Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

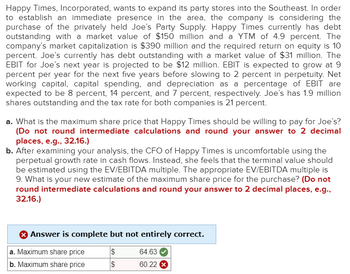

Transcribed Image Text:Happy Times, Incorporated, wants to expand its party stores into the Southeast. In order

to establish an immediate presence in the area, the company is considering the

purchase of the privately held Joe's Party Supply. Happy Times currently has debt

outstanding with a market value of $150 million and a YTM of 4.9 percent. The

company's market capitalization is $390 million and the required return on equity is 10

percent. Joe's currently has debt outstanding with a market value of $31 million. The

EBIT for Joe's next year is projected to be $12 million. EBIT is expected to grow at 9

percent per year for the next five years before slowing to 2 percent in perpetuity. Net

working capital, capital spending, and depreciation as a percentage of EBIT are

expected to be 8 percent, 14 percent, and 7 percent, respectively. Joe's has 1.9 million

shares outstanding and the tax rate for both companies is 21 percent.

a. What is the maximum share price that Happy Times should be willing to pay for Joe's?

(Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.)

b. After examining your analysis, the CFO of Happy Times is uncomfortable using the

perpetual growth rate in cash flows. Instead, she feels that the terminal value should

be estimated using the EV/EBITDA multiple. The appropriate EV/EBITDA multiple is

9. What is your new estimate of the maximum share price for the purchase? (Do not

round intermediate calculations and round your answer to 2 decimal places, e.g.,

32.16.)

Answer is complete but not entirely correct.

$

$

a. Maximum share price

b. Maximum share price

64.63

60.22 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In addition to footwear, Kenneth Cole Productions designs and sells handbags, apparel, and other accessories. You decide, therefore, to consider comparables for KCP outside the footwear industry. You also know the following about KCP: it has sales of $518 million, EBITDA of $55.6 million, excess cash of $100 million, $3 million of debt, EPS of $1.65, book value of equity of $12.05 per share, and 21 million shares outstanding. a. Suppose that Fossil, Inc., has an enterprise value to EBITDA multiple of 11.51 and a P/E multiple of 16.01. What share price would you estimate for KCP using each of these multiples, based on the data for KCP? b. Suppose that Tommy Hilfiger Corporation has an enterprise value to EBITDA multiple of 8.46 and a P/E multiple of 17.86. What share price would you estimate for KCP using each of these multiples based on the data for KCP? a. Suppose that Fossil, Inc., has an enterprise value to EBITDA multiple of 11.51 and a P/E multiple of 16.01. What share price would…arrow_forward(EBIT-EPS analysis) A group of retired college professors has decided to form a small manufacturing corporation that will produce a full line of traditional office furniture. The investors have proposed two financing plans. Plan A is an all-common-equity alternative. Under this agreement, 1 million common shares will be sold to net the firm $20 per share. Plan B involves the use of financial leverage. A debt issue with a 20-year maturity period will be privately placed. The debt issue will carry an interest rate of 10 percent, and the principal borrowed will amount to $6 million. The marginal corporate tax rate is 21 percent. a. Find the EBIT indifference level associated with the two financing proposals. b. Prepare a pro forma income statement that proves EPS will be the same regardless of the plan chosen at the EBIT level found in part a. c. Prepare an EBIT-EPS analysis chart for this situation. d. If a detailed financial analysis projects that long-term EBIT will always be close to…arrow_forwardDFS Corporation is currently an all-equity firm, with assets with a market value of $ 163 million and 5 million shares outstanding. DFS is considering a leveraged recapitalization to boost its share price. The firm plans to raise a fixed amount of permanent debt (i.e., the outstanding principal will remain constant) and use the proceeds to repurchase shares. DFS pays a 21 % corporate tax rate, so one motivation for taking on the debt is to reduce the firm's tax liability. However, the upfront investment banking fees associated with the recapitalization will be 6 % of the amount of debt raised. Adding leverage will also create the possibility of future financial distress or agency costs; shown in the table here, are DFS's estimates for different levels of debt. a. Based on this information, which level of debt is the best choice for DFS? b. Estimate the stock price once this transaction is announced. 9 Debt amount ($ million) 0 10 20 30 40 50 Present value of expected distress and…arrow_forward

