EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

If you give me wrong answer I will give you unhelpful rate on these general accounting question

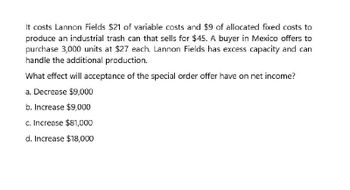

Transcribed Image Text:It costs Lannon Fields $21 of variable costs and $9 of allocated fixed costs to

produce an industrial trash can that sells for $45. A buyer in Mexico offers to

purchase 3,000 units at $27 each. Lannon Fields has excess capacity and can

handle the additional production.

What effect will acceptance of the special order offer have on net income?

a. Decrease $9,000

b. Increase $9,000

c. Increase $81,000

d. Increase $18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Delta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forwardGelbart Company manufactures gas grills. Fixed costs amount to 16,335,000 per year. Variable costs per gas grill are 225, and the average price per gas grill is 600. Required: 1. How many gas grills must Gelbart Company sell to break even? 2. If Gelbart Company sells 46,775 gas grills in a year, what is the operating income? 3. If Gelbart Companys variable costs increase to 240 per grill while the price and fixed costs remain unchanged, what is the new break-even point?arrow_forwardEmerald Island Company is considering building a manufacturing plant in County Kerry. Predicting sales of 100,000 units, Emerald Isle estimates the following expenses: An Irish firm that specializes in marketing will be engaged to sell the manufactured product and will receive a commission of 10% of the sales price. None of the U.S. home office expense will be allocated to the Irish facility. Required: 1. If the unit sales price is 2, how many units must be sold to break even? (Hint: First compute the variable cost per unit.) 2. Calculate the margin of safety ratio. 3. Calculate the contribution margin ratio.arrow_forward

- Deuce Sporting Goods manufactures a high-end model tennis racket. The company’s forecasted income statement for the year, before any special orders, is as follows: Fixed costs included in the forecasted income statement are $400,000 in manufacturing cost of goods sold and $200,000 in selling expenses. A new client placed a special order with Deuce, offering to buy 1,000 tennis rackets for $100.00 each. The company will incur no additional selling expenses if it accepts the special order. Assuming that Deuce has sufficient capacity to manufacture 1,000 more tennis rackets, by what amount would differential income increase (decrease) as a result of accepting the special order? (Hint: First compute the variable cost per unit relevant to this decision.)arrow_forwardSchylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardcan you please help me figure this outarrow_forward

- A buyer from another country offered to purchase 2,000 units of product for $ 2.50 per unit. The normal selling price is $ 3.00 per unit. The company's regular variable costs of $ 1.50 per unit would not change, however overall fixed costs would increase by $ 500 if his order is accepted. How much will net income increase if this special order is accepted? Multiple Choice $ 2,500. $ 2,000. $1,500. $ 3,000. $ 1,850.arrow_forwardSunland Enterprises produces giant stuffed bears. Each bear consists of $16 of variable costs and $13 of fixed costs and sells for $49. A wholesaler offers to buy 9,280 units at $18 each, for which Sunland has the capacity to produce. Sunland will incur extra shipping costs of $1 per bear. Determine the incremental income or loss that Sunland Enterprises would realize by accepting the special order. Incremental profit e Textbook and Media Save for Later $ Attempts: 0 of 1 used Submit Answerarrow_forwardA travel agency has a holiday package that sells for OMR 125. Fixed costs are OMR 80000; and at the present volume of 1000 customers, variable costs are OMR 25000 and profits are OMR 20000. (a) What is the break-even point volume? (b) Assuming that fixed costs remain constant, how many additional customers will be required for the agency to increase profit by OMR 1000? (Ans. (a) 800 units (b) 10 customers)arrow_forward

- Sold?arrow_forwardSteven and Son Inc. sells its car wash package for $180 per unit, its total variable costs per unit is $80 per unit, whereas the total fixed costs are $150,000. The company is considering the increase this year targeted profit to $250,000. What is the company's expected sales to reach its targeted profit? Select one: а. Expected sales would be $270,000 А. Expected sales would be $270,000 sales would be $270,000 b. Expected sales would be $900,000 c. Expected sales would be $720,000 d. Expected sales would be $450,000arrow_forwardK Allen's Ark sells 2,000 canoes per year at a sales price of $470 per unit. Allen's sells in a highly competitive market and uses target pricing. The company has calculated its target full product cost at $740,000 per year. Total variable costs are $250,000 per year and cannot be reduced. Assume all products produced are sold. What are the target fixed costs? OA. $940,000 OB. $200,000 OC. $250,000 OD. $490,000 GEZOSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning