FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:July 1) Purchased merchandise from Griffin Company for

$10,400 under credit terms of 1/15, n/30, FOB shipping

point, invoice dated July 1.

July 2) Sold merchandise to Wilson Company for $3,100

under credit terms of 2/10, n/60, FOB shipping point, invoice

dated July 2.

July 2) The cost of the merchandise sold to Wilson Company

was $1,860.

July 3) Paid $1,005 cash for freight charges on the purchase

of July 1.

July 8) Sold merchandise for $6,100 cash.

July 8) The cost of the merchandise sold was $3,700.

July 9) Purchased merchandise from Lee Company for

$4,400 under credit terms of 2/15, n/60, FOB destination,

invoice dated July 9.

July 11) Received a $900 credit memorandum from Lee

Company for the return of part of the merchandise

purchased on July 9.

July 12) Received the balance due from Wilson Company for

the invoice dated July 2, net of the discount.

July 16) Paid the balance due to Griffin Company within the

discount period.

July 19) Sold merchandise to Garcia Company for $5,600

under credit terms of 2/15, n/60, FOB shipping point, invoice

dated July 19.

2

July 19) The cost of the merchandise sold to Garcia

Company was $3,900.

July 21) Issued a $1,100 credit memorandum to Garcia

Company for an allowance on goods sold on July 19.

July 24) Paid Lee Company the balance due, net of discount.

July 30) Received the balance due from Garcia Company for

the invoice dated July 19, net of discount.

July 31) Sold merchandise to Wilson Company for $11 400

S

3

E

D

888

$

4+

R

F

De 5

%

T

Impact on Income

G

Prey

1 of 1

6

MacBook Air

FO

Y

(decrease) to

Income

&

7

Next

U

#00

8

FB

9

0

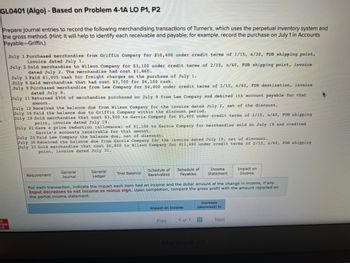

Transcribed Image Text:GLO401 (Algo) - Based on Problem 4-1A LO P1, P2

Prepare journal entries to record the following merchandising transactions of Turner's, which uses the perpetual inventory system and

the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts

Payable-Griffin.)

raw

point,

July 1 Purchased merchandise from Griffin Company for $10,400 under credit terms of 1/15, n/30, FOB shipping

invoice dated July 1.

July 2 Sold merchandise to Wilson Company for $3,100 under credit terms of 2/10, n/60, FOB shipping point, invoice

dated July 2. The merchandise had cost $1,860.

July 3 Paid $1,005 cash for freight charges on the purchase of July

July 8 Sold merchandise that had cost $3,700 for $6,100 cash.

July 9 Purchased merchandise from Lee Company for $4,400 under credit terms of 2/15, n/60, FOB destination, invoice

dated July 9.

July 11 Returned $900 of merchandise purchased on July 9 from Lee Company and debited its account payable for that

amount.

July 12 Received the balance due from Wilson Company for the invoice dated July 2, net of the discount.

July 16 Paid the balance due to Griffin Company within the discount period.

July 19 Sold merchandise that cost $3,900 to Garcia Company for $5,600 under credit terms of 2/15, n/60, FOB shipping

point, invoice dated July 19.

July 21 Gave a price reduction (allowance) of $1,100 to Garcia Company for merchandise sold on July 19 and credited

Garcia's accounts receivable for that amount.

July 24 Paid Lee Company the balance due, net of discount.

July 30 Received the balance due from Garcia Company for the invoice dated July 19, net of discount.

July 31 Sold merchandise that cost $6,800 to Wilson Company for $11,400 under credit terms of 2/10, n/60, FOB shipping

point, invoice dated July 31.

Requirement

General

Journal

General

Ledger

Trial Balance

Schedule of Schedule of

Receivables Payables

Impact on income

For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any.

Input decreases to net income as minus sign. Upon completion, compare the gross profit with the amount reported on

the partial income statement.

Prey

1 of 1

Income

Statement

Increase

(decrease) to

MacBook Air

Impact on

Income

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- July 1 Purchased merchandise from Carter Company for $11,200 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. July 2 Sold merchandise to Martin Company for $3,500 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $2,100. July 3 Paid $1,165 cash for freight charges on the purchase of July 1. July 8 Sold merchandise that had cost $4,100 for $6,900 cash. July 9 Purchased merchandise from Walker Company for $4,800 under credit terms of 2/15, n/60, FOB destination, invoice dated July sukrale cab the th 9. July 11 Returned $1,000 of merchandise purchased on July 9 from Walker Company and debited its account payable for that amount. July 12 Received the balance due from Martin Company for the invoice dated July 2, net of the discount. July 16 Paid the balance due to Carter Company within the discount period. July 19 Sold merchandise that cost $4,500 to Ryan Company for $6,400 under credit terms of 2/15, n/60, FOB…arrow_forward2arrow_forwardOn June 3, Pearl Company sold to Chester Company merchandise having a sale price of $5,600 with terms of 3/10, n/60, f.o.b. shipping point. An invoice totaling $95, terms n/30, was received by Chester on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Chester Company. (a) Prepare journal entries on the Pearl Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts.arrow_forward

