Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Need answer the questions

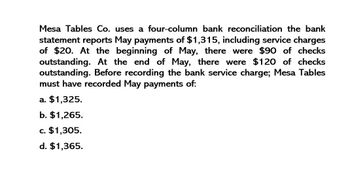

Transcribed Image Text:Mesa Tables Co. uses a four-column bank reconciliation the bank

statement reports May payments of $1,315, including service charges

of $20. At the beginning of May, there were $90 of checks

outstanding. At the end of May, there were $120 of checks

outstanding. Before recording the bank service charge; Mesa Tables

must have recorded May payments of:

a. $1,325.

b. $1,265.

c. $1,305.

d. $1,365.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The bank reconciliation shows the following adjustments. Deposits in transit: $1,698 Notes receivable collected by bank: $2,500; interest: $145 Outstanding checks: $987 Error by bank: $436 Bank charges: $70 Prepare the correcting journal entry.arrow_forwardThe bank reconciliation shows the following adjustments: Deposits in transit: $1,234 Outstanding checks: $558 Bank service charges: $50 NSF checks: $250 Prepare the correcting journal entry.arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $3,678 Book balance: $2,547 Deposits in transit: $321 Outstanding checks: $108 and $334 Bank charges: $25 Notes receivable: $1,000; interest: $35arrow_forward

- Using the following information, prepare a bank reconciliation. Bank balance: $4,587 Book balance: $5,577 Deposits in transit: $1,546 Outstanding checks: $956 Interest income: $56 NSF check: $456arrow_forwardThe bank reconciliation shows the following adjustments. Deposits in transit: $526 Outstanding checks: $328 Bank charges: $55 NSF checks: $69 Prepare the correcting journal entry.arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $6,988 Book balance: $6,626 Deposits in transit: $1,600 Outstanding checks: $599 and $1,423 Bank charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $234 but posted in the accounting records as $324. This check was expensed to Utilities Expense.arrow_forward

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardCatherines Cookies has a beginning balance in the Accounts Receivable control total account of $8,200. $15,700 was credited to Accounts Receivable during the month. In the sales journal, the Accounts Receivable debit column shows a total of $12,000. What is the ending balance of the Accounts Receivable account in the general ledger?arrow_forwardNeed help this questionarrow_forward

- Need help this question general accountingarrow_forwardBefore reconciling its bank statement, Rollin Corporation's general ledger had a month-end balance in the cash account of $5.750. The bank reconciliation for the month contained the following items: Deposits in transit Outstanding checks Interest earned NSF check returned to bank Bank service charge Given the above information, what is the up-to-date ending cash balance Rollin should report at month-end? Multiple Choice $4,980. O $5,300. $ 770 495 20 120 20 $5,630.arrow_forwardThe accountant of ABC Company is preparing a bank reconciliation statement for the month of October. The bank statement shows a balance of $9,719 while the ledger balance is $7,261. He compiles the following information: Description Check #3119 recorded at $1,830 Amount $1,380 a b NSF checks $500 EFT for insurance deducted $336 d EFT for rent collected $775 Service charge deducted Outstanding checks Deposit in transit Notes collected by bank e $15 f $4,036| g $3,402 h $1,450 Compute the adjusted bank balance for the month of October. а. $10,520 b. $9,070 с. $9,085 d. $8,749arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning