FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

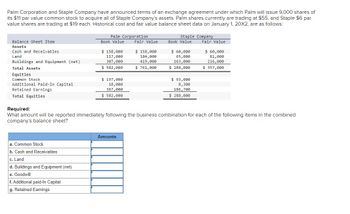

Transcribed Image Text:Palm Corporation and Staple Company have announced terms of an exchange agreement under which Palm will issue 9,000 shares of

its $11 par value common stock to acquire all of Staple Company's assets. Palm shares currently are trading at $55, and Staple $6 par

value shares are trading at $19 each. Historical cost and fair value balance sheet data on January 1, 20X2, are as follows:

Balance Sheet Item

Assets

Cash and Receivables

Land

Buildings and Equipment (net)

Total Assets

Equities

Common Stock

Additional Paid-In Capital

Retained Earnings

Total Equities

Palm Corporation

Book Value

a. Common Stock

b. Cash and Receivables

c. Land

d. Buildings and Equipment (net)

e. Goodwill

f. Additional paid-In Capital

g. Retained Earnings

$ 158,000

117,000

307,000

$ 582,000

$ 197,000

18,000

367,000

$ 582,000

Fair Value

Amounts

$ 158,000

184,000

419,000

$ 761,000

Staple Company

Book Value

$ 60,000

65,000

163,000

$ 288,000

$ 93,000

8,300

186,700

$ 288,000

Fair Value

Required:

What amount will be reported immediately following the business combination for each of the following items in the combined

company's balance sheet?

$ 60,000

81,000

216,000

$ 357,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- PR Company pays $25,000 in cash and issues no-par stock with a fair value of $40,000 to acquire all of SX Corporation's net assets. SX's balance sheet at the date of acquisition is as follows: Current assets Property, plant & equipment, net Identifiable intangible assets Total assets Current liabilities Long-term debt Capital stock Retained earning SX Corporation Book value Fair value $5,000 $8,000 13,000 4,000 $22,000 Accumulated other comprehensive income Treasury stock Total abilities & equity $4,600 14,500 4,000 5.500 (1,000) (R600) $22,000 9,000 13,000 $5,600 13,800 PR's consultants find these items that are not reported on SXS balance sheetarrow_forwardSmith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $38 per share and the bullding's book value on the books of the seller was $215,000. Which of the following is correct for Smith Company when Smith issues 10,000 shares of $10 par value common stock and pays $21,500 cash in exchange for the butlding? Murtiple cholce Total assets Increase $380,000. Stockholders equity increases $215.000. Total assets increase $350.500. stocknoiders' equity increases $358.500.arrow_forwardHELP MEarrow_forward

- Presented below is information related to Cullumber Company.1. On July 6, Cullumber Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $200,000 Buildings 600,000 Equipment 400,000 Total $1,200,000 Cullumber Company gave 12,000 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property.2. Cullumber Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $168,000 Construction of bases for equipment to be installed later 216,000 Driveways and parking lots 195,200 Remodeling of office space in building, including new partitions and walls 257,600 Special assessment by city on land 28,800 3. On December 20, the company paid cash…arrow_forwardSudoku Company issues 21,000 shares of $9 par value common stock in exchange for land and a building. The land is valued at $231,000 and the building at $377,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building.arrow_forwardExercise 11-6 (Algo) Stock issuance for noncash assets LO P1 Sudoku Company issues 30,000 shares of $7 par value common stock in exchange for land and a building. The land is valued at $236,000 and the building at $364,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building. No A Transaction 1 Answer is complete but not entirely correct. General Journal Land Building Common stock, $7 par value Paid-in capital in excess of par value, common stock ✓ Debit 236,000✔ 364,000 Credit 210,000 210,000 xarrow_forward

- What will be the balance in the investment account on December 31, 20y4 under the equity method of accounting? A. 152,000 B. 150,000 C. 159,200 D. 155,600arrow_forwardSudoku Company issues 18,000 shares of $8 par value common stock in exchange for land and a building. The land is valued at $227,000 and the building at $365,000. Prepare the journal entry to record issuance of the stock in exchange for the land and building. View transaction list Journal entry worksheet A Record the issue of 18,000 shares of $8 par value common stock in exchange for land valued at $227,000 and a building valued at $365,000. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardDinesh bhaiarrow_forward

- New Harvest Bakery acquired all the outstanding common stock of Red Rock Bakery for $72,800 in cash. The book values and fair values of Red Rock's assets and liabilities were as follows: Book Value Fair Value Current assets Property, plant, and equipment Other assets Current liabilities Long-term liabilities $25,100 43,900 4,900 18,000 25,600 $23,900 50,400 5,700 14,600 20,500 Calculate the amount paid for goodwill. Goodwillarrow_forwardOn May 1, Burns Corporation acquired 100 percent of the outstanding ownership shares of Quigley Corporation in exchange for $728,000 cash. At the acquisition date, Quigley's book and fair values were as follows: Cash Receivables Inventory Land Building and equipment (net) Patented technology Total assets Accounts payable Long-term liabilities Common stock ($5 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders equity Total assets Assets Book Value $ 112,000 $ 218,000 232,000 $ 177,000 323,000 0 $1,062,000 $ 162,500 $ 638,000 210,000 90,000 (38,500) $1,062,000 Burns directs Quigley to seek additional financing for expansion through a new long-term debt issue. Consequently, Quigley will issue a set of financial statements separate from that of its new parent to support its request for debt and accompanying regulatory filings. Quigley elects to apply pushdown accounting in order to show recent fair valuations for its assets. Prepare a separate…arrow_forwardPresented below is information related to Concord Company 1. On July 6, Concord Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land Buildings Equipment Total Concord Company gave 12.500 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property 2. Concord Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. Repairs to building Construction of bases for equipment to be installed later Driveways and parking lots Remodeling of office space in building including new partitions and walls Special assessment by city on land 3. On December 20, the company paid cash for equipment, $234.000, subject to a 2% cash discount, and freight on equipment of $9.450. Prepare entries on the books of Concord Company for these transactions. (Do not round intermediate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education