FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

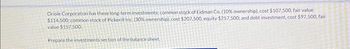

Transcribed Image Text:Oriole Corporation has these long-term investments: common stock of Eidman Co. (10% ownership), cost $107,500, fair value

$114,500: common stock of Pickerill Inc. (30% ownership), cost $207.500, equity $257,500; and debt investment, cost $97,500, fair

value $157,500.

Prepare the investments section of the balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Orem Corporation's current liabilities are $191,880, its long-term liabilities are $1,356, 420, and its working capital is $268, 600. If the corporation's debt-to - equity ratio is 0.39, total long-term assets must equal: Multiple Choice $5, 249, 700 $5,057, 820 $4, 565, 820 $3,970, 000arrow_forwardMerritt stone works is all - equity financed and has net sales of $217,800, taxable income of $32,600 a return on assets of 11.5percent, a tax rate of 21 percent and rotal debt of $63, 700. What are the value for the three components of the DuPont Identity?arrow_forwardam. 238.arrow_forward

- Wainscot Industries has $50.850 of working capital, $36,320 of current liabilities, and $116,880 of long-term debt. If Wainscot's debt-to-equity ratio is 0.40, what is the total amount of Wainscot's non-current assets? O $383,000 O $485.350 O $449,030 O $358,230 O None of the abovearrow_forwardMuffin's Masonry Incorporated's balance sheet lists net fixed assets as $31 million. The fixed assets could currently be sold for $53 million. Muffin's current balance sheet shows current liabilities of $14.0 million and net working capital of $13.0 million. If all the current accounts were liquidated today, the company would receive $8.10 million cash after paying the $14.0 million in current liabilities What is the book value of Muffin's Masonry's assets today and the market value of these assets? Note: Enter your answers in millions of dollars rounded to 2 decimal places. (i.e., Enter 5,500,000 as 5.50.) Current assets Fixed assets Total BOOK VALUE MARKET VALUE (in millions of dollars) $ 0.00 $ 0.00arrow_forwardChoose the letter of the correct answer. How much is the total assets, liabilities and shareholder' equity of Tom Corporation? (check the picture attached) a. Asset = P 326,000; Liabilities = P 130,000; Shareholder's equity = P 196,000 b. Asset = P 320,000; Liabilities = P 136,000; Shareholder's equity = P 184,000 c. Asset = P 200,000; Liabilities = P 70,000; Shareholder's equity = P 130,000 d. Asset = P 326,000; Liabilities = P 180,000; Shareholder's equity = P 146,000arrow_forward

- ABCO Ventures is investing $1.2 million into Showco, and ABCO is receiving a 35% equity interest in Showco in return. Showco’s pre-money valuation is approximately: a. $420,000 b. $1.2 millionc. $2.2 million d. $3.4 millione. None of the above.arrow_forwardThe liabilities and owners’ equity for Campbell Industries is found here. What percentage of the firm’s assets does the firm now finance using debt (liabilities)? If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm’s new debt ratio?arrow_forwardDickson Corporation is comparing two different capital structures. Plan I would result in 26,000 shares of stock and $85,500 in debt. Plan II would result in 20,000 shares of stock and $256,500 in debt. The interest rate on the debt is 6 percent. a. Ignoring taxes, compare both of these plans to an all-equity plan assuming that EBIT will be $95,000. The all-equity plan would result in 29,000 shares of stock outstanding. What is the EPS for each of these plans? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. In part (a), what are the break-even levels of EBIT for each plan as compared to that for an all-equity plan? (Do not round intermediate calculations.) c. Ignoring taxes, at what level of EBIT will EPS be identical for Plans I and II? (Do not round intermediate calculations.) d-1. Assuming that the corporate tax rate is 22 percent, what is the EPS of the firm? (Do not round intermediate calculations and round your answers to 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education