- Landman Corporation (LC) manufactures time series photographic equipment. It is currently at its target debt-equity ratio of .78. It’s considering building a new $66.8 million manufacturing facility. This new plant is expected to generate aftertax cash flows of $7.93 million in perpetuity. There are three financing options: A new issue of common stock: The required return on the company’s new equity is 15.2 percent. A new issue of 20-year bonds: If the company issues these new bonds at an annual coupon rate of 7.1 percent, they will sell at par. Increased use of accounts payable financing: Because this financing is part of the company’s ongoing daily business, the company assigns it a cost that is the same as the overall firm WACC. Management has a target ratio of accounts payable to long-term debt of .10. (Assume there is no difference between the pretax and aftertax accounts payable cost.) If the tax rate is 23 percent, what is the NPV of the new plant? Note: A negative answer should…arrow_forwardAmcor Ltd is a paper packaging company that currently has a beta of 0.49,debt with a market value of $11.5 million and equity with a market value of $5.7 billion.Amcor is considering expanding into the manufacture of personal protective equipment,a project that is of similar risk to the activities of Ansell Ltd.Ansell's beta is 0.91,and it has debt of with a market value of $1.4 billion and equity with a market value of $2 million. The current cost debt for Amcor is 5% p.a. compounding semi-annually,the current yield on government bonds is 2% p.a. and the equity market risk premium is estimated to be 6% p.a. compounded annually.The tax rate is 30%. a.Calculate Amcor's cost of equity for this project. b.Calculate Amcor's WACC for the project.arrow_forwardTecumseh Inc. is analyzing the possible merger with Devonshire Inc. Savings from the merger are estimated to be a one-time after-tax benefit of $156 million. Devonshire Inc. has 5.2 million shares outstanding at a current market price of $82 per share. What is the maximum cash price per share that could be paid for Devonshire Inc.? (Omit "$" sign in your response.) Maximum cash price per share $arrow_forward

- Overnight Publishing Company (OPC) has $2.7 million in excess cash. The firm plans to use this cash either to retire all of its outstanding debt or to repurchase equity. The firm's debt is held by one institution that is willing to sell it back to OPC for $2.7 million. The institution will not charge OPC any transaction costs. Once OPC becomes an all-equity firm, it will remain unlevered forever. If OPC does not retire the debt, the company will use the $2.7 million in cash to buy back some of its stock on the open market. Repurchasing stock also has no transaction costs. The company will generate $1,320,000 of annual earnings before interest and taxes in perpetuity regardless of its capital structure. The firm immediately pays out all earnings as dividends at the end of each year. OPC is subject to a corporate tax rate of 22 percent and the required rate of return on the firm's unlevered equity is 13 percent. The personal tax rate on interest income is 20 percent and there are no…arrow_forwardHastings Corporation is interested in acquiring Vandell Corporation. Hastings Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell’s free cash flows to be $2.3 million, $2.9 million, $3.4 million, and $3.79 million at Years 1 through 4, respectively, after which the free cash flows will grow at a constant 5% rate. Hastings plans to assume Vandell’s $10.29 million in debt (which has a 7.4% interest rate) and raise additional debt financing at the time of the acquisition. Hastings estimates that interest payments will be $1.6 million each year for Years 1, 2, and 3. After Year 3, a target capital structure of 30% debt will be maintained. Interest at Year 4 will be $1.431 million, after which the interest and the tax shield will grow at 5%. Vandell currently has 1.5 million shares outstanding and a target capital structure consisting of 30% debt; its current beta is 1.10 (i.e., based on its target capital structure). Vandell and Hastings each have a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education