FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

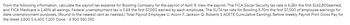

Transcribed Image Text:From the following information, calculate the payroll tax expense for Bowling Company for the payroll of April 9: View the payroll. The FICA Social Security tax rate is 6.28n the first $142,800earned,

and FICA Medicare is 1.45% all earings. Federal unemployment tax is 0.68 the first $7,000 earned by each employee. The SUTA tax rate for Bowling 5.70m the first $7,000 of employee earnings for

state unemployment purposes. (Round to the nearest cent as needed.) Total Payroll Employee U. Acorn F. Jackson Q. Roberts $ ACETE Cumulative Earnings Before Weekly Payroll Print Gross Pay for

the Week 3,600 $ 6,400 7,200 Done - X 900 550 350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please give me answer in relatablearrow_forwardJournalize Payroll Tax The payroll register of Patel Engineering Co. indicates $1,698 of social security withheld and $424.50 of Medicare tax withheld on total salaries of $28,300 for the period. Earnings of $8,200 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places. Payroll Tax Expense v Social Security Tax Payable v Medicare Tax Payable v State Unemployment Tax Payable v Federal Unemployment Tax Payable v DEFERarrow_forwardESPAÑOL INGLÉS FRANCÉS ABC pays its employees monthly. The payroll information shown below is for December 2021, the last month of the ABC fiscal year 1. Total gross wages: $400,000 2. income tax withholding: $80,000 3. Federal Unemployment Tax Rate (FUTA) 0.60%, $30,000 of total payroll exceeds $7,000 limit 4. State Unemployment Tax Rate (SUTA) 5.4%, $30,000 of total payroll exceeds $7,000 limit 5. Social Security Tax Rate: 6.20%, $8,000 of total payroll exceeds the $147,000 limit. 6. Medicare tax rate: 1.45% unlimited Determine the total employee withholdings Enviar comentar MacBook Air 10arrow_forward

- Nov. 30: Journalized the monthly payroll for November, based on the following data. Description entries available are: Cash, Medicare Tax Payable, No Entry Required, Sales Salaries Expenses, Sales Salaries Payable. Salaries Deductions Sales salaries $135,000 Federal income tax withheld $39,266 Office salaries 77,250 Social security tax withheld 12,735 $212,250 Medicare tax withheld 3,184 Unemployment tax rates: State unemployment 5.4% Federal unemployment 0.6% Amount subject to unemployment taxes: State unemployment $5,000 Federal unemployment 5,000 Nov. 30: Journalized the employer's payroll taxes on the payroll. Description Debit Credit Description Debit Credit Dec. 14: Journalized the payment of the September 15 note at maturity. Description Debit Credit Dec. 31: The pension cost for…arrow_forwardCompute the net pay for each employee using the federal income tax withholding table included. Assume that FICA Social Security tax is 6.2% on a wage base limit of $142,800, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. (Round each computation to the nearest cent as needed.) View the employee information. Compute the net pay for each employee. View the biweekly payroll period percentage method withholding chart. Li Kan Isabel Poland Gross earnings for the current pay period Deductions for employee withholding taxes - BIWEEKLY Payroll Period Percentage Method Withholding Chart STANDARD Withholding Rate Schedules Single or Married Filing Separately of the amount The tentative amount to Plus this withhold is: percentage-exceeds— that the Adjusted Wage Total deductions Net pay Adjusted wage amount is at least $0, but less than $483 $ 0.00 0% $ Adjusted wage amount is at least $483, but less than $865 $ 0.00 10% $ 483 Adjusted wage amount…arrow_forwardJournalize Payroll Tax The payroll register of Chen Engineering Co. indicates $1,956 of social security withheld and $489.00 of Medicare tax withheld on total salaries of $32,600 for the period. Earnings of $10,100 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave it blank. Round to two decimal places.arrow_forward

- Midwest Shipping pays employees at the end of each month. Payroll information is listed below for January, the first month of the fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Salaries Federal and state income taxes withheld Federal unemployment tax rate State unemployment tax rate (after FUTA deduction) Social Security (FICA) tax rate $900,000 120,000 0.80% 5.40% 7.65% Required: Record salaries expense and payroll tax expense for the January pay period. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 2 Record the employer payroll taxes. Note: Enter debits before credits.arrow_forwardThomas Martin receives an hourly wage rate of $22, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 44; federal income tax withheld, $329; social security tax rate, 6.0%; and Medicare tax rate, 1.5%. What is the gross pay for Martin? a.$968 b.$1,012 c.$1,452 d.$1,936arrow_forwardPayroll Tax Entries According to a summary of the payroll of Mountain Streaming Co., $582,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $19,000 was subject to state and federal unemployment taxes. a. Calculate the employer's payroll taxes, using the following rates: state unemployment, 4.2%; federal unemployment, 0.8%. $ b. Journalize the entry to record the accrual of payroll taxes. If an amount box does not require an entry, leave it blank. ▼arrow_forward

- Given the following, calculate the state (assume 5.3%) and federal unemployment taxes that the employer must pay for each of the first two quarters. The federal unemployment tax is 0.8% on the first $7,000. Both state and federal unemployment taxes apply to the first $7,000 only. (Round your answers to the nearest cent.) PAYROLL SUMMARY Quarter 1 Quarter 2 $3,200 Bill Adams $ 7,300 12,800 Rich Haines 7,400 Alice Smooth 2,600 4,400 PAYROLL SUMMARY Quarter 1 Quarter 2 Total $780.8 8 $451.4 SUTA $678.4 $392.2 8 FUTA $102.4 24 59.2 * ...arrow_forwardXYZ Company is processing payroll for the week ending January 9th. Employee earnings total $5,000. Federal income tax withheld from employee paychecks totaled $1,100. The social security tax rate is 6%, the Medicare tax rate is 1.5%, the state unemployment tax rate is 5.4% and the federal unemployment tax rate is .8%. a) Journalize the payroll entry for the week. DATE Debit Credit X/X b) Journalize the payroll tax entry for the week. DATE Debit Credit X/Xarrow_forwardWallace Corporation summarizes the following information from its weekly payroll records during April. Type of Salary Gross Pay F.I.C.A. Tax Federal Income Tax State Income Tax Net Pay Office Staff $75,000 $6,000 $5,475 $2,000 $61,525 Required: Prepare the two journal entries to record the payment of the payroll and the accrual of its payroll taxes for April. Assume an 8% F.I.C.A. rate for both employees and the employer. Also assume a 5.4% state unemployment tax rate, a 0.6% federal unemployment tax rate, and that all wages are subject to all payroll taxes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education