Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide answer the accounting question

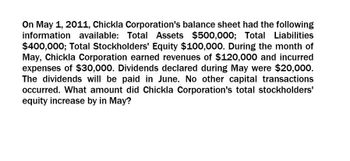

Transcribed Image Text:On May 1, 2011, Chickla Corporation's balance sheet had the following

information available: Total Assets $500,000; Total Liabilities

$400,000; Total Stockholders' Equity $100,000. During the month of

May, Chickla Corporation earned revenues of $120,000 and incurred

expenses of $30,000. Dividends declared during May were $20,000.

The dividends will be paid in June. No other capital transactions

occurred. What amount did Chickla Corporation's total stockholders'

equity increase by in May?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Smith Corporation is reviewing the following transactions for its year-ended December 31, 2015. For each item listed, indicate the: Name of the account to use. Whether it is current or long-term, asset or liability. The amount. On December 15, 2015 the company declared a $2.00 per share dividend on 40,000 shares of common stock outstanding, to be paid on January 5, 2013 Credit sales for year amounted to $10,000,000. Smith estimates its Allowance for Doubtful Accounts as 3% of credit sales. At December 31, bonds payable of $100,000,000 are outstanding. The bonds pay 12% interest every September 30 and mature in installments of $25,000,000 every September 30. Bonuses to key employees based on net income for 2015 are estimated to be $150,000. Included in long-term investments are 10-year U.S. Treasury bonds that mature March 31, 2016. The bonds were purchased November 20, 2015. The accounts receivable account includes $20,000 due in three years from employees. The property, plant,…arrow_forwardRobbin Corporation ended its fiscal year on September 30, 2018, with cash of $77 million, accounts receivable of $25 million, property and equipment of $31 million, and other long-term assets of $19 million. The company's liabilities consist of accounts payable of $33 million and long-term notes payable of $23 million. Robbin Corporation has total stockholders' equity of $96 million; of this total, common stock is $26 million. Solve for the company's ending retained earnings and then prepare Robbin Corporation's balance sheet at September 30, 2018. Use a proper heading on the balance sheet. Begin by solving for the company’s ending retained earnings. (Enter your answer in millions.) Robbin Corporation’s ending retained earnings balance is $ million.arrow_forward(Post-Balance-Sheet Events) Madrasah Corporation issued its financial statements for the year ended December 31, 2017, on March 10, 2018. The following events took place early in 2018.(a) On January 10, 10,000 shares of $5 par value common stock were issued at $66 per share.(b) On March 1, Madrasah determined after negotiations with the Internal Revenue Service that income taxes payable for 2017 should be $1,270,000. At December 31, 2017, income taxes payable were recorded at $1,100,000.InstructionsDiscuss how the preceding post-balance-sheet events should be reflected in the 2017 financial statementsarrow_forward

- Are these answers correct?arrow_forwardIn January 2022, the management of Sheridan Company concludes that it has sufficient cash to permit some short-term investments in debt and equity securities. During the year, the following transactions occurred. Feb. 1 Purchased 600 shares of Muninger common stock for $30,000. Mar. 1 Purchased 800 shares of Tatman common stock for $20,000. Apr. 1 Purchased 60 of $1,160,7% Yoakem bonds for $69,600. Interest is payable semiannually on April 1 and October 1. July 1 Received a cash dividend of $0.70 per share on the Muninger common stock. Aug. 1 Sold 200 shares of Muninger common stock at $65 per share. Sept. 1 Received a $1 per share cash dividend on the Tatman common stock. Oct. 1 Received the semiannual interest on the Yoakem bonds. Oct. 1 Sold the Yoakem bonds for $67,900. At December 31, the fair value of the Muninger and Tatman common stocks were $51 and $24 per share respectively. These stock investments by Sheridan Company provide less than a 20% ownership interest.arrow_forwardBelton, Inc. had the following transactions in 2018, its first year of operations: Issued 37,000 shares of common stock. Stock has par value of $1.00 per share and was issued at $21.00 per share. Earned net income of $72,000. Paid no dividends. At the end of 2018, what is the total amount of paid-in capital? A. $777,000 B. $37,000 C. $849,000 D. $72,000arrow_forward

- Detroit Inc reported the following ($ in thousands) as of December 31, 2021. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 2,500 Common stock 3,400 Paid-in capital—share repurchase 1,900 Treasury stock (at cost) 220 Paid-in capital—excess of par 30,300 During 2022 ($ in thousands), net income was $9,100; 25% of the treasury stock was resold for $510; cash dividends declared were $700; cash dividends paid were $450. What ($ in thousands) was shareholders' equity as of December 31, 2022?arrow_forwardWomack Corporation ended its fiscal year on September 30, 2021, with cash of $72 million, accounts receivable of $21 million, property and equipment of $30 million, and other long-term assets of $20 million. The company's liabilities consist of accounts payable of $35 million and long-term notes payable of $16 million Womack Corporation has total stockholders' equity of $92 million, of this total, common stock is $30 million. Solve for the company's ending retained earnings and then prepare Womack Corporation's balance sheet at September 30, 2021. Use a proper heading on the balance sheet. Now prepare Womack Corporation's balance sheet at September 30, 2021. Use a proper heading on the balance sheet. Start with the heading and then complete the assets section of the statement. Finally, complete the liabilities and stockholders' equity section of the statement. (Enter all amounts in millions. Classify the balance sheet by selecting the proper title on all applicable subtotal or total…arrow_forwardHawthorn Corporation’s adjusted trial balance contained the following accounts at December 31, 2017: Retained Earnings $120,000, Common Stock $750,000, Bonds Payable $100,000, Paid-in Capital in Excess of Par—Common Stock $200,000, Goodwill $55,000, Accumulated Other Comprehensive Loss $150,000, and Noncontrolling Interest $35,000. Prepare the stockholders’ equity section of the balance sheet.arrow_forward

- An analyst compiled the following information for U Inc. for the year ended December 31, 2021: . Net income was $1,960,000. Depreciation expense was $530,000. . Interest paid was $265,000. Income taxes paid were $132,500. . . . Common stock was sold for $226,000. Preferred stock (8% annual dividend) was sold at par value of $276,000. . Common stock dividends of $76,000 were paid. Preferred stock dividends of $22,080 were paid. Equipment with a book value of $126,000 was sold for $252,000. • . . Using the indirect method, what was U Inc.'s net cash flow from operating activities for the year ended December 31, 20213 Multiple Choicearrow_forwardYellow Enterprises reported the following ($ in thousands) as of December 31, 2021. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 1800 Common stock 4000 Paid-in capital—share repurchase 1900 Treasury stock (at cost) 270 Paid-in capital—excess of par 31,000 During 2022 ($ in thousands), net income was $10,800; treasury stock was resold for $540; cash dividends declared were $730. What ($ in thousands) was shareholders' equity as of December 31, 2022?arrow_forwardDuring 2019 Sasha Corporation reported a net income of $1,529,500. On January 1, 2020, Sasha had 350,000 shares of common stock outstanding, and issued an additional 210,000 shares of common stock on October 1. The company has a simple capital structure. Determine the weighted-average number of common shares outstanding and compute the earnings per share.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,