FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

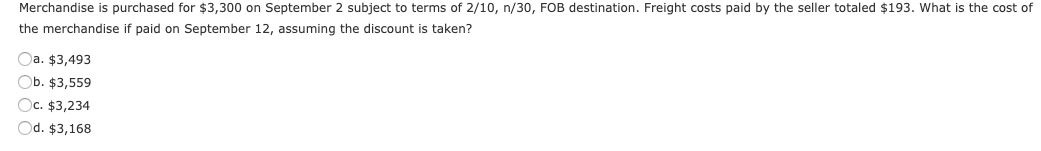

Transcribed Image Text:Merchandise is purchased for $3,300 on September 2 subject to terms of 2/10, n/30, FOB destination. Freight costs paid by the seller totaled $193. What is the cost of

the merchandise if paid on September 12, assuming the discount is taken?

Oa. $3,493

Ob. $3,559

Oc. $3,234

Od. $3,168

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- July 1 Purchased merchandise from Zhang Company for $7,400 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Knight Company for $1,600 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $960. July 3 Paid $405 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $1,900 for $3,100 cash. July 9 Purchased merchandise from Taylor Company for $2,900 under credit terms of 2/15, n/60, FOB destination, invoice dated July July 11 Returned $600 of merchandise purchased on July 9 from Taylor Company and debited its account payable for that amount. July 12 Received the balance due from Knight Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Zhang Company within the discount period. July 19 Sold merchandise that cost $1,800 to Wright Company for $2,600 under credit terms of 2/15, n/60, FOB shipping point, invoice dated…arrow_forwardQuestion: The cost of goods sold as a percentage of net sales revenue is (round your answer to two decimal places). Sales Revenue $420,000 Sales Returns and Allowances 1,400 Sales Discounts Net Sales Revenue Cost of Good Sold a) 62.45% b) 62.58% c) 61.90% d) 62.24% 850 417,750 260,000arrow_forwardJournalize the following inventory merchandise transactions for both Sampson and Batson, assuming that the both Sampson and Batson uses the perpetual inventory system. Refer to the Chart of Accounts for exact wording of account titles. Dec. 1 Sampson Co. sold merchandise to Batson Co. on account, $34,200, terms 2/15, net 45. The cost of the merchandise sold is $25,650. 6 Batson Co. paid the invoice within the discount period.arrow_forward

- Sales and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System The following selected transactions were completed during April between Swan Company and Bird Company. Both companies use the net method under a perpetual inventory system. Ap 2. Swan Company sold merchandise on account to Bird Company, $54,800, terms FOB shipping point, 2/10, n/30. Swan paid freight of $1,620, which was added to the invoice. The cost ef the goods sold was $33,180. 8. Swan Company sold merchandise on account to Bird Company, $48,300, terms FOB destination, 1/15, n/eom. The cost of the goods sold was $25,920. 8. Swan Company paid freight of $1,205 for delivery of merchandise sold to Bird Company on April 8. 12. Bird Company paid Swan Company for purchase of April 2. 23. Bird Company paid Swan Company for purchase of April 24. Swan Company sold merchandise on account to Bird Company, $66,060, terms FOB shipping point, n/eom. The cost of the goods sold was $37,140. 25. Swan…arrow_forward17arrow_forwardJuly 1 Purchased merchandise from Carter Company for $11,200 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Martin Company for $3,500 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $2,100. July 3 Paid $1,165 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $4,100 for $6,900 cash. July 9 Purchased merchandise from Walker Company for $4,800 under credit terms of 2/15, n/60, FOB destination, invoice dated July sukrale cab the th 9. July 11 Returned $1,000 of merchandise purchased on July 9 from Walker Company and debited its account payable for that amount. July 12 Received the balance due from Martin Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Carter Company within the discount period. July 19 Sold merchandise that cost $4,500 to Ryan Company for $6,400 under credit terms of 2/15, n/60, FOB…arrow_forward

- Given the following data, what is cost of goods sold as determined by the FIFO method? Sales Beginning inventory Purchases OA. $1,750 O B. $2,040 O C. $1,600 OD. $3,200 320 units 290 units at $5 per unit 88 units at $10 per unitarrow_forwardThe following merchandise transactions occurred in December. Both cormpanies use a perpetual inventory systerm.Dec.3.Wildhorse Company sold merchandise to Blossom Co. for $40,000, terms 2/10, n/30, FOB destination. This merchandisecost Wildhorse Company $18,000.4The correct company paid freight charges of $800.8Blossom Co. returned unwanted merchandise to Wildhorse. The returned merchandise had a sale price of $2,500 and acost of $990. It was restored to inventory.13Wildhorse Company received the balance due from Blossom Co. Assuming that Blossorm Co. had a balance in Merchandise Inventory on Decerber 1 of $6,000, determine the balance in theMerchandise Inventory account at the end of Decermber for Blossormn Co.arrow_forward2arrow_forward

- Subject:- accountingarrow_forwardNonearrow_forwardOn June 10, Blue Spruce Company purchased $8,400 of merchandise on account from Ayayai Company, FOB shipping point, terms 3/10, n/30. Blue Spruce pays the freight costs of $460 on June 11. Goods totaling $700 are returned to Ayayai for credit on June 12. On June 19, Blue Spruce pays Ayayai Company in full, less the discount. Both companies use a perpetual inventory system.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education