Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

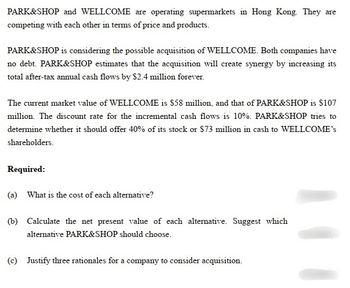

Transcribed Image Text:PARK&SHOP and WELLCOME are operating supermarkets in Hong Kong. They are

competing with each other in terms of price and products.

PARK&SHOP is considering the possible acquisition of WELLCOME. Both companies have

no debt. PARK&SHOP estimates that the acquisition will create synergy by increasing its

total after-tax annual cash flows by $2.4 million forever.

The current market value of WELLCOME is $58 million, and that of PARK&SHOP is $107

million. The discount rate for the incremental cash flows is 10%. PARK&SHOP tries to

determine whether it should offer 40% of its stock or $73 million in cash to WELLCOME's

shareholders.

Required:

(a) What is the cost of each alternative?

(b) Calculate the net present value of each alternative. Suggest which

alternative PARK&SHOP should choose.

(c) Justify three rationales for a company to consider acquisition.

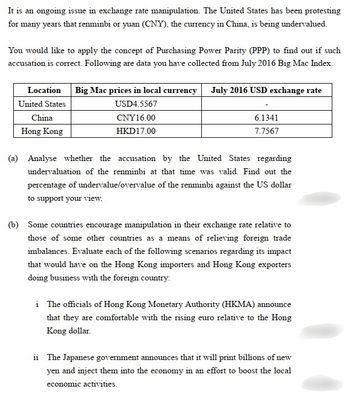

Transcribed Image Text:It is an ongoing issue in exchange rate manipulation. The United States has been protesting

for many years that renminbi or yuan (CNY), the currency in China, is being undervalued.

You would like to apply the concept of Purchasing Power Parity (PPP) to find out if such

accusation is correct. Following are data you have collected from July 2016 Big Mac Index.

Location

United States

China

Hong Kong

Big Mac prices in local currency July 2016 USD exchange rate

USD4.5567

CNY 16.00

HKD17.00

6.1341

7.7567

(a) Analyse whether the accusation by the United States regarding

undervaluation of the renminbi at that time was valid. Find out the

percentage of undervalue/overvalue of the renminbi against the US dollar

to support your view.

(b) Some countries encourage manipulation in their exchange rate relative to

those of some other countries as a means of relieving foreign trade

imbalances. Evaluate each of the following scenarios regarding its impact

that would have on the Hong Kong importers and Hong Kong exporters

doing business with the foreign country:

i The officials of Hong Kong Monetary Authority (HKMA) announce

that they are comfortable with the rising euro relative to the Hong

Kong dollar.

ii The Japanese government announces that it will print billions of new

yen and inject them into the economy in an effort to boost the local

economic activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Templeton Extended Care Facilities, Inc. is considering the acquisition of a chain of cemeteries for $400 million. Because the primary asset of this business is real the majority of the money needed to buy the business. The current owners have estate, Templeton's management has determined that they will be able to borrow no debt financing but Templeton plans to borrow $300 million and invest only $100 million in equity ($40 million in Preferred Shared and $60 million in Common Shares) in the acquisition. Templeton is issuing new common stock at a market price of $27. Dividends last year were $1.45 and are expected to grow at an annual rate of 6% forever. • Templeton is issuing a $1000 par value bond that pays 8% annual interest and matures in 15 years. Investors are willing to pay $950 for the bond and Temple faces a tax rate of 35%. The preferred stock of Templeton currently sells for $36 a share and pays $2.50 in dividends annually ● What is the Weighted Average Cost of capital?arrow_forwardHappy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe’s Party Supply. Happy Times currently has debt outstanding with a market value of $120 million and a YTM of 6.8 percent. The company’s market capitalization is $260 million and the required return on equity is 15 percent. Joe’s currently has debt outstanding with a market value of $25.5 million. The EBIT for Joe’s next year is projected to be $17 million. EBIT is expected to grow at 10 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 9 percent, 15 percent, and 8 percent, respectively. Joe’s has 2.15 million shares outstanding and the tax rate for both companies is 25 percent. a.What is the maximum share price that Happy Times should be willing to pay for…arrow_forwardPenn Corp. is analyzing the possible acquisition of teller company. Both firms have no debt. Penn believes the acquisition will increase its total after tax annual cash flow by $3.1 million indefinitely. The Current market value of teller is $78 million and that of Penn is $135 million. The appropriate discounting rate for the incremental cash flows is 12%. Penn is trying to decide whether it should offer 40% of its stocks or 94 million in cash to Teller’s shareholders. A. What is the cost of each alternative B. What is the NPV of each alternative C. Which alternative should Penn choosearrow_forward

