FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

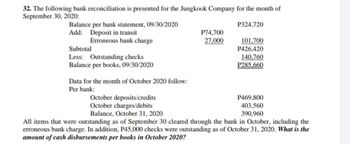

Transcribed Image Text:32. The following bank reconciliation is presented for the Jungkook Company for the month of

September 30, 2020:

Balance per bank statement, 09/30/2020

P324,720

Add: Deposit in transit

P74,700

Erroneous bank charge

27,000

101,700

Subtotal

P426,420

Less: Outstanding checks

140,760

Balance per books, 09/30/2020

P285,660

Data for the month of October 2020 follow:

Per bank:

P469,800

October deposits/credits

October charges/debits

Balance, October 31, 2020

403,560

390,960

All items that were outstanding as of September 30 cleared through the bank in October, including the

erroneous bank charge. In addition, P45,000 checks were outstanding as of October 31, 2020. What is the

amount of cash disbursements per books in October 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A -1 Prepared by Reviewed by William, Inc. Bank Confirmation - General Account December 31, 2022 Balance per Bank at December 31, 2022 $20,200.22 * Deposit in Transit - per A-1-2 2,000.00 # Outstanding Checks - per A-1-3 (5,200.00) Other - Note Collected by Bank (10,000.00) ^ Bank Service Charge (9.50) Balance per Books at December 31, 2022 $8,990.72 * f f Column footed. ^ Amount agrees to amount recorded as a deposit on the bank statement and description agrees with receipt enclosed with 12/31/22 bank statement. This note is the Kristopher note receivable that was recorded as a receipt by the client in the cash receipts journal on January 3, 2023. The receivable was appropriately credited and properly reflected in the January cash receipts journal. No adjustment needed as bank and books simply record this in different periods. #Agreed to December 31,…arrow_forwardHello please give me Answerarrow_forwardConsolidated Paper has just completed its bank reconciliation for the month of Febrruary 2023 as shown below. Balance per bank....... Add: Deposit in transit......... O Less: Outstanding checks... $16,200 2,600 (900) Balance per books...... Add: Interest earned. Less: Bank service charge.... Add: Error in posting payment of accounts receivable Reconciled balance........ $17,900 customer............ $17,400 200 (100) 2 3 Reconciled balance............... 4 5 a. Prepare the adjusting entry (debits and credits) that is needed as a result of the bank reconciliation. 6 b. What cash balance will Consolidated Paper report on its February 28, 2023 financial statements 7 8 9 0 1 400 $17,900arrow_forward

- Balance, December 31, 2018 $3,340 ADD: Deposit in transit 100 3,440 LESS: Outstanding checks $400 400 Adjusted bank balance, December 31, 2018 $3,040 Book: Balance, December 31, 2018 $2,540 ADD: Bank collection $510 Interest revenue 20 530 3,070 LESS: Service charge $30 30 Adjusted book balance, December 31, 2018 $3,040arrow_forwardWhat is the correct cash balance at August 31, 2018a. P902,00b. P860,000c. P820,000d. 802,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education