FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

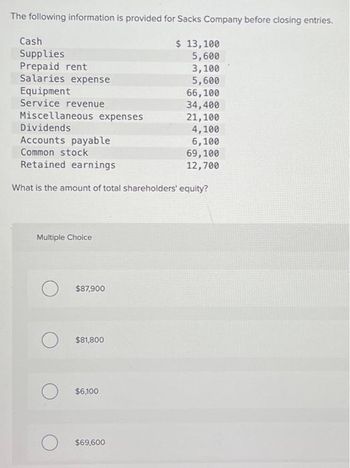

Transcribed Image Text:The following information is provided for Sacks Company before closing entries.

$ 13,100

5,600

3,100

5,600

66,100

34,400

21,100

4,100

Cash

Supplies

Prepaid rent

Salaries expense

Equipment

Service revenue

Miscellaneous expenses

Dividends

Accounts payable

Common stock

Retained earnings

What is the amount of total shareholders' equity?

Multiple Choice

O $87,900

$81,800

$6,100

$69,600

6,100

69,100

12,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 52 Indicate the effect of the following event on the company's accounting equation. For each account tiítle affected indicate the specific account name, dollar change, and whether it increased or decreased. Show the correct effect in the Stockholders' Equity column so the Balance Sheet balances. Reissued the 1,000 shrs. acquired in event above, for $40/shr. O Increase the asset cash $40,000 and stockholders' equity àccounts common stock $40,000 Increase the asset cash $40,000, and stockholders' equity account additional paid in capital-treasury stock $10,000, increased the stockholders' equity account treasury stock $30,000 thereby increasing stockholders' equity O Increase the asset cash $40,000, stockholders' equity accounts common stock $5,000 and additional paid in capital-commom stock $35,000 O Increase the asset cash $40,000, and stockholders' equity actount additional paid in capital-treasury stock $10,000, decreased the stockholders' equity account treasury stock…arrow_forwardFinancial Statements from the End-of-Period Spreadsheet Triton Consulting is a consulting firm owned and operated by Jayson Neese. The following end-of-period spreadsheet was prepared for the year ended April 30, 20Y3: During the year ended April 30, 20Y3, common stock of $5,000 vwas issued. Triton Consulting End-of-Period Spreadsheet For the Year Ended April 30, 20Y3 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 21,500 21,500 Accounts Receivable 51,150 51,150 Supplies 2,400 1,650 750 Office Equipment 32,000 32,000 Accumulated Depreciation 4,500 900 5,400 Accounts Payable 3,350 3,350 Salaries Payable 2,000 2,000 Common Stock 20,000 20,000 Retained Earnings 52,200 52,200 Dividends 10,000 10,000 Fees Earned 279,000 279,000 Salary Expense 240,000 2,000 242,000 Supplies Expense 1,650 1,650 Depreciation Expense 900 900 Miscellaneous Expense 2,000 2,000 359,050 359,050 4,550 4,550 361,950 361,950arrow_forwardI need helparrow_forward

- Determining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forwardPURRFECT PETS, INC. Balance Sheet at June 30, Year 1 Assets Liabilities Cash $ 732,700 Accounts Payable $ 349,100 Accounts Receivable 419,300 Notes Payable due June 30, Year 3 268,900 Supplies 58,410 Total Liabilities 618,000 Equipment 118,600 Other Assets 69,410 Stockholders' Equity Common Stock 662,000 Retained Earnings 118,420 Total Stockholders' Equity 780,420 Total Assets $ 1,398,420 Total Liabilities & Stockholders’ Equity $ 1,398,420 How much financing did the stockholders of Purrfect Pets, Inc., directly contribute to the company?arrow_forwardQuestion Content Area A summary of selected transactions in ledger accounts appears below for Alberto’s Plumbing Services for the current calendar year-end. Common Stock 1/1 6,778 Retained Earnings 12/31 9,605 12/31 22,551 Dividends 3/30 2,696 12/31 9,605 9/30 6,909 Net income for the period is a.9,605 b.29,329 c.22,551 d.38,934arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education