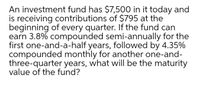

An investment fund has $7,500 in it today and is receiving contributions of $795 at the beginning of every quarter. If the fund can earn 3.8% compounded semi-annually for the first one-and-a-half years, followed by 4.35% compounded monthly for another one-and- three-quarter years, what will be the maturity value of the fund?

An investment fund has $7,500 in it today and is receiving contributions of $795 at the beginning of every quarter. If the fund can earn 3.8% compounded semi-annually for the first one-and-a-half years, followed by 4.35% compounded monthly for another one-and- three-quarter years, what will be the maturity value of the fund?

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:An investment fund has $7,500 in it today and

is receiving contributions of $795 at the

beginning of every quarter. If the fund can

earn 3.8% compounded semi-annually for the

first one-and-a-half years, followed by 4.35%

compounded monthly for another one-and-

three-quarter years, what will be the maturity

value of the fund?

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College