FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

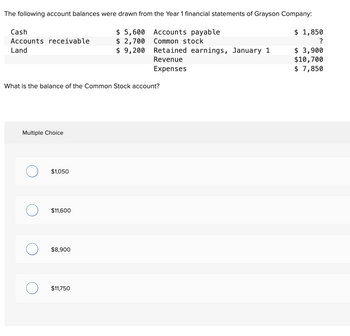

Transcribed Image Text:The following account balances were drawn from the Year 1 financial statements of Grayson Company:

$ 1,850

Accounts payable

Common stock

?

$ 3,900

$10,700

$ 7,850

Cash

Accounts receivable

Land

Multiple Choice

What is the balance of the Common Stock account?

O

$1,050

$11,600

$8,900

$ 5,600

$ 2,700

$ 9,200

$11,750

Retained earnings, January 1

Revenue

Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current position analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $368,200 $281,600 Marketable securities 126,400 316,000 Accounts and notes receivable (net) 174,400 105,600 Inventories 639,500 402,600 Prepaid expenses 129,500 257,400 Total current $1,930,000 $1,364,000 Current liabilities: Accounts and notes payable (short-term) $295,000 $300,000 Accrued labies Total current liabilities 214,200 $510,000 132,000 $640,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. 1. Working capital 2. Current ratio 3. Quick ratio b. The quidity of Nilo has result of an Current Year Previous Year from the preceding year to the current year. The working capital, current ratio, and quick ratio have all Most of these changes are the in current assets relative to current liabilities.arrow_forwardMiscellaneous financial information Amount Retained earnings 786 Total stockholders' equity 14, 971 Operating net working capital 28,483 Net working capital 29,102 Nonoperating current assets other than cash 347 Short-term debt 1, 126 Total current liabilities 13, 613 Total long-term liabilities 107,872 Inventory ? ? Current portion of long-term debt 561 Accounts receivable 2,052 Treasury stock -5,279 What did Madison Makeup report as long-term assets? 93,741 What did Madison Makeup report as cash? 42,368arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $329,800 $259,200 Marketable securities 381,900 291,600 Accounts and notes receivable (net) 156,300 97,200 Inventories 900,200 560,000 Prepaid expenses 463,800 358,000 Total current assets $2,232,000 $1,566,000 Current liabilities: Accounts and notes payable (short-term) $359,600 $378,000 Accrued liabilities 260,400 162,000 Total current liabilities $620,000 $540,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4 3.…arrow_forward

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $395,200 $324,000 Marketable securities 457,600 364,500 Accounts and notes receivable (net) 187,200 121,500 Inventories 617,800 411,800 Prepaid expenses 318,200 263,200 Total current assets $1,976,000 $1,485,000 Current liabilities: Accounts and notes payable (short-term) $301,600 $315,000 Accrued liabilities 218,400 135,000 Total current liabilities $520,000 $450,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital %24 2. Current ratio 3. Quick ratioarrow_forwardComplete the following balance sheet based on the information provided ASSETS LIABILITIES & SHAREHOLDERS' EQUITY %$4 Question 2 Accounts payable Cash $63,000 Common stock Accounts receivable %$4 Retained earnings %24 Inventory %24 Plant and equipment, net $56,000 Total liabilities and s135,000 $135,000 Total assets shareholders' equity The values of selected ratios are as follows: Quick ratio 1.40 Average collection period Debt ratio 38 days 0.38 (Asset) Turnover ratio [Answer: Cash = 37,386, AR = 34,434, Inventory = 7,180, AP = 51,300, RE = 20,700] 2.45 %3D %3D %3D %3Darrow_forwardPrior Year Current Year Accounts payable 3,153.00 5,915.00 Accounts receivable 6,935.00 9,046.00 Accruals 5,794.00 6,085.00 Additional paid in capital 19,655.00 13,876.00 Cash. ??? ??? Common Stock 2,850 2,850 COGS 22,169.00 18,794.00 Current portion long-term debt 500 500 Depreciation expense 1,016.00 1,037.00 Interest expense 1,276.00 1,138.00 Inventories 3,041.00 6,672.00 Long-term debt 16,904.00 22,546.00 Net fixed assets 75,987.00 73,861.00 Notes payable 4,002.00 6,534.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,536.00 34,724.00 Sales 46,360 45,799.00 Taxes 350 920 Category ww What is the firm's total change in cash from the prior year to the current year?arrow_forward

- Determining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $486,400 $392,000 Marketable securities 563,200 441,000 Accounts and notes receivable (net) 230,400 147,000 Inventories 792,000 469,700 Prepaid expenses 408,000 300,300 Total current assets $2,480,000 $1,750,000 Current liabilities: Accounts and notes payable (short-term) $464,000 $490,000 Accrued liabilities 336,000 210,000 Total current liabilities $800,000 $700,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4…arrow_forwardRatio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: Current Year Prior Year Accounts payable $618,000 $300,000 Current maturities of serial bonds payable 550,000 550,000 Serial bonds payable, 10% 2,480,000 3,030,000 Common stock, $1 par value 90,000 120,000 Paid-in capital in excess of par 1,000,000 1,010,000 Retained earnings 3,470,000 2,750,000 The income before income tax expense was $757,500 and $662,800 for the current and prior years, respectively. a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one decimal place. Current year fill in the blank 1 Prior year fill in the blank 2 b. Determine the times interest earned ratio for both years. Round to one decimal place. Current year fill in the blank 3 Prior year fill in the blank 4 c. The ratio of liabilities to stockholders' equity have improved and the…arrow_forward

- Income Statement, Statement of stockholders’ equity, and Balance Sheet Viva Travel Service reported assets, liabilities, revenues and expenses for September 30, 20Y6 below. As of October 1, 20Y5, the beginning of the current year, Viva Travel Service reported retained earnings as $60,900, and common stock as $7,500. During the current year, dividends in the amount of $28,600 were paid. Accounts payable $22,290 Accounts receivable 134,312 Common stock 15,000 Cash 240,858 Fees earned 801,300 Miscellaneous expense 6,230 Rent expense 103,770 Supplies 10,380 Supplies expense 16,600 Utilities expense 62,260 Wages expense 296,480 Instructions: Question Content Area 1. Prepare an income statement for the current year ended September 30, 20Y6. Viva Travel ServiceIncome StatementFor the Year Ended September 30, 20Y6 $- Select - Operating expenses: $- Select - - Select - - Select - - Select - - Select -…arrow_forwardPresented below are data for Caracas Corp. Assets, January 1 Liabilities, January 1 Stockholders' Equity, Jan. 11 Dividends Common Stock Stockholders' Equity, Dec. 31 Net Income Net income for 2012 is $684 income. $684 loss. $38 income. $38 loss. 2010 $3,800 2,280 ? 760 684 ? 760 2011 $4,560 ? ? 570 608 ? 684 2012 ? $2,736 2,850 646 650 2,166 ?arrow_forwardStatement of stockholders’ equity; net loss Selected accounts from the ledger of Restoration Arts for the fiscal year ended April 30, 20Y5, are as follows: Common Stock May 1 (20Y4) 10,000 July 1 7,500 Retained Earnings Dividends Apr. 30 31,200 May 1 (20Y4) 475,500 July 31 (20Y4) 1,250 Apr. 30 5,000 Apr. 30 5,000 Oct. 31 1,250 Jan. 31 1,250 Apr. 30 (20Y4) 1,250 Prepare a statement of stockholders’ equity for the year ended April 30, 20Y5. Restoration Arts Statement of Stockholders’ Equity For the Year Ended April 30, 20Y5 Common Stock Retained Earnings Total $ $ $ $ $ $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education