FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

This question has not been previously submitted.

Thank you

Transcribed Image Text:11:52

Module 7 Problem Set

1. BE 14.06 ALGO

2. BE 14.05 ALGO

3. BE.14.11.ALGO

4. BE.14.08.ALGO

5. BE.14.02.ALGO

6. BE 14.04 ALGO

7. BE 14.09.ALGO

8. BE.14.03.ALGO

9. BE.14.10.ALGO

10. BE 14.01 ALGO

Progress: 2/10 items

Assignment Score: 0.0%

cengagenow.com

D2L

000

●

Q5G 80%

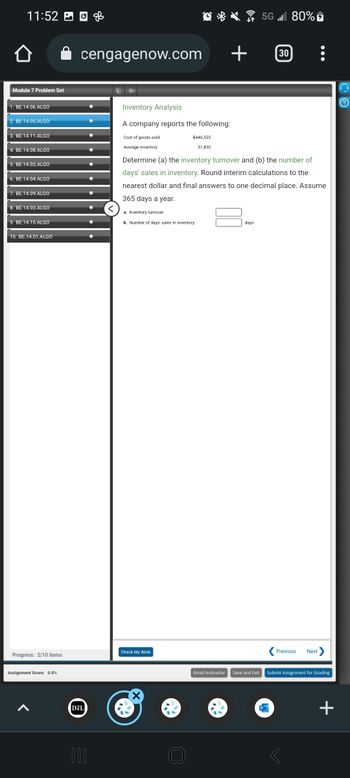

Inventory Analysis

A company reports the following:

Cost of goods sold

Average inventory

$440,555

51,830

a. Inventory turnover

b. Number of days' sales in inventory

Check My Work

Determine (a) the inventory turnover and (b) the number of

days' sales in inventory. Round interim calculations to the

nearest dollar and final answers to one decimal place. Assume

365 days a year.

+ 30

CK

Previous Next>

Email Instructor Save and Exit Submit Assignment for Grading

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why does the Section 404 is perhaps the most controversial provision of SOX?arrow_forwardWe learned about the importance of selecting the "filing status"; What are the different filing status options and why is proper selection important?arrow_forwardHas Sarbanes Oxley been an effective piece of legislation?arrow_forward

- Which is a primary source of the PCAOB independence rules? AICPA Frequently Asked Questions: Nonattest Services. SEC Frequently Asked Questions. AICPA independence rules as of April 16, 2003. International independence standards.arrow_forwardHow would you explain to your client that you will not submit a preemptive offer on their behalf?arrow_forwardHas Sarbones Oxley been an effective piece of legislation?arrow_forward

- TO whom it may concern, I was wondering to know following details for question. Explain relevant law General RuleException Apply law to key facts General Rule Exceptionarrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education