Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

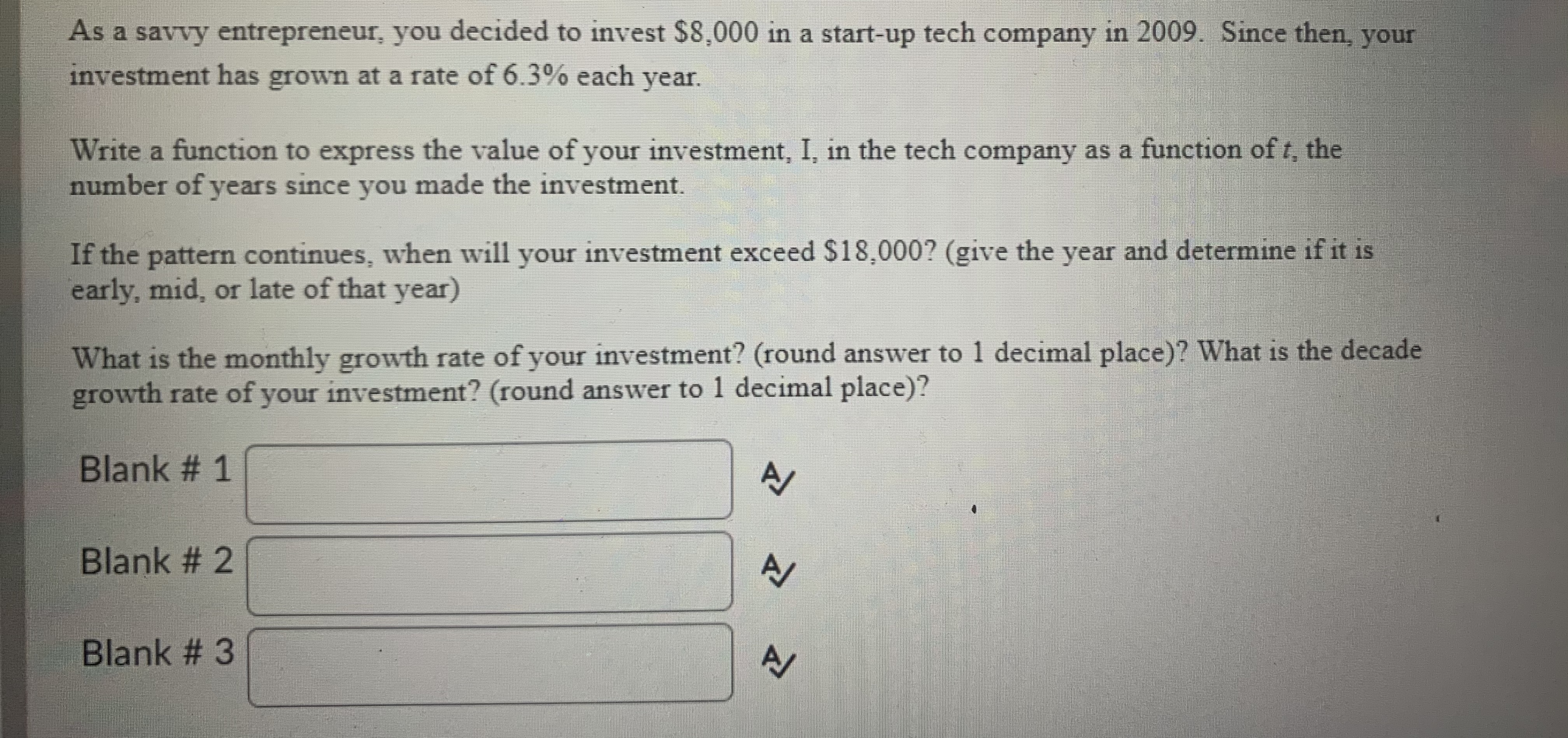

Transcribed Image Text:As a savvy entrepreneur, you decided to invest $8,000 in a start-up tech company in 2009. Since then, your

investment has grown at a rate of 6.3% each year.

Write a function to express the value of your investment, I, in the tech company as a function of t, the

number of years since you made the investment.

If the pattern continues, when will your investment exceed $18,000? (give the year and determine if it is

early, mid, or late of that year)

What is the monthly growth rate of your investment? (round answer to 1 decimal place)? What is the decade

growth rate of your investment? (round answer to 1 decimal place)?

Blank # 1

A/

Blank # 2

Blank # 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Similar questions

- Please use a TIMELINE to solve. I need to understand the timeline.arrow_forwardYou invested $2,500 in Awesome Software, Inc. The company did well that year, and you received a check for $300. What was your rate of rate of return on this investment?arrow_forwardHow do I work this problem in excel? You have been offered $3,000 in 4 years for providing $2,000 today into a business venture with a friend. If interest rates are 10%, is this a good investment for you?arrow_forward

- You are the owner of a graphic design firm that has a number of high-end clients. Your business started up last year and is financed by three angel investors. Your initial pro forma showed that you were going to be very profitable and return a maximum of $5 million to the angel investors within five-to-six years. The angel investors expect a return of 14 percent on their investment and originally invested $1 million in your startup. At this rate, the net present value (discounted cash flow of the future returns) was $3.8 million (Present Value of future discounted cash flows). Q2. After the first year, “so far so good,” you have signed on some new clients that show great potential and met the targets of your scorecard. That said, it looks like you will have to expand staff and buy some high-end equipment to satisfy the needs of the new clients. You estimate you will need an additional $2.2 million from investors to carry you through the next two years. With the new investments and…arrow_forwardYou are thinking about investing $4,953 in your friend's landscaping business. Even though you know the investment is risky and you can't be sure, you expect your investment to be worth $5,650 next year. You notice that the rate for one-year Treasury bills is 1%. However, you feel that other investments of equal risk to your friend's landscape business offer an expected return of 10% for the year. What should you do? The present value of the return is $ (Round to the nearest cent.)arrow_forwardComing Up Roses has grown into a very successful business and you have just received an offer from someone to purchase the business from you for $1.2 million. The potential buyer has offered you $400,000 at the time of sale, $600,000 at the end of the growing season, in 6 months, and the balance, $200,000 in 1.5 years from now. What is the present value of this offer if you could invest at 6% compounding monthly?arrow_forward

- Elite Gaming plans to develop a mobile app. Development of the app will require an investment of $800,000 immediately as well as another $800,000 two years from today. Elite expects that cash flow from the app will begin five years from today and be $1.1 million per year for three years. In other words, there will be a cash flow from the app of $1.1 million 5 years from today, $1.1 million 6 years from today and a final $1.1 million 7 years from today. What is the net present value (NPV) of this project if the cost of capital is 10%? The NPV is closest to: A. $447,977 B. $773,778 C. $651,603 D. $407,252arrow_forwardA. Assume that you have completed your plans and proformas for the next year of operations. The upcoming year looks promising. What would you most likely do from the following list? a. From your proformas project your company’s weighted average cost of capital and return on assets, and compare the two b. Take a vacation because you have been working so hard c. Purchase a new house for your personal use because the future is looking so good d. Make sure that your company’s weighted average cost of capital exceeds your company’s return on assets, if not, rework your plans and proformas B. Assume that all sales are on account. If the average accounts receivable balance was $1,000,000 and accounts receivable turnover was 12 for the last year of operations, what was sales revenue? a. $10,000,000 b. $15,000,000 c. $12,000,000 d. $6,000,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education