FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

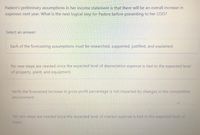

Transcribed Image Text:Padere's preliminary assumptions in her income statement is that there will be an overall increase in

expenses next year. What is the next logical step for Padere before presenting to her COO?

Select an answer:

Each of the forecasting assumptions must be researched, supported, justified, and explained.

No new steps are needed since the expected level of depreciation expense is tied to the expected level

of property, plant, and equipment.

Verify the forecasted increase in gross profit percentage is not impacted by changes in the competitive

environment.

No new steps are needed since the expected level of interest expense is tied to the expected level of

loans.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Martha invested $3,500. During 2020, Martha's investment earned 7%, and inflation increased by 4%. What was Martha's real rate of return? 4.00% 2.88% 5.00% 7.00% 3.00%arrow_forwardComputer Solutions’ success in the fourth quarter of 2022 has attracted the attention of David Wright,who considered investing in the company. A price of $15 per share was offered by Ramona, whichDavid accepted (a great way to start out the new year). The following transactions occurred betweenJanuary 1 and January 31, 2023, and need to be recorded in the general journal. Based on the initial success of Computer Solutions, David Wright invested an additional $15,000 cash in the company in exchange for 1,000 shares of the Company’s $10 par value common stock. (Reminder: anything paid in excess of par goes to Paid in Capital in Excess of Par. Can someone please help me with the general journal entry for this problem?arrow_forwardA company is thinking of investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B)0 (150,000) outlay (150,000) outlay 1 24,000 12,0002 24,000 25,3333 44,000 52,0004 84,000 63,333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Which product should be chosen and why?arrow_forward

- After analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below. To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project price at the beginning. They then receive four equal instalment payments of 20% of the total project price associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the…arrow_forwardQuestion Why is the consideration of time important in financial decision-making? How can the time value be adjusted? Illustrate your answer. (100-150 words).arrow_forwardYou have invested in a business that proudly reports that it is profitable. Your investment of $4000 has produced a profit of $201. The managers think that if you leave your $4500 levested with them, they should be able to generate $291 per year in profits for you in perpetuity. Evaluating other investment opportunites, you note that other long-term investments of similar risk offer an expected return of 7.9%. Should you remain invested in this fr ? The expected ratus of your envestment is__? (Round to one decimal)arrow_forward

- Subject: accountingarrow_forwardAs the newly-appointed Chief Financial Officer of BnB Construction Inc. State whether the company is likely to be successful if it approaches its bank Republic Limited for a loan to undertake the expansion project at a cost of $500.00 million. You should analyse the current financial position and recent financial performance of the company (liquidity, profitability, leverage, asset management, market value- 2 to 3 ratios for each category). Comment on whether the firm has a great chance of success with the loan or whether alternative forms of financing should be sought. Give justification for your answer.arrow_forwardGreater Findlay Development Consortium is preparing to open a new retail strip mall and have multiple businesses that would like lease space in it. Each business will pay a fixed amount of rent plus a percentage of the gross sales generated each year. The cash flows from each of the businesses has approximately the same amount of risk. The business names, annual expected cash flows, and initial capital outflow for each of the businesses that would like to lease space in the strip mall are provided below. Greater Findlay Development Consortium uses a 12% hurdle rate which is its cost of capital. All business will be evaluated based on 4-year term because the contract will expire in four years. Video Now Apple Garden Croger Mart Horizon Wireless Initial Capital Outlay ($200,000) ($298,000) ($248,000) ($272,000) Annual Net Cash Flows Year 1 65,000 100,000 80,000…arrow_forward

- ________ differences between book income and taxable income result in an effective tax rate that differs from the statutory tax rate. Group of answer choices Short-term Permanent Temporary Long-termarrow_forwardAlthough the income statement is a record of past achievement, the calculations required forcertain expenses involve estimates of the future.’ What does this statement mean? Can you thinkof examples where estimates of the future are used?arrow_forwardYou are creating a pro forma balance sheet for the upcoming year. You have already prepared a pro forma income statement, and are predicting total assets will increase by $185,000 due to the increase in sales you are anticipating. How will you choose to finance this new growth in order to make sure the balance sheet balances?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education