FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

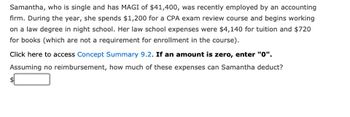

Transcribed Image Text:Samantha, who is single and has MAGI of $41,400, was recently employed by an accounting

firm. During the year, she spends $1,200 for a CPA exam review course and begins working

on a law degree in night school. Her law school expenses were $4,140 for tuition and $720

for books (which are not a requirement for enrollment in the course).

Click here to access Concept Summary 9.2. If an amount is zero, enter "0".

Assuming no reimbursement, how much of these expenses can Samantha deduct?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- i need the answer quicklyarrow_forwardMelissa recently paid $870 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $400 fee to register for the conference, $260 per night for three nights' lodging, $120 for meals in restaurants, and $425 for cab fare. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable.) c. Suppose that Melissa made the trip to San Francisco primarily to visit the national parks and only attended the business conference as an incidental benefit of being present on the coast at that time. What amount of the airfare can Melissa deduct as a business expense? Deductible amountarrow_forwardPlease do not give image formatarrow_forward

- please solve Carrow_forwardWesley, who is single, listed his personal residence with a real estate agent on March 3, 2021, at a price of $390,000. He rejected several offers in the $350,000 range during the summer. Finally, on August 16, 2021, he and the purchaser signed a contract to sell for $363,000. The sale (i.e., closing) took place on September 7, 2021. The closing statement showed the following disbursements: Real estate agent's commission $21,780 Appraisal fee 600 Exterminator's certificate 300 Recording fees 800 Mortgage to First Bank 305,000 Cash to seller 34,520 Wesley's adjusted basis for the house is $200,000. He owned and occupied the house for seven years. On October 1, 2021, Wesley purchases another residence for $325,000. If an amount is zero, enter "0". a. Calculate Wesley's recognized gain on the sale. b. What is Wesley's adjusted basis for the new residence? c. Assume instead that the selling price is $800,000. What is Wesley's recognized gain? His adjusted basis for the new residence?…arrow_forwardMelissa recently paid $400 for round-trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $250 fee to register for the conference, $300 per night for three nights' lodging, $200 for meals in restaurants, and $150 for cab fare. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Leave no answers blank. Enter zero if applicable. d. Suppose that Melissa's permanent residence and business were located in San Francisco. She attended the conference in San Francisco and paid $250 for the registration fee. She drove 100 miles over the course of three days and paid $90 for parking at the conference hotel. In addition, she spent $150 for breakfast and dinner over the three days of the conference. She bought breakfast on the way to the conference hotel, and she bought dinner on her way home each night from the conference. What amount of these costs can Melissa deduct as…arrow_forward

- James was a high school teacher earning a net salary of $4500 per month. After working for one year, he quit his job to start his own kiosk business dealing in various consumer goods. In order to learn how to run the business, James enrolled in a TAFE to acquire accounting skills. James’ course was for 6 months. James had to pay $3,000 as tuition for the 3 months. After the training, James borrowed $40,000.00 from his uncle whom he pays 8 percent interest per year. Also, James withdrew $ 50,000 from his savings account. He had been earning 5 percent interest per year for this account. Further, to start the business James used his own premises given to him by his father. His father had been receiving $11,000 from rent per year. Finally, to start the business James uses $75,000 he had been given by his father to go on holiday to USA. James’s first year of business can be summarised as follows: "image" Based on your calculations of accounting profit and economic profit, would you advise…arrow_forwardMakayla Jennings 34 is filing as a single tax payer during the year she earned 53000 in wages from her job as a high school english teacher makayla has always been a avid reader and in addition to her teaching job she had an opportunity in early 2020 to lead a book club at a nearby community center makayla led the book for early January until March 19 2020 when the center closed due to covid restrictions the community center pay het and in early 2021 she recieve form 1099 nec reporting 510 for nonemployee compensation in box 1 the community center is within walking distance of makayla home so she did not have any vehicle or travel expenses he only businesd related expenses was 50 in supplies makayla has no other income What is the amount of makayla self employment tax?arrow_forwardA5 please help......arrow_forward

- Amara is a sole proprietor who operates her business using the cash method of accounting and a calendar year. Based on the following list, how much income will be reported on her 2023 Schedule C? $10,000 check received January 4, 2024, for a job completed December 20, 2021. $15,000 check received December 29, 2023, for a job completed December 28, 2022, deposited January 5, 2024. $9,500 balance due for work that Amara performed in June 2023. Amara took her client to small claims court in December 2023, but did not receive any satisfaction. 1) $9.500 2) $15,000 3) $19,500 4) $25,000arrow_forwardThrough November, Cameron has received gross income of $130,500. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $9,730 of revenue at a cost to Cameron of $4,050, which is deductible for AGI. In contrast, engagement 2 will generate $7,100 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. Description (1) Gross income before new work engagement (2) Income from engagement (3) Additional for AGI deduction (4) Adjusted gross income (6) Deduction for QBI Taxable income Engagement 1 Engagement 2arrow_forwardHugo Garcia is preparing his balance sheet and income and expense statement for the year ending December 31, 2020. He is having difficulty classifying a few items and asks for your help. Which of the transactions are assets, liabilities, income, or expense items? a. Hugo rents a house for $1,350 a month. b. Hugo bought diamond earrings for his wife and charged them using his Visa card. The earrings cost $900, but he hasn’t yet received the bill. c. Hugo borrowed $3,500 from his parents last fall, but so far, he has made no payments to them. d. Hugo makes monthly payments of $225 on an installment loan; about half of it is interest, and the balance is repayment of principal. He has 20 payments left, totaling $4,500. e. Hugo paid $3,800 in taxes during the year and is due a tax refund of $650, which he hasn’t yet received. f. Hugo invested $2,300 in a mutual fund. g. Hugo’s Aunt Lydia gave him a birthday gift of $300.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education