FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

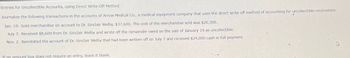

Transcribed Image Text:Entries for Uncollectible Accounts, using Direct Write-Off Method

Journalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables:

Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $37,600. The cost of the merchandise sold was $20,300.

July 7. Received $8,600 from Dr. Sinclair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible.

Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $29,000 cash in full payment.

If an amount box does not require an entry, leave it blank.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Customer refund Senger Company sold merchandise of $14,000, terms n/30, to Burris Inc. on April 12. Burris paid Senger for the merchandise on May 12. On June 1, Senger paid Burris $520 for costs incurred by Burris to repair defective merchandise. a. Journalize the entry by Senger Company to record the customer refund to Burris Inc. If an amount box does not require an entry, leave it blank. June 1 b. Assume that instead of paying Burris cash, Senger issued a credit memo to Burris to be used against Burris's outstanding account receivable balance. Journalize the entry by Senger Company to record the issuance of the credit memo. If an amount box does not require an entry, leave it blank. 8 June 1arrow_forwardInstructions Мay 1. Sold merchandise on account to Taiwan Palace Co., $36,000. The cost of the merchandise sold was $23,540. Aug. 30. Received $10,380 from Taiwan Palace Co. and wrote off the remainder owed on the sale of May 1 as பாலlectble® Dec. 8, Reinstated the account of Taiwan Palace Co. that had been written off on August 30 and received $25,620 cash in full payment. Required: Journalize the above transactions Inn the accounts of Arizona Interfors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables Referto the chart of accounts for the exact wording of the account tides. CNOW journals do not use lines for journal explanatrions Every line on a journa/ page is used for debit or credit entries CNOWjournals will automatically indent a credit entrv when acredit amnuntis enteredarrow_forward2 )arrow_forward

- journal entries for the following transactions of Furniture Warehouse. Aug 3 Sold 15 couches at $500 each to a customer, credit terms 2/15, n/30, invoice date August 3; the couches cost Furniture Warehouse $150 each. Aug 8 Customer returned 2 couches for a full refund. The merchandise was in sellable condition at the original cost. Aug 15 Customer found 4 defective couches but kept the merchandise for an allowance of $1,000. Aug 18 Customer paid their account in full with cash.arrow_forwardPepper Company completed the following selected transactions and events during March of this year. (Terms of allcredit sales for the company are 2/10, n/30.) Mar. Sold merchandise on credit to Jennifer Nelson, Invoice No. 954, for P16,800 (cost is P12,200). 4 6 Purchased P1,220 of office supplies on credit from Mack Company. Invoice dated March 3, termsny30. Sold merchandise on credit to Dennie Hoskins, Invoice No. 955, for P10,200 (cost is 6 P8,100). Purchased P52,600 of merchandise, invoice dated March 6, terms 2y10, ny30, from 11 Defore Industries. 12 Borrowed P26,000 cash by giving Commerce Bank a long-term promissory note payable. Received cash payment from Jennifer Nelson for the March 4 sale less the discount (Invoice No. 954). 14 16 Received a P200 credit memorandum from Defore Industries for unsatisfactory merchandise Pepper purchased on March 11 and later returned. Received cash payment from Dennie Hoskins for the March 6 sale less the discount 16 (Invoice No. 955). Purchased…arrow_forwardOn December 1, Macy company sold merchandise with a selling price of $8000 on account to Mrs Jorge son with terms 2/10, narrow_forward

- 1-Feb 6-Feb A B Blake Inc. sold merchandise to Kramer Corp. for $1,000 Terms of the sale were 2/10, n/30 Blake receives payment in full from Kramer. Prepare the journal entry for Arnold assuming the company uses the: net method to account for sales discounts. Prepare the journal entry under #2 assuming that payment was not received until March 3. Date A B Account Title Debit Creditarrow_forwardJournalize the following transactions for Iron Sports Corp.: March 1 Iron Sports Corp. sold $64,200 of merchandise on account with credit terms of 2/10, n/30. Cost of merchandise sold was $29,900. March 8 Iron Sports Corp. received $5,000 sales return on damaged goods from the customer. The cost of merchandise returned was $2,400. March 15 Iron Sports Corp. received payment from the customer on the amount due, less the return and discount. Date March 1 March 1 March 8 March 8 March 15 Description + + + ◆ + M + Debit Creditarrow_forwardFollowing are the merchandising transactions of Dollar Store. November 1 Dollar Store purchases merchandise for $1,300 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. November 5 Dollar Store pays cash for the November 1 purchase. November 7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. November 10 Dollar Store pays $65 cash for transportation costs for the November 1 purchase. November 13 Dollar Store sells merchandise for $1,404 with terms n/30. The cost of the merchandise is $702. November 16 Merchandise is returned to the Dollar Store from the November 13 transaction.. The returned items are priced at $290 and cost $145; the items were not damaged and were returned to inventory. Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method. View transaction list Journal entry worksheetarrow_forward

- Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $18,040. The cost of the merchandise sold was $9,550. July 7. Received $5,010 from Dr. Sinclair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible. Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $13,030 cash in full payment CHART OF ACCOUNTS Arrow Medical Co. General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Dr. Sinclair Welby 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable…arrow_forwardEntries for Uncollectible Accounts, using Direct Write-Off Method Journalize the following transactions in the accounts of Arrow Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Sinclair Welby, $47,300. The cost of the merchandise sold was $25,500. July 7. Received $11,800 from Dr. Sindair Welby and wrote off the remainder owed on the sale of January 19 as uncollectible. Nov. 2. Reinstated the account of Dr. Sinclair Welby that had been written off on July 7 and received $35,500 cash in full payment. If an amount box does not require an entry, leave it blank. Jan. 19-sale Jan. 19-cost July 7 Nov. 2-reinstate Nov. 2-collectionarrow_forward1. Dollar Store purchases merchandise for $2,200 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1 2. Dollar Store pays cash for the November 1 purchase 3. Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund 4. Dollar Store pays $110 cash for transportation costs for the November 1 purchase 5. Dollar Store sells merchandise for $2,376 with terms n/30 6. The cost of the merchandise is $1,188 7. Merchandise is returned to the Dollar Store from the November 13 transaction. The returned items are priced at $230 8. The returned items cost $115; the items were not damaged and were returned to inventory I just need to know the general journal, Debt, and Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education