Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

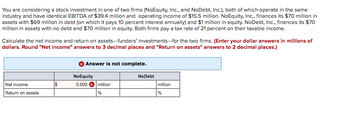

Transcribed Image Text:You are considering a stock investment in one of two firms (NoEquity, Inc., and NoDebt, Inc.), both of which operate in the same

industry and have identical EBITDA of $39.4 million and operating income of $15.5 million. NoEquity, Inc., finances its $70 million in

assets with $69 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Inc., finances its $70

million in assets with no debt and $70 million in equity. Both firms pay a tax rate of 21 percent on their taxable income.

Calculate the net income and return on assets-funders' investments-for the two firms. (Enter your dollar answers in millions of

dollars. Round "Net income" answers to 3 decimal places and "Return on assets" answers to 2 decimal places.)

Answer is not complete.

NoEquity

Net income

$

0.000

million

Return on assets

%

NoDebt

million

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The Company is comparing two different capital structures, an all - equity plan (Plan I) and a levered plan (Plan II). Under Plan I, The Company would have 405, 053 shares of stock outstanding. Under Plan II, there would be 337, 151 shares of stock outstanding and $5.9 million in debt outstanding. The interest rate on the debt is 9.05 percent, and there are no taxes. The breakeven EBIT is $arrow_forwardFoundation, Incorporated, is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 185,000 shares of stock outstanding. Under Plan II, there would be 135,000 shares of stock outstanding and $1.9 million in debt outstanding. The interest rate on the debt is 7 percent, and there are no taxes. a. If EBIT is $425,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If EBIT is $675,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the break-even EBIT? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) a. Plan I EPS a. Plan II EPS b. Plan I EPS b. Plan II EPS c. Break-even EBITarrow_forwardSodaFizz has debt outstanding that has a market value of $3 million. The company’s stock has a book value of $2 million and a market value of $6 million. What are the weights in SodaFizz’s capital structure?arrow_forward

- Dickson Corporation is comparing two different capital structures. Plan I would result in 26,000 shares of stock and $85,500 in debt. Plan II would result in 20,000 shares of stock and $256,500 in debt. The interest rate on the debt is 6 percent. a. Ignoring taxes, compare both of these plans to an all-equity plan assuming that EBIT will be $95,000. The all-equity plan would result in 29,000 shares of stock outstanding. What is the EPS for each of these plans? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. In part (a), what are the break-even levels of EBIT for each plan as compared to that for an all-equity plan? (Do not round intermediate calculations.) c. Ignoring taxes, at what level of EBIT will EPS be identical for Plans I and II? (Do not round intermediate calculations.) d-1. Assuming that the corporate tax rate is 22 percent, what is the EPS of the firm? (Do not round intermediate calculations and round your answers to 2…arrow_forwardReynolds Construction's current value of operations is $750 million based on the free cash flow valuation model. Its balance sheet shows $50 million of short-term investments that are unrelated to operations, and $300 million of total debt. What is the best estimate for the firm's value of equity, in millions?.arrow_forwardAAA Corporation and BBB Corporation are identical in every way except their capital structures. AAA Corporation, an all-equity firm, has 40million shares of stock outstanding, currently worth $15 per share. BBB Corporation uses leverage in its capital structure. The market value of BBB’s debt is $100million and its cost of debt is 6.7 percent. Each firm is expected to have earnings before interest of $200 million in perpetuity. Assume that every investor can borrow at 6.7 percent per year. Corporate tax rate is 35%. (SHOW YOUR WORK) 1). What is the value of AAA Corporation? 2). What is the value of BBB Corporation? 3). What is the market value of BBB Corporation’s equity? 4). What would be the BBB’s cost of equity (Rs)? 5). What would be BBB’s weighted average cost of capital (WACC)?arrow_forward

- XYZ is comparing two different capital structures. Plan I would result in 13,000 shares of stock and $130,500 in debt. Plan II would result in 10,000 shares of stock $243,600 in debt. The interest rate on the debt is 10%. a). Ignoring taxes, compare plans I and II to an all equity plan assuming that EBIT will be $56,000. The all equity plan will result in 16,000 shares of stock OUTSTANDING. Which of the 3 plans has the highest EPS? And which has the lowest? b). In part A, what are the break-even levels of EBIT for plan I compared to an all equity plan? What about for plan II I compared to an all equity plan? Is one higher than the other? Why (explain). c). Ignoring taxes, when will EPS be identical for plans I and II?arrow_forwardThere are two firms: Firm U and Firm L. Both firms have $30,000 total assets and $5,000 EBIT (earnings before interest and taxes). Firm U is an unlevered firm without debt, and its number of outstanding shares is 1,000. Firm L is a levered firm financed with 50% debt and 50% common equity. The firm plans to use the debt to repurchase 50% of the outstanding shares (Note: reduce the outstanding shares). The pre-tax cost of debt for Firm L is 10%. Both firms have a 20% corporate tax rate. Calculate the earnings per share (EPS) for the unlevered firm U. A)$3.5 per share B)$5.0 per share C)$4.0 per share D)$5.6 per sharearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education