FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

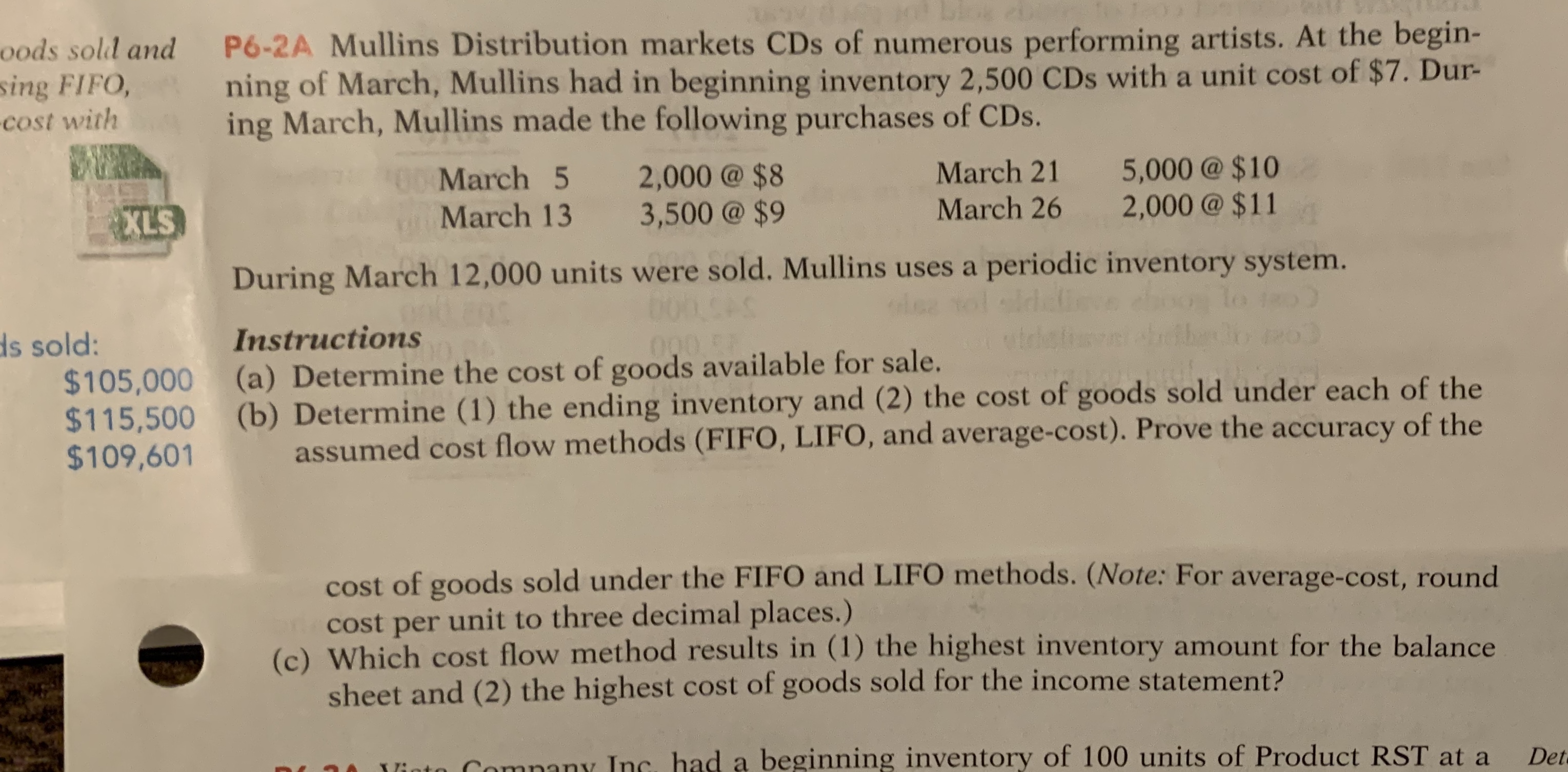

Transcribed Image Text:P6-2A Mullins Distribution markets CDs of numerous performing artists. At the begin-

ning of March, Mullins had in beginning inventory 2,500 CDs with a unit cost of $7. Dur-

ing March, Mullins made the following purchases of CDs.

March 5

2,000@ $8

3,500 @ $9

March 21

5,000@ $10

2,000@ $11

oMarch 13

March 26

During March 12,000 units were sold. Mullins uses a periodic inventory system.

CAS

Instructions

(a) Determine the cost of goods available for sale.