- The managing directors of Track PLC are considering what value to place on Money Plus PLC, a company which they are planning to take over soon. Track PLC’s share price is currently £4.21, and the company’s earnings per share stand at 29p. Track’s weighted average cost of capital is 12%.The board estimates that annual after-tax synergy benefits resulting from the takeover will be £5m, that Money Plus’s distributable earnings will grow at an annual rate of 2% and that duplication will allow the sale of £25m of assets, net of corporate tax (currently standing at 30%), in a year’s time. Information relating to Money Plus PLC:Financial Position Statement of Money plus PLC.£m Non-Current Assets 296 Current Assets 70366 Equity:Ordinary Shares (£1) 156 Reserves 75 2317% Bonds 83 Current Liabilities 52 Total Liabilities 366 Statement of Profit or Loss Extracts£m Profit before interest and tax 76.0 Interest payments 8.3 Profit before tax 67.7 Taxation 20.3 Distributable Earnings 47.4Other…arrow_forwardGeneral Systems, a computer manufacturer, announces that it will be acquiring FastWorks Software. You know the following: - General Systems had a beta of 1.25 before the merger. The firm has a market value of equity of $15 billion and $4 billion in debt outstanding. - FastWorks Software had a beta of 1.4 before the merger. The firm has a market value of equity of $6 billion and $2 billion in debt outstanding. Both firms have a 40% tax rate. Estimate the business risk (unlevered beta) for General Systems before acquisition. Estimate the business risk (unlevered beta) for FastWorks Software before acquisition. Estimate the business risk (unlevered beta) for the combined firm (after the acquisition). If General Systems acquired FastWorks Software by issuing 40% debt and 60% equity capital. Estimate the levered beta for the combined firm.arrow_forwardNonearrow_forward

- Bhupatbhaiarrow_forwardYou have estimated the current-year EBITDA of Mallock Transportation for a potential buyer of the firm, and you have discovered that the CEO of Mallock, who owns 90% of the firm, is taking a salary that is at least $100,000 higher than the cost of an outsider that could be hired to run the firm. The CEO will retire upon the sale, and the firm expects no loss in revenue since clients have signed long-term contracts that will be difficult to cancel. You adjust EBITDA to account for the CEOs replacement. The adjustment is called: a. Fraud b. Business judgment c. Accounting under GAAP d. Normalizing EBITDA e. None of the abovearrow_forwardHappy Times, Incorporated, wants to expand its party stores into the Southeast. In order to establish an immediate presence in the area, the company is considering the purchase of the privately held Joe’s Party Supply. Happy Times currently has debt outstanding with a market value of $200 million and a YTM of 5.8 percent. The company’s market capitalization is $440 million and the required return on equity is 11 percent. Joe’s currently has debt outstanding with a market value of $33.5 million. The EBIT for Joe’s next year is projected to be $13 million. EBIT is expected to grow at 8 percent per year for the next five years before slowing to 3 percent in perpetuity. Net working capital, capital spending, and depreciation as a percentage of EBIT are expected to be 7 percent, 13 percent, and 6 percent, respectively. Joe’s has 2.15 million shares outstanding and the tax rate for both companies is 21 percent. a.What is the maximum share price that Happy Times should be willing to pay for…arrow_forward

- Mega Pharma, Inc. (MPI) is considering merging with a smaller, independent company, SuperDrug, Ltd. (SDL). Using the appropriate discount rate of 12%, the analysts at MPI have determined that the purchase will increase its annual aftertax cash flow by 5 million indefinitely. SDL’s current market price is $50.25, and the firm has 5.5 million shares outstanding. What is the maximum price per share that MPI should offer to purchase SDL? (SHOW YOUR WORK)arrow_forwardSecurity Brokers Inc. specializes in underwriting new issues by small firms. On a recent offering of Beedles Inc., the terms were as follows: Price to public: $5 per share Number of shares: 3 million Proceeds to Beedles: $14,000,000 The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $360, 000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Round your answers to the nearest dollar. Loss should be indicated by a minus sign. $5 per share? $ $6.75 per share? $ $4 per share? $arrow_forwardThe King Carpet Company has $3,010,000 in cash and a total of $12,110,000 in current assets. The firm's current liabilities equal $5,630,000 such that the firm's current ratio equals 2.2 The company's managers want to reduce the firm's cash holdings down to $1,180,000 by paying $560,000 in cash to expand the firm's truck fleet and using $1,270,000 in cash to retire a short-term note. If they carry this plan through, what will happen to the firm's current ratio? The new current ratio is ? (round 2 decimals)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education