FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

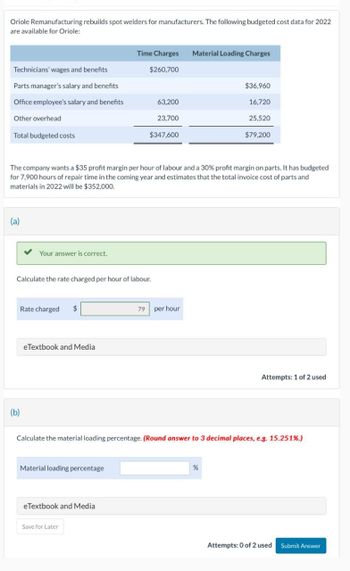

Transcribed Image Text:Oriole Remanufacturing rebuilds spot welders for manufacturers. The following budgeted cost data for 2022

are available for Oriole:

Time Charges

Material Loading Charges

Technicians' wages and benefits

$260,700

Parts manager's salary and benefits

$36,960

Office employee's salary and benefits

63,200

16,720

Other overhead

23,700

25,520

Total budgeted costs

$347,600

$79,200

The company wants a $35 profit margin per hour of labour and a 30% profit margin on parts. It has budgeted

for 7,900 hours of repair time in the coming year and estimates that the total invoice cost of parts and

materials in 2022 will be $352,000.

(a)

Your answer is correct.

Calculate the rate charged per hour of labour.

Rate charged

eTextbook and Media

79 per hour

Attempts: 1 of 2 used

(b)

Calculate the material loading percentage. (Round answer to 3 decimal places, e.g. 15.251%.)

Material loading percentage

eTextbook and Media

Save for Later

%

Attempts: 0 of 2 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dazzle Party is a small business that produces decorative balloons for events. Dazzle Party uses normal costing and assigns manufacturing overhead (MOH) costs using labour hours as the allocation base. Budgeted and actual production data for the year 2023 is provided below. Budget $60,000 120,000 Actual $52,000 MOH costs Labour-hours 110,000 Required: Calculate the difference between the allocated MOH cost and the actual MOH cost incurred in 2023. Clearly state whether this difference represents a case of under-allocation or over-allocation of MOH.arrow_forwardFinancearrow_forwardSubject: acountingarrow_forward

- answer in text form please (without image)arrow_forwardPlease help me to solve this problemarrow_forwardBlue Spruce Welding rebuilds spot welders for manufacturers. The following budgeted cost data for 2022 is available for Blue Spruce. Technicians' wages and benefits Parts manager's salary and benefits Office employee's salary and benefits Other overhead (a) Total budgeted costs Compute the rate charged per hour of labor. Time Charges $202,800 Labor rate $ 39,000 7,800 $249,600 The company desires a $39 profit margin per hour of labor and a 28% profit margin on parts. It has budgeted for 7,800 hours of repair time in the coming year, and estimates that the total invoice cost of parts and materials in 2022 will be $416,000. Material Loading Charges per hour $39,300 14,780 29,120 $83,200arrow_forward

- Carla Vista Remanufacturing rebuilds spot welders for manufacturers. The following budgeted cost data for 2022 are available for Carla Vista: Technicians' wages and benefits Parts manager's salary and benefits Office employee's salary and benefits Other overhead Total budgeted costs (a) Rate charged $ Time Charges Material Loading Charges $245,830 Calculate the rate charged per hour of labour. eTextbook and Media Save for Later 47,580 31,720 $325,130 The company wants a $30 profit margin per hour of labour and a 25% profit margin on parts. It has budgeted for 7,930 hours of repair time in the coming year and estimates that the total invoice cost of parts and materials in 2022 will be $388,000. $36,860 16,490 per hour 25,220 $78,570 Attempts: 0 of 2 used Submit Answerarrow_forwardThe Current Designs staff has prepared the annual manufacturing budget for the rotomolded line based on an estimated annual production of 4,640 kayaks during 2022. Each kayak will require 56 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). The polyethylene powder used in these kayaks costs $1.20 per pound, and the finishing kits cost $210 each. Each kayak will use two kinds of labor-2 hours of type I labor from people who run the oven and trim the plastic, and 3 hours of work from type II workers who attach the hatches and seat and other hardware. The type I employees are paid $17 per hour, and the type II are paid $14 per hour. Manufacturing overhead is budgeted at $414,840 for 2022, broken down as follows. Variable costs Indirect materials $46,400 Manufacturing supplies 64,960 Maintenance and utilities 102,080 213,440 Fixed costs Supervision 78,000 Insurance 13,200 Depreciation 110,200 201,400 Total $414,840 During the first quarter, ended March 31,…arrow_forwardChelsea Clinic projected the following budget information for 2020: Total FFS Visit Volume 90,000 visits Payer Mix: Blue Cross Highmark Reimbursement Rates: Blue Cross Highmark Variable Costs Resource Inputs: Labor Supplies Resource Input Prices: Labor Supplies Fixed Costs (overhead, plant, and equipment) 40% 60% $25 per visit $20 per visit 48,000 total hours 100,000 total units $25.00 per hour $1.50 per unit $500,000 a. Construct Chelsea Clinic’s operating budget for 2020. b. Discuss how each key budget assumption might result in a budget variance, and name the variance that would be used to examine results associated with each assumption.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education