FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

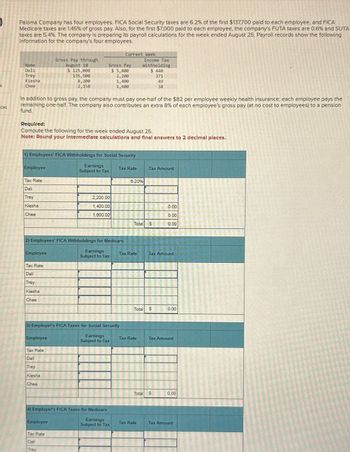

Paloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA

Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA

taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following

information for the company's four employees.

Name

Dali

Trey

Kiesha

Chee

Employee

Tax Rate

Dali

Trey

Kiesha

Chee

In addition to gross pay, the company must pay one-half of the $82 per employee weekly health insurance; each employee pays the

remaining one-half. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension

fund.

1) Employees' FICA Withholdings for Social Security

Earnings

Subject to Tax

Employee

Required:

Compute the following for the week ended August 25.

Note: Round your Intermediate calculations and final answers to 2 decimal places.

Tax Rate

Dali

Trey

Kiesha

Chee

Gross Pay through

August 18

$ 125,000

135,500

8,200

2,158

Employee

2) Employees' FICA Withholdings for Medicare

Earnings

Subject to Tax

Tax Rate

Dali

Trey

Kiesha

Chee

Gross Pay

$ 5,800

2,200

1,400

1,600

Employee

Tax Rate

Dali

Trey

Current Week

2,200.00

1,400.00

1,600.00

3) Employer's FICA Taxes for Social Security

Earnings

Subject to Tax

4) Employer's FICA Taxes for Medicare

Earnings

Subject to Tax

Tax Rate

Income Tax

Withholding

$ 448

371

6.20%

Tax Rate

Total

Total

Tax Rate

Tax Rate

38

Tax Amount

S

$

Tax Amount

Total S

0.00

0.00

0.00

0.00

Tax Amount

0.00

Tax Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 8, the end of the first weekly pay period of the year, Regis Company's employees earned $25,760 of office salaries and $70,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $13,660 of federal income taxes, $1,420 of medical insurance deductions, and $840 of union dues. No employee earned more than $7,000 in this first period. Required: 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. 1.2 Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. 2. Prepare the journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment…arrow_forwardEmployee AA is paid monthly. For the month of January, she earned a total of $8,260. The tax for social security is 6.2% of the first $128,400 of employee earnings each calendar year and the tax rate for Medicare is 1.45% of all earnings. The FUTA tax rate of .6% and the SUTA tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from Employee AA’s earnings was $1,325.17. Employee AA’s net pay for the month is:arrow_forwardam.300.arrow_forward

- CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Portions of the payroll register for Barney's Bagels for the week ended July 15 are shown below.The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%,both of which are levied on the first $7,000 of earnings.The Social Security tax rate is 6.2% on the first $128,400 of earnings. The Medicare rate is 1.45% on gross earnings. Calculate the employer's payroll taxes expense and prepare thejournal entry to record the employer'spayroll taxes expense for the week ended July 15of the current year.arrow_forwardThe payroll register for D. Salah Company for the week ended May 18 indicated the following: Line Item Description Amount Salaries $711,000 Federal income tax withheld 142,200 The salaries were all subject to the 6.0% social security tax and the 1.5% Medicare tax. In addition, state and federal unemployment taxes were computed at the rate of 5.4% and 0.8%, respectively, on $14,000 of salaries. Assume the company runs all paychecks through Salaries Payable. If an amount box does not require an entry, leave it blank. Question Content Area a. Journalize the entry to record the payroll for the week of May 18. Date Account Debit Credit May 18 Feedback Area Feedback Question Content Area b. Journalize the entry to record the payroll tax expense incurred for the week of May 18. Date Account Debit Credit May 18arrow_forwardOn January 14, at the end of the second week of the year, the totals of Castle Company's payroll register showed that its store employees' wages amounted to $40,660 and that its warehouse wages amounted to $12,600. Withholdings consisted of federal income taxes, $6,391, employer's Social Security taxes at the rate of 6.2 percent, and employees' Social Security taxes at a rate of 6.2 percent. Both the employer's and employees' Social Security taxes are based on the first $118,500, and no employee has reached the limit. Additional withholdings were Medicare taxes at the rate of 1.45 percent on all earnings and charitable contributions withheld, $720. Required: a. Calculate the amount of Social Security and Medicare taxes to be withheld and prepare the general journal entry to record the payroll. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in…arrow_forward

