FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

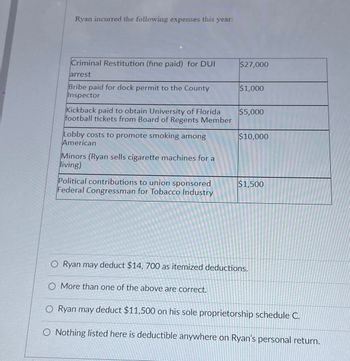

Transcribed Image Text:Ryan incurred the following expenses this year:

Criminal Restitution (fine paid) for DUI

arrest

Bribe paid for dock permit to the County

Inspector

Kickback paid to obtain University of Florida

football tickets from Board of Regents Member

Lobby costs to promote smoking among

American

Minors (Ryan sells cigarette machines for a

living)

Political contributions to union sponsored

Federal Congressman for Tobacco Industry

$27,000

$1,000

$5,000

$10,000

$1,500

O Ryan may deduct $14, 700 as itemized deductions.

O More than one of the above are correct.

O Ryan may deduct $11,500 on his sole proprietorship schedule C.

O Nothing listed here is deductible anywhere on Ryan's personal return.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Nicanor is a married man with surviving spouse: Community Properties: Real Property located in Manila - Php 5,000,000 Bank deposits – Php 5,000,000 Exclusive Properties: Family Home in Nueva Ecija – Php 10,000,000 Other Exclusive properties – Php 2,000,000 Community Deductions: Funeral Expenses – Php 500,000 Other Valid Deductions – Php 1,000,000 Medical Expenses – Php 1,000,000 Assuming Nicanor is head of the family, how much is the NET DISTRIBUTABLE ESTATE?arrow_forwardSidney is a car salesman. As a result of being the best salesman for the year, his employer permits him to buy a new BMW with a cost of Fair Market Value to the dealer of $40,000 for only $25,000. This is to be Sidney's personal vehicle and not used in business. As a result of this purchase, Sydney must report. Zero Income or Loss $40,000 income $15,000 income $20,000 incomearrow_forwardCalvin’s AGI is $84,000. charitable contribution deduction 42000 carryover ?arrow_forward

- Which one of the following costs is most likely NOT fully deductible? Group of answer choices Jose, a local business owner, pays $30,000 in Self-Employment taxes. Sandra owns a mini golf course. She pays her employer portion of payroll taxes because of her employees, which totals to $12,000. Travis owns a CPA firm and pays his son Joe as an associate. Joe is a CPA and is paid the same salary as the other associates. X-Corp writes off a $12,000 business debt owed by Sam because he has not responded to their numerous requests for payment.arrow_forwardClassify each of the following cases as "Included in" or "Excluded from" gross income. Included in/Excluded from Gross Income a. Eloise received $150,000 in the settlement of a sex discrimination case against her former employer. b. Nell received $10,000 for damages to her personal reputation. Nell also received $40,000 in punitive damages. c. Orange Corporation, an accrual-basis taxpayer, received $50,000 from a lawsuit it filed against its auditor, who overcharged for services rendered in a previous year. d. Beth received $10,000 in compensatory damages in a lawsuit she filed against a tanning parlor for severe burns she received from using the parlor's tanning equipment. Beth also received $30,000 in punitive damages in the lawsuit against the tanning parlor. e. Joanne received compensatory damages of $75,000 from a cosmetic surgeon who botched her nose job. Joanne also received $300,000 in punitive damages from the cosmetic surgeon who…arrow_forwardMs. Zhao has $200,000 private activity municipal bond interest income from The City of Indianapolis. Ms. Zhao's only other income for the year is her $600,000 salary and Mr. Zhao has a $400,000 salary. Furthermore, both Ms. and Mr. Zhao, married, are 50 years old, file a joint return, have no dependents, and have $27,000 itemized deductions. Compute the Zhao's tentative minimum tax for the current year.arrow_forward

- 1. Jim paid his brother to provide computer services for Jim's business. Jim paid him $14,000. Other firms provide the same services for $5,000. How much of this expenditure is deductible? 2. XYZ landscaping sold a truck during 2021 for $15,000 recognizing a gain of $2,000. What is the adjusted basis of the truck? 3. Bill earned $50,000 from self employment during 2021. How much must he pay in self employment tax? 4. Ed commutes to work every day during 2021. He spent $3,000 in transportation. How much can he deduct for 2021?arrow_forwardMarvin had the following transactions: Salary $50,000 Compensation of body injury due to car accident 15200 Bank loan (proceeds used to buy personal auto) 10,000 Alimony payment to ex-wife (divorce settled in 2018) 6,000 Child support payment 12,000 Gift from aunt Gain from sale of city of Bloomington bonds 5,000 20,000 Interest from City of Bloomington Bonds 500 Interest received on the U.S. Government bonds 1,500 Interest received on corporate (GE company) bonds 350 Lottery winnings 500 Life insurance proceed after her grandmother died 150,000 Calculate Marvin’s AGI:arrow_forwardThomas, a calendar year cash basis taxpayer, has the following transactions: Salary from job $50,000 Alimony paid to ex-wife (divorce after 2018) 9,000 Medical expenses 4,500 Charitable contributions 2,000 Based on this information, Thomas has: AGI of $34,500. AGI of $41,000. AGI of $50,000. Medical expense deduction of $3,075. None of the above.arrow_forward

- 14. A taxpayer was in an automobile accident while he was going to work. He was in a rehabilitation facility for ten months re-learning how to walk. The resulting lawsuit was settled, and he received the following amounts for: medical expenses lost wages emotional distress due to injuries punitive damages O $500,000 O $25,000 How much of the settlement must he include in gross income on his tax return? O $575,000 $ 120,000 75,000 O $0 25,000 500,000arrow_forwardEf 449.arrow_forwardMorris a single taxpayer earns wages of $350,000. In tax year 2021 he also owns a sole proprietorship with $210,000 of income and $480,000 of allowed deductions ( 270,000 dollar loss). Boris has enough tax basis to cover the loss as and is considered at risk for the loss amount and he materially participates in the activity. What is the amount of excess business loss he will carry forward $10,000 $80,000 $260,000 $270,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education