CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I need this question answer general Accounting

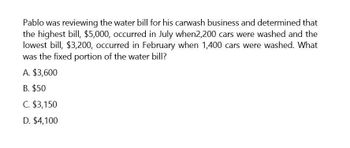

Transcribed Image Text:Pablo was reviewing the water bill for his carwash business and determined that

the highest bill, $5,000, occurred in July when2,200 cars were washed and the

lowest bill, $3,200, occurred in February when 1,400 cars were washed. What

was the fixed portion of the water bill?

A. $3,600

B. $50

C. $3,150

D. $4,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last month the sweet tooth candy shop had total sales including sales tax of 61,889.  The stores are located in a state that has a sales tax of 6 1/2%.  Round your answer to the nearest cent. A- as the accountant for the sweet tooth calculate the amount of sales revenue in dollars for the Shoppes last month? B-as the accountant for the sweet tooth, calculate the amount of sales tax in dollars that must be sent to the state department of revenue?arrow_forwardSee the attached image for question: The manager of the ice cream shop noticed that 90% of all club members brought along a family member who spent an average of $18 in the shop. The tax on their bill was 5.5%. A, What was the total amount spent by the family members in one year?B, What would each family member have to spend, on average, to generate $5,000 in income before sales tax?C, What would each family member's average bill be with sales tax?arrow_forwardCan you please solve this accounting question ?arrow_forward

- Last month The Sweet Tooth Candy Shops had total sales, including sales tax, of $54,889. The stores are located in a state that has a sales tax of 7 1/2%. (Round your answers to the nearest cent.) (a)As the accountant for The Sweet Tooth, calculate the amount of sales revenue (in $) for the shops last month. (b)As the accountant for The Sweet Tooth, calculate the amount of sales taxes (in $) that must be sent to the state Department of Revenue.arrow_forwardLast month The Sweet Tooth Candy Shops had total sales, including sales tax, of $51,889. The stores are located in a state that has a sales tax of 6-%. (Round your answers to the nearest cent.) (a) As the accountant for The Sweet Tooth, calculate the amount of sales revenue (in $) for the shops last month. $4 (b) As the accountant for The Sweet Tooth, calculate the amount of sales taxes (in $) that must be sent to the state Department of Revenue. $4arrow_forwardCan you please give answer for accounting questionarrow_forward

- 2.Last month The Sweet Tooth Candy Shops had total sales, including sales tax, of $51,889. The stores are located in a state that has a sales tax of 7 1 2 %. (Round your answers to the nearest cent.) (a) As the accountant for The Sweet Tooth, calculate the amount of sales revenue (in $) for the shops last month. $ (b) As the accountant for The Sweet Tooth, calculate the amount of sales taxes (in $) that must be sent to the state Department of Revenue. $arrow_forwardWilson Cafeteria issues gift cards, which are very popular in the small town where the restaurant is located. In a recent month, Wilson issued $4,000 in gift cards. Experience indicates that 80 percent of the cards will be redeemed before they expire. Required: What is the entry to record the estimated gift card expense? If an amount box does not require an entry, leave it blank.arrow_forwardJason’s Doughnut Shop had cash sales for the day of $700. In addition, all sales are subject to an 8% sales tax. What journal entry should be made to record the day’s sales and sales taxes? Show your calculations.arrow_forward

- what was my supply exspense for the month if i wrote a check for $14,000, then I return $1500.00 in damaged supplies for a cash refund of $1500, then spent $10,000.00 more on supplies payable in 30 days . After inventory it shows I have $9400.00 worth of supplies left on hand.arrow_forwardKlee Motors is a small car dealership. On average, it sells a car for $24 000, which it purchases from the manufacturer for $20 000. Each month, Klee Motors pays $60 000in rent and utilities and $60 000 in salespeople’s salaries. In addition to their salaries, sales people are paid a commission of $500 for each car they sell. Klee Motors also spends $15 000 each month on local advertisements. a. How many cars must Klee Motors sell each month to break even? b. Will Klee Motors earns a profit if it can sell 6 cars? c. How much sales revenue shall the company earn to achieve a $100,000 profit?arrow_forwardThis is Ben’s budget. Use his budget to determine the answer to the following question: Calculate the amount of tax Ben owes monthly using the tax rate of 25%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you