3/22/20 38) IIarrow_forwardA buyer uses a perpetual inventory system, and it purchased. $4,000 of merchandise on credit terms of 2/10, n/30 on December 5. Later, on December 15, the buyer pays the invoice in full. Complete the buyer's journal entry for payment by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. No 1 Date December 15 Sales Accounts receivable Answer is not complete. General Journal XX Debit 4,000✔ Creditarrow_forwardA seller uses a perpetual inventory system, and on April 4, it sells $5,000 in merchandise to a customer on credit terms of 3/10, n/30. On April 13, the seller receives payment from the customer. Note: Enter debits before credits. Date April 13 General Journal Debit Creditarrow_forward

- On June 3, Oriole Company sold to Chester Company merchandise having a sale price of $6,000 with terms of 4/10, n/60, f.o.b. shipping point. An invoice totaling $93, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. Prepare journal entries on the Oriole Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts.arrow_forwardOn September 1, Jerry's Lighting purchased merchandise with a list price of $4,100 with credit terms of 3/10, n/60; freight of $200 prepaid and added to the invoice. On September 3, Jerry's returns of $500 of the merchandise. If payment is made within the discount period, the total amount paid by Jerry's Lighting is;arrow_forwardplease answer part C and part D but not in image formatarrow_forward

- On June 3, Marigold Company sold to Chester Company merchandise having a sale price of $3,800 with terms of 4/10, n/60, f.o.b. shipping point. An invoice totalling $91, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. (a) Prepare journal entries on the Marigold Company books to record all the events noted above under each of the following bases. (1) (2) No. Your answer is partially correct. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) (1) (2) Sales and receivables are entered at gross selling price. Sales and receivables are entered at net of cash discounts. Date June 3 June 3 June 12 June 3…arrow_forwardMerchandise is sold on account to a customer for $18,300, terms FOB shipping point, 1/10, n/30. The seller paid the freight of $570. Determine the following: a. Amount of the sale b. Amount debited to Accounts Receivable c. Amount recieved within the discount periodarrow_forwardon june 3, concord comoany sold to chester merchandise having a sale price of $5,500 with terms 2/10,n/60,F.O.B. shipping point. An invoice totalling $99, terms n/30, was received by chester on june 8 from john booth transportservice for the freight cost. on june 12, the company received a check for the balance due from chester company. prepare journal entries on the concord company books to record all the events noted above under each of the following basis. (1) sales and receivable are entered at gross selling price. (2). sales and receivable are entered at net cash discounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education