- A company's payroll records report $3,460 of gross pay and $484 of federal income tax withholding for an employee for the weekly pay period. Compute this employee's FICA Social Security tax (6.2%), FICA Medicare tax (1.45%), state income tax (1.0%), and net pay for the current pay period. Note: Round your final answers to 2 decimal places. Gross pay FICA Social Security tax deduction FICA Medicare tax deduction Federal income tax deduction State income tax deduction Total deductions Net payarrow_forwardMerger Company has 10 employees, each of whom earns $1,900 per month and has been employed since January 1. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Prepare the March 31 journal entry to record the March payroll taxes expense. Note: Round your answers to 2 decimal places. View transaction list Journal entry worksheet 1 Record employer payroll tax expense. Note: Enter debits before credits. Date March 31 Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardOn January 8, the end of the first weekly pay perlod of the year, Regis Company's employees earned $21,760 of office salarles and $70,840 of sales salarles. Withholdings from the employees' salarles Include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $13,560 of federal Income taxes, $1,400 of medical Insurance deductions, and $880 of union dues. No employee eamed more than $7,000 in this first period. Required: 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's state unemployment tax rate is 5.4% of the first $7,000 pald to each employee. The federal unemployment tax rate is 0.6% 1.2 Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilitles. 2 Prepare the Journal entry to record Regis's employer payroll taxes resulting from the January 8 payroll. Regis's state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax…arrow_forward

- Giblin’s Goodies pays employees weekly on Fridays. However, the company notices that March 31 is a Wednesday, and the pay period will end on April 2. The payroll data for March 29-31 is as follows Gross pay: $8,000.00 Federal income tax: $920.00 Social Security tax: $496.00 Medicare tax: $116.00 State income tax: $160.00 Federal Unemployment Tax: $48.00 State Unemployment Tax: $432.00 REQUIRED:Give the adjusting entry in the General Journal to recognize the employee and employer share of the payroll for March 29–31. The date of the entry is March 31. Then record the journal entry to reverse the adjustment on April 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Record the adjusting Journal Entry for employees' share of payroll accrual. Date General Journal Debit Creditarrow_forwardPaloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees. Current Week Gross Pay through August 18 $ 124,200 134,300 9,000 2,950 Income Tax Name Gross Pay $ 4,700 3,400 1,600 1,000 Withholding $ 554 Dali Trey Kiesha 306 55 Chee 44 In addition to gross pay, the company must pay one-half of the $98 per employee weekly health insurance; each employee pays the remaining one-half. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Required: Compute the following for the week ended August 25. (Round your intermediate calculations and final answers to 2 decimal…arrow_forwardAt the end of October, the payroll register for Garden Marbles Corporation contained the following totals: wages, $742,000; federal income taxes withheld, $189,768; state income taxes withheld, $31,272; Social Security tax withheld, $46,004; Medicare tax withheld, $10,759; medical insurance deductions, $25,740; and wages subject to unemployment taxes, $114,480. Determine the total and components of the (1) monthly payroll and (2) employer payroll expenses, assuming Social Security and Medicare taxes equal to the amount for employees, a federal unemployment insurance tax of 0.8 percent, a state unemployment tax of 5.4 percent, and medical insurance premiums for which the employer pays 80 percent of the costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education