(b) Determine (1) the ending inventory and (2) the cost of goods sold under each of the

assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the

cost of goods sold under the FIFO and LIFO methods. (Note: For average-cost, round

Cost per unit to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Glee Distribution markets CDs of the performing artist Unique. At the beginning of October, Glee had in beginning inventory 2,000 of Unique's CDs with a unit cost of $7. During October, Glee made the following purchases of Unique's CDs. Oct. 3 2,500 @ $8 Oct. 19 3,000 @ $10 Oct. 9 3,500 @ $9 Oct. 25 4,000 @ $11 During October, 10,900 units were sold. Glee uses a periodic inventory system. v (a) Determine the cost of goods available for sale. Cost of goods available for sale Open Show Work Click if you would like to Show Work for this question: LINK TO TEXTarrow_forwardi.7arrow_forwardThe following three identical units of Item JC07 are purchased during April: Item Beta Units Cost April 2 Purchase $264 April 15 Purchase 268 April 20 Purchase 272 Total $804 Average cost per unit $268 ($804 ÷ 3 units) Assume that one unit is sold on April 27 for $367. Determine the gross profit for April and ending inventory on April 30 using the (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) weighted average cost method. Gross Profit Ending Inventory a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) c. Weighted average cost 3.arrow_forward

- Rahularrow_forwardLaker Company reported the following January purchases and sales data for its only product. Date Activities Units Acquired at Cost Units sold at Retail Jan. 1 Beginning inventory 145 units @ $ 7.00 = $ 1,015 Jan. 10 Sales 105 units @ $ 16.00 Jan. 20 Purchase 70 units @ $ 6.00 = 420 Jan. 25 Sales 85 units @ $ 16.00 Jan. 30 Purchase 190 units @ $ 5.50 = 1,045 Totals 405 units $ 2,480 190 units The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 215 units, where 190 are from the January 30 purchase, 5 are from the January 20 purchase, and 20 are from beginning inventory. Exercise 5-4 Perpetual: Income effects of inventory methods LO A1 Required:1. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,300…arrow_forwardPage 4 of 9 Keiler Motorcycle Shop completed the following transactions during the month of October. Keiler uses a perpetual inventory system. Any freight paid was paid with cash. Oct. 3 Purchased 20 bikes at a cost of $1,150 each from the Lyons Bike Company, under credit terms 1/30, n/45. FOB shipping point. 4 The correct company paid $150 cash freight for above shipment 6 Sold 10 bikes to Doug's Bicycle for $1,500 each, terms 1/15, n/30. Terms FOB destination. 7 Received credit from the Lyons Bike Company for the return of 2 defective bikes. 13 Issued a credit to Doug's Bicycle for the return of one bike from Oct 6 sale. 17 Purchased with cash Office Supplies from the Office Depot in the amount of $200. 20 Doug's Bicycle paid their account in full 24 Paid Lyons Bike Company. Required: Part A: Journalize the above transactions Part B: Calculate the balance of inventory at October 31, assuming the opening balance is $5,000 Part C: dentify one transaction that would be recorded…arrow_forward

- Inventory - Periodic On January 1, 20x8, the Music Store had 400 MP3 players in inventory with a cost of $48 per unit. During 20x8 the company made the following purchases of MP3 players: Feb 21 Jun 15 Oct 15 1,000 units at $50 each = $50,000 1,000 units at $52 each = $52,000 1,000 units at $58 each = $58,000 The selling price of each MP3 player is $100. The store had an excellent Christmas season with the result that only 70 MP3 players were left in inventory on December 31, 20x8. Assuming the company uses a periodic inventory system, calculate gross profit for the year ending December 31, 20x8, under each of: i) FIFO; ii) Weighted Averagearrow_forward3. Required information Skip to question [The following information applies to the questions displayed below.]Ferris Company began January with 4,000 units of its principal product. The cost of each unit is $8. Merchandise transactions for the month of January are as follows: Purchases Date of Purchase Units Unit Cost* Total Cost Jan. 10 3,000 $ 9 $ 27,000 Jan. 18 4,000 10 40,000 Totals 7,000 67,000 * Includes purchase price and cost of freight. Sales Date of Sale Units Jan. 5 2,000 Jan. 12 1,000 Jan. 20 3,000 Total 6,000 5,000 units were on hand at the end of the month.arrow_forwardJournal Entries Allied Merchandisers was organized on May 1. Macy Company is a major customer (buyer) of Allied (seller) products. May 3 Allied made its first and only purchase of inventory for the period on May 3 for 3,000 units at a price of $8 cash per unit (for a total cost of $24,000). May 5 Allied sold 1,500 of the units in inventory for $12 per unit (invoice total: $18,000) to Macy Company under credit terms 2/10, n/60. The goods cost Allied $12,000. May 7 Macy returns 150 units because they did not fit the customer’s needs (invoice amount: $1,800). Allied restores the units, which cost $1,200, to its inventory. May 8 Macy discovers that 150 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $600 to compensate for the damage. May 15 Allied receives payment from Macy for the amount owed on the May 5 purchase; payment is net of returns, allowances, and any cash…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education