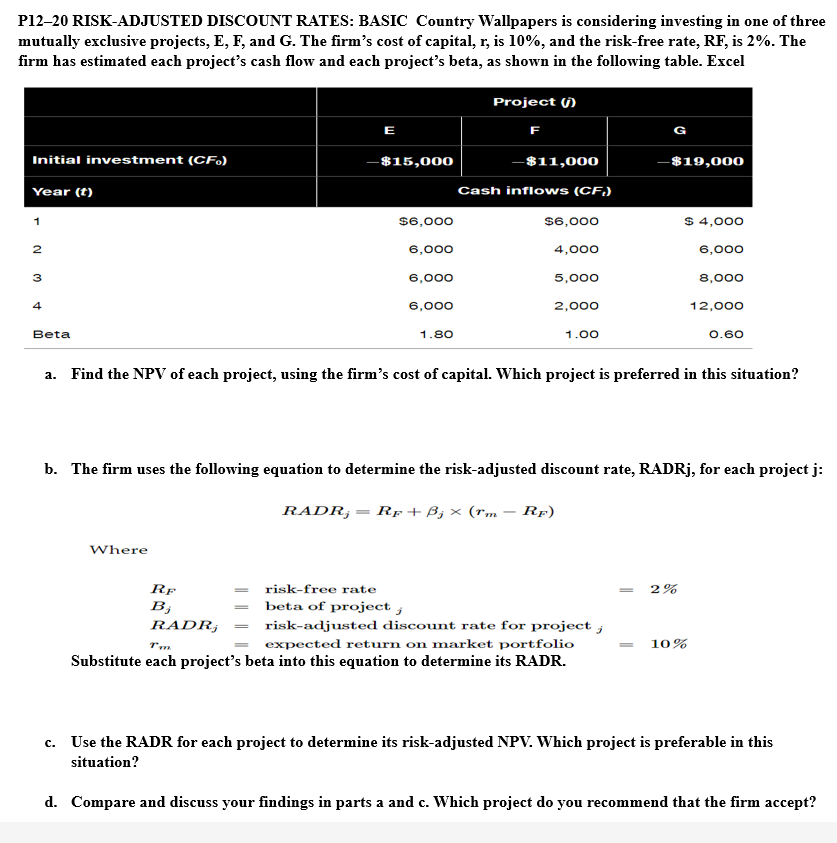

P12-20 RISK-ADJUSTED DISCOUNT RATES: BASIC Country Wallpapers is considering investing in one of three mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 10%, and the risk-free rate, RF, is 2%. The firm has estimated each project's cash flow and each project's beta, as shown in the following table. Excel Initial investment (CF) Year (t) 1 N 3 Beta E Where -$15,000 RF B₂ RADR, = $6,000 6,000 6,000 6,000 1.80 Project () F -$11,000 Cash inflows (CF,) $6,000 4,000 5,000 2,000 1.00 a. Find the NPV of each project, using the firm's cost of capital. Which project is preferred in this situation? -$19,000 b. The firm uses the following equation to determine the risk-adjusted discount rate, RADRj, for each project j: RADR;= Rp + ß₂ × (rm · RF) risk-free rate beta of project, risk-adjusted discount rate for project; expected return on market portfolio Substitute each project's beta into this equation to determine its RADR. T'm $ 4,000 6,000 8,000 12,000 0.60 2% 10% c. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in this situation? d. Compare and discuss your findings in parts a and c. Which project do you recommend that the firm accept?

P12-20 RISK-ADJUSTED DISCOUNT RATES: BASIC Country Wallpapers is considering investing in one of three mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 10%, and the risk-free rate, RF, is 2%. The firm has estimated each project's cash flow and each project's beta, as shown in the following table. Excel Initial investment (CF) Year (t) 1 N 3 Beta E Where -$15,000 RF B₂ RADR, = $6,000 6,000 6,000 6,000 1.80 Project () F -$11,000 Cash inflows (CF,) $6,000 4,000 5,000 2,000 1.00 a. Find the NPV of each project, using the firm's cost of capital. Which project is preferred in this situation? -$19,000 b. The firm uses the following equation to determine the risk-adjusted discount rate, RADRj, for each project j: RADR;= Rp + ß₂ × (rm · RF) risk-free rate beta of project, risk-adjusted discount rate for project; expected return on market portfolio Substitute each project's beta into this equation to determine its RADR. T'm $ 4,000 6,000 8,000 12,000 0.60 2% 10% c. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in this situation? d. Compare and discuss your findings in parts a and c. Which project do you recommend that the firm accept?

Chapter14: Multinational Capital Budgeting

Section: Chapter Questions

Problem 30QA

Related questions

Question

Transcribed Image Text:P12-20 RISK-ADJUSTED DISCOUNT RATES: BASIC Country Wallpapers is considering investing in one of three

mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 10%, and the risk-free rate, RF, is 2%. The

firm has estimated each project's cash flow and each project's beta, as shown in the following table. Excel

Initial investment (CF)

Year (t)

1

2

3

4

Beta

E

Where

-$15,000

$6,000

6,000

6,000

6,000

RF

B;

RADR,

1.80

Project ()

F

-$11,000

Cash inflows (CF,)

$6,000

4,000

5,000

2,000

1.00

G

a. Find the NPV of each project, using the firm's cost of capital. Which project is preferred in this situation?

risk-free rate

beta of project;

T'm

risk-adjusted discount rate for project ;

expected return on market portfolio

Substitute each project's beta into this equation to determine its RADR.

-$19,000

b. The firm uses the following equation to determine the risk-adjusted discount rate, RADRj, for each project j:

RADR, RF + B₂ × (rm RF)

$ 4,000

6,000

8,000

12,000

0.60

2%

10%

c. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in this

situation?

d. Compare and discuss your findings in parts a and c. Which project do you recommend that the firm accept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning