College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

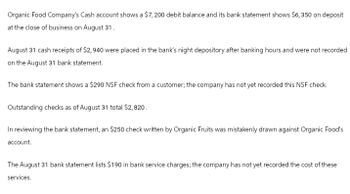

Transcribed Image Text:Organic Food Company's Cash account shows a $7,200 debit balance and its bank statement shows $6,350 on deposit

at the close of business on August 31.

August 31 cash receipts of $2,940 were placed in the bank's night depository after banking hours and were not recorded

on the August 31 bank statement.

The bank statement shows a $290 NSF check from a customer; the company has not yet recorded this NSF check.

Outstanding checks as of August 31 total $2,820.

In reviewing the bank statement, an $250 check written by Organic Fruits was mistakenly drawn against Organic Food's

account.

The August 31 bank statement lists $190 in bank service charges; the company has not yet recorded the cost of these

services.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the following information, prepare a bank reconciliation. Bank balance: $12,565. Book balance: $13,744. Deposits in transit: $2,509. Outstanding checks: $1,777. Bank charges: $125. Bank incorrectly charged the account for $412. The bank will correct the error next month. Check number 1879 correctly cleared the bank in the amount of $562 but posted in the accounting records as $652. This check was expensed to Utilities Expense.arrow_forwardThe bank reconciliation revealed that one deposit had cleared the bank two weeks after the date of the deposit. Should this be of concern? Why, or why not?arrow_forwardOrganic Food Company's Cash account shows a $7,400 debit balance and its bank statement shows $6,490 on deposit at the close of business on August 31. August 31 cash receipts of $3,140 were placed in the bank’s night depository after banking hours and were not recorded on the August 31 bank statement. The bank statement shows a $310 NSF check from a customer; the company has not yet recorded this NSF check. Outstanding checks as of August 31 total $3,020. In reviewing the bank statement, an $270 check written by Organic Fruits was mistakenly drawn against Organic Food’s account. The August 31 bank statement lists $210 in bank service charges; the company has not yet recorded the cost of these services. Prepare any necessary journal entries that Organic Food Company must record as a result of preparing the bank reconciliation.arrow_forward

- Organic Food Co.'s cash account shows a $7,200 debit balance and its bank statement shows $6,350 on deposit at the close of business on August 31. August 31 cash receipts of $2,940 were placed in the bank’s night depository after banking hours and were not recorded on the August 31 bank statement. The bank statement shows a $290 NSF check from a customer; the company has not yet recorded this NSF check. Outstanding checks as of August 31 total $2,820. In reviewing the bank statement, an $250 check written by Organic Fruits was mistakenly drawn against Organic Food’s account. The August 31 bank statement lists $190 in bank service charges; the company has not yet recorded the cost of these services. Prepare a bank reconciliation using the above information.arrow_forwardOrganic Food Company's Cash account shows a $7,400 debit balance and its bank statement shows $6,490 on deposit at the close of business on August 31. a. August 31 cash receipts of $3,140 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. Deduct b. The bank statement shows a $310 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $3,020. d. In reviewing the bank statement, an $270 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $210 in bank service charges; the company has not yet recorded the cost of these services. Prepare a bank reconciliation using the above information. Bank statement balance i Add: Adjusted bank balance ORGANIC FOOD COMPANY Bank Reconciliation August 31 $ 0 0 Book balance Add: Deduct: 0 0 Adjusted book balance $ 0 0 0 0arrow_forwardWright Company's cash account shows a $30,500 debit balance and its bank statement shows $28,800 on deposit at the close of business on May 31. The May 31 bank statement lists $250 in bank service charges; the company has not yet recorded the cost of these services. Outstanding checks as of May 31 total $7,100. May 31 cash receipts of $7,700 were placed in the bank’s night depository after banking hours and were not recorded on the May 31 bank statement. In reviewing the bank statement, a $550 check written by Smith Company was mistakenly drawn against Wright’s account. The bank statement shows a $300 NSF check from a customer; the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information.arrow_forward

- Organic Foods Co's cash account shows a $5,500 debit balance and its bank statement shows $5,160 on deposit at close of business on August 31. Prepare a bank reconciliation using the following information. a) August 31 cash receipts of $1,240 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b) The bank statement shows a $120 NSF check from a customer; the company has not yet recorded this NSF check. c) Outstanding checks as of August 31 total $1,120. d) In reviewing the bank statement, an $80 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e) The August 31 bank statement lists $20 in bank service charges; the company has not yet recorded the cost of these services.arrow_forwardNolan Company's cash account shows a $26,426 debit balance and its bank statement shows $25,694 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $2,907. b. The June 30 bank statement lists $32 in bank service charges; the company has not yet recorded the cost of these services. c. In reviewing the bank statement, a $80 check written by the company was mistakenly recorded in the company's books as $89. d. June 30 cash receipts of $3,656 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. e. The bank statement included a $40 credit for interest earned on the company's cash in the bank. The company has not yet recorded interest earned. Prepare a bank reconciliation using the above information. Bank statement balance Add: Deduct: Adjusted bank balance NOLAN COMPANY Bank Reconciliation June 30 Book balance Add: Deduct: Adjusted book balancearrow_forwardNolan Company's cash account shows a $29,193 debit balance and its bank statement shows $28,152 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $2,801. b. The June 30 bank statement lists $32 in bank service charges; the company has not yet recorded the cost of these services. c. In reviewing the bank statement, a $80 check written by the company was mistakenly recorded in the company's books as $89. d. June 30 cash receipts of $3,853 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. e. The bank statement included a $34 credit for interest earned on the company's cash in the bank. The company has not yet recorded interest earned. Prepare a bank reconciliation using the above information. NOLAN COMPANY Bank Reconciliation June 30 Bank statement balance Book balance Add: Add: Deduct: Deduct: Adjusted bank balance Adjusted book balancearrow_forward

- Liberty Company receives a bank statement dated April 30 that shows a balance of $4,722.68. Liberty’s checkbook balance, as of April 30, is $5,277.73. The bank has not processed check 566 for $35 or check 567 for $264. A $750 deposit made on April 30 does not appear on the bank statement. The bank statement shows a few items that Liberty is unaware of: check printing charges of $61.50 and interest earned of $11.45. Liberty recorded check 563 as $128, but the bank processed the check incorrectly as $182. Find the April 30 reconciled balance.arrow_forwardOrganic Food Co.’s Cash account shows a $5,500 debit balance and its bank statement shows $5,160 on deposit at the close of business on August 31. Prepare a bank reconciliation using the following information. a. August 31 cash receipts of $1,240 were placed in the bank’s night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $120 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $1,120. d. In reviewing the bank statement, an $80 check written by Organic Fruits was mistakenly drawn against Organic Food’s account. e. The August 31 bank statement lists $20 in bank service charges; the company has not yet recorded the cost of these services.arrow_forwardIron Company receives a bank statement dated April 30 that shows a balance of $3,276.82. Iron’s checkbook balance, as of April 30, is $3,205.37. The bank has not processed check 892 for $45 or check 895 for $640. A $550 deposit made on April 30 does not appear on the bank statement. The bank statement shows a few items that Iron is unaware of: check printing charges of $65 and interest earned of $11.45. Iron recorded check 890 as $122, but the bank processed the check correctly as $132. Find the reconciled balance by completing the bank reconciliation:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage