Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

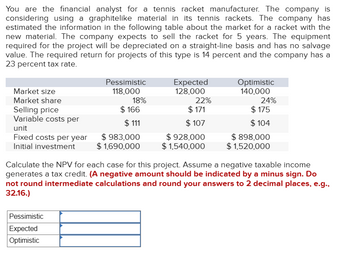

Transcribed Image Text:You are the financial analyst for a tennis racket manufacturer. The company is

considering using a graphitelike material in its tennis rackets. The company has

estimated the information in the following table about the market for a racket with the

new material. The company expects to sell the racket for 5 years. The equipment

required for the project will be depreciated on a straight-line basis and has no salvage

value. The required return for projects of this type is 14 percent and the company has a

23 percent tax rate.

Market size

Market share

Selling price

Variable costs per

unit

Fixed costs per year

Initial investment

Pessimistic

118,000

Pessimistic

Expected

Optimistic

18%

$ 166

$111

$ 983,000

$ 1,690,000

Expected

128,000

22%

$171

$ 107

$ 928,000

$ 1,540,000

Optimistic

140,000

24%

$175

$ 104

$ 898,000

$1,520,000

Calculate the NPV for each case for this project. Assume a negative taxable income

generates a tax credit. (A negative amount should be indicated by a minus sign. Do

not round intermediate calculations and round your answers to 2 decimal places, e.g.,

32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Caine Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $193,900 and has an estimated useful life of 8 years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $30,600. Management also believes that the new bottling machine will save the company money because it is expected to be more reliable than other rpachines, and thus will reduce downtime. Assume a discount rate of 7%. Click here to view the factor table. Calculate the net present value. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round present value answer to 0 decimal places, eg. 125) Net present value $ How much would the reduction in downtime have to be worth in order for the project to be acceptable? (Round answer to 0 decimal places, e.g. 125.)arrow_forwardChadron Sports is considering adding a miniature golf course to its facility. The course would cost $138,000, would be depreciated on a straight-line basis over its five-year life, and would have a zero salvage value. The estimated income from the golfing fees would be $72,000 a year with $24,000 of that amount being variable cost. The fixed cost would be $11,600. In addition, the firm anticipates an additional $14,000 in revenue from its existing facilities if the golf course is added. The project will require $7,000 of net working capital, which is recoverable at the end of the project. What is the net present value of this project at a discount rate of 12 percent and a tax rate of 34 percent? O $14,438.78 $12,708.48 O $11,757.49 O $10,631.16 O $14,900.41arrow_forwardYou are considering a proposal to produce and market a new sluffing machine. The most likely outcomes for the project are as follows: Expected sales: 125,000 units per year Unit price: $240 Variable cost: $144 Fixed cost: $5,430,000 The project will last for 10 years and requires an initial Investment of $21.78 million, which will be depreciated straight-line over the project life to a final value of zero. The firm's tax rate is 30%, and the required rate of return is 12% However, you recognize that some of these estimates are subject to error. In one scenario a sharp rise in the dollar could cause sales to fall 30% below expectations for the life of the project and, if that happens, the unit price would probably be only $230. The good news is that fixed costs could be as low as $3,620,000, and variable costs would decline in proportion to sales. a. What is project NPV If all variables are as expected? Note: Do not round Intermediate calculations. Enter your answer in thousands not in…arrow_forward