- HOW DO I PREPARE A TRANSACTION CHART? On June 10, Wildhorse Company purchased $9,500 of merchandise on account from Novak Company, FOB shipping point, terms 2/10, n/30. Wildhorse pays the freight costs of $590 on June 11. Damaged goods totaling $350 are returned to Novak for credit on June 12. The fair value of these goods is $75. On June 19, Wildhorse pays Novak Company in full, less the purchase discount. Both companies use a perpetual inventory system.arrow_forwardSara’s Market recorded the following events involving a recent purchase of merchandise: Received goods for $150,000, terms 2/10, n/40. Returned $3,000 of the shipment for credit. Paid $750 freight on the shipment. Paid the invoice within the discount period. As a result of these events, the company’s merchandise inventory increased by $147,750. increased by $144,810. increased by $144,795 increased by $144,060.arrow_forwardThe following transactions are for Wildhorse Company. 1. On December 3, Wildhorse Company sold $584,300 of merchandise to Swifty Co., on account, terms 2/10, n/30, FOB destination. Wildhorse paid $370 for freight charges. The cost of the merchandise sold was $359,300. 2. On December 8, Swifty Co. was granted an allowance of $21,300 for merchandise purchased on December 3. 3. On December 13, Wildhorse Company received the balance due from Swifty Co. 1. Prepare the journal entries to record these transactions on the books of Wildhorse Company using a perpetual inventory system 2. Assume that Wildhorse Company received the balance due from Swifty Co. on January 2 of the following year instead of December 13. Prepare the journal entry to record the receipt of payment on January 2.arrow_forward

- Shore Co. sold merchandise to Blue Star Co. on account, $112,000, terms FOB shipping point, 2/10, n/30. The cost of the goods sold is $67,200. Shore Co. paid freight of $1,800. Journalize the entries for Shore and Blue Star for the sale, purchase, and payment of amount due. Refer to the appropriate company’s Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Shore Co. General Ledger ASSETS 110 Cash 121 Accounts Receivable-Blue Star Co. 125 Notes Receivable 130 Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Office Equipment 195 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary…arrow_forwardThis information relates to Swifty Corporation. 1. 2. 3. 4. 5. On April 5, purchased merchandise from Blue Spruce Inc. for $30,500, terms 2/10, n/30. On April 6, paid freight costs of $1,140 on merchandise purchased from Blue Spruce. On April 7, purchased equipment on account for $36,600. On April 8, returned some of April 5 merchandise to Blue Spruce that cost $4,900. On April 15, paid the amount due to Blue Spruce in full. Swifty uses a periodic inventory system. Prepare the journal entries to record the transactions listed above on the books of Swifty Corporation. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to the nearest whole dollar, e.g. 5,725. List all debit entries before credit entries.) Date Account Titles and Explanation Debit DOOT Creditarrow_forwardRecording Sales Transactions Jeet Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April: a. On April 1, Jeet purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,100, and the cost of the merchandise sold was $2,225. b. On April 1, Jeet paid freight charges of $250 cash to have the goods delivered to its warehouse. c. On April 8, Jeet returned $800 of the merchandise. The cost of the merchandise returned was $500. d. On April 10, Jeet paid Reece the balance due. Required: Prepare the journal entries to record these transactions on the books of Reece Company. For a compound transaction, if those boxes in which no entry is required, leave the box blank. April 1 (Recorded sale on account) April 1 (Recorded cost of merchandise sold) April 8 (Record return of merchandise) April 8arrow_forward

- Information related to Blossom Company is presented below. On April 5, purchased merchandise on account from Swifty Company for $27,900, terms 3/10, net/30, FOB shipping point. On April 6, paid freight costs of $400 on merchandise purchased from Swifty. On April 7, purchased equipment on account for $30,500. On April 8, returned $3,800 of merchandise to Swifty Company. On April 15, paid the amount due to Swifty Company in full. 1. 2 3. 4. 5. Prepare the journal entries to record these transactions on the books of Blossom Company under a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation No. 1. N 2. 3. 4. 5. Debit Creditarrow_forwardInformation related to Splish Brothers Inc. is presented below. rch On April 5, purchased merchandise on account from Sheffield Company for $26,400, terms 4/10, net/30, FOB shipping point. On April 6, paid freight costs of $930 on merchandise purchased from Sheffield. On April 7, purchased equipment on account for $41,900. On April 8, returned damaged merchandise to Sheffield Company and was granted a $4,100 credit for returned merchandise. 5. On April 15, paid the amount due to Sheffield Company in full. 1. 2. 3. 4. Prepare the journal entries to record these transactions on the books of Splish Brothers Inc. under a perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. 1. 2. Date Account Titles and Explanation norcal_archives_20....zip O i Ei W QCA 5.docx C ((( W response essay.docx Debit < 76°F_^ Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education