- The ABC Ltd is analysing the costs and benefits of setting up an extra fast-food outlet in Adelaide. The predicted costs and income flows are provided below: $2 million site acquisition and development costs. The capital depreciation expense is $50,000 per year. Investment in plant and equipment of $600,000. The plant and equipment have an estimated useful life of 5 years and the residual value would be zero. The plant and equipment will be depreciated on a straight-line basis for tax purposes. The forecasted sales in year 1 is $600,000 and $800,000 per year thereafter. Labour and material costs are equivalent to 50 per cent of incremental sales. The policy (objective) is to sell the outlet at the end of year 3. The estimated selling price is $3.5 million. Sales in a similar outlet of ABC Ltd will decline by $80,000 per year due to loss of customers and experienced staff to the new venture. Other operating costs are about $150,000 per year (fixed) The net working capital requirement at…arrow_forwardYou must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $290,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $48,000. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $33,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar.$ What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar.Year 1: $ Year 2: $ Year 3: $ If the WACC is 12%, should the spectrometer be…arrow_forwardYou are the financial analyst for a tennis racket manufacturer. The company is considering using a graphitelike material in its tennis rackets. The company has estimated the information in the following table about the market for a racket with the new material. The company expects to sell the racket for 6 years. The equipment required for the project will be depreciated on a straight-line basis and has no salvage value. The required return for projects of this type is 13 percent and the company has a 23 percent tax rate. Market size Market share Selling price Variable costs per unit Fixed costs per year Initial investment Pessimistic 113,000 19% $164 $ 106 $978,000 $ 1,968,000 Expected 123,000 23% $ 169 $ 102 $ 923,000 $1,818,000 Optimistic 135,000 25% $ 173 $ 99 $ 893,000 $ 1,798,000 Calculate the NPV for each case for this project. Assume a negative taxable income generates a tax credit. (A negative amount should be indicated by a minus sign. Do not round intermediate calculations…arrow_forward

- Sarasota Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $450,000 and has an estimated useful life of 8 years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $78,750. Management also believes that the new bottling machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Click here to view PV tables. How much would the reduction in downtime have to be worth in order for the project to be acceptable? Sarasota's discount rate is 10%. (Use the above table.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 5,275.) Reduction in downtime would have to have a present value $arrow_forwardVijayarrow_forwardPenny and Daughter’s construction business is considering purchasing a new Bobcat. The equipment will cost $230,000 and is expected to last 14 years. The Bobcat has a salvage vale of $16,000. Calculate the depreciation AND book value for each year. You can create one table for a-d or you can create different tables for each. This problem will need to be done in excel. (30 points)a. Use straight-line depreciation. (5 points)b. Use declining-balance depreciation with a depreciation rate that ensures the book value equals the salvage vale in the last year of the life of the equipment. c. Use double declining balance depreciation. d. Use MACRS depreciation where the Bobcat is considered a 10 year property. e. Graph the Book values of each methods on a single graph. The graph should have points at each year for each BV and a line of each method. You will have 4 lines on your graph. You should include year 0 on your graph so that all four lines start at the same point. Each method should be…arrow_forward

- You must evaluate the purchase of a proposed Spectrometer for R&D department. The purchase. Price of the spectrometer including modifications is $200,000, and the equipment will be depreciated at the time of purchase. The equipment would be sold after 3 years for $51,000. The equipment would require a $15,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save firm $49,000 per year in before-tax laber casts. The firm's marginal fecteral-plus-state tarrate is 25% a) What is the initial investment outlay for the Spectrumeter after bonus depreciation is considered, that is the Year 0 project cash flow? the Enter your answer as a a positive value. Rand answer to the nearest dollar. $ b.) What are the project's annual cash flows in Years Round 1, 2, and 3? Do not round intermediate calculations. your answers to the nearest dollar. Year 1: 9 Year 2: $ Year 3: $ 10 4 yourarrow_forwardThe management of Kunkel Company is considering the purchase of a $34,000 machine that would reduce operating costs by $9,000 per year. At the end of the machine's five-year useful life, it will have zero scrap value. The company's required rate of return is 12%. Use Excel or a financial calculator to solve. Required: 1. Determine the net present value of the investment in the machine. (Any cash outflows should be indicated by a minus sign. Round answers to the nearest dollar.) Net present value 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? (Any cash outflows should be indicated by a minus sign.) Total Cash Item Cash Flow Years Flows Annual cost savings Initial investment 1 Net cash flow %24 24arrow_forwardplease asnwer correctly: Your company has been approached to bid on a contract to sell 5,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.4 million and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $395,000 to be returned at the end of the project, and the equipment can be sold for $325,000 at the end of production. Fixed costs are $595,000 per year, and variable costs are $85 per unit. In addition to the contract, you feel your company can sell 12,300, 14,600, 19,200, and 11,600 additional units to companies in other countries over the next four years, respectively, at a price of $180. This price is fixed. The tax rate is 23 percent, and the required return is 10 percent. Additionally, the president of the company…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education