CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

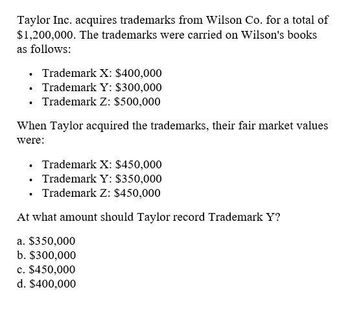

Transcribed Image Text:Taylor Inc. acquires trademarks from Wilson Co. for a total of

$1,200,000. The trademarks were carried on Wilson's books

as follows:

■ Trademark X: $400,000

⚫ Trademark Y: $300,000

.

Trademark Z: $500,000

When Taylor acquired the trademarks, their fair market values

were:

⚫ Trademark X: $450,000

. Trademark Y: $350,000

⚫ Trademark Z: $450,000

At what amount should Taylor record Trademark Y?

a. $350,000

b. $300,000

c. $450,000

d. $400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Hoolia Corporation acquires equipment and patents from another company for $50 million and records the acquisition as an asset acquisition. The equipment has a fair value of $19.20 million and the patents have a fair value of $28.80 million. Neither asset is nonqualifying. At what value does Hoolia record the equipment? Select one: a. $25.0 million b. $20.0 million c. $21.2 million d. $19.2 millionarrow_forwardWhat is the goodwill arising from the acquisition?arrow_forwardBryer Co. purchases all of the assets and liabilities of Stellar Co. for $1,500,000. The fair value of Stellar’s assets is $2,000,000, and its liabilities have a fair value of $1,200,000. The book value of Stellar’s assets and liabilities are not known. For what amount would Bryer record goodwill associated with the purchase? a. $800,000.b. $500,000.c. $700,000.d. $0.arrow_forward

- On Jan. 1, 2022, ABC Co. sold a machinery to XYZ Co. for P1,900,000. Because of the entity's commitments to its customers to provide their needs for the next 4 years, ABC simultaneously leased back the machinery. The transfer of the asset to the buyer qualifies to be accounted for as a sale under IFRS 15. Information relating to this transaction follows:FV of machinery, P2,200,000CA of machinery, P1,700,000Remaining useful life of machinery, 6 yearsLease term, 4 yearsAnnual rent payable at the end of each year, P500,000Market rate of interest, 10%PVF, ordinary annuity, 10%, 4 periods, 3.1699PVF, ordinary annuity, 10%, 6 periods, 4.3553PVF, single payment, 10%, 4 periods, 0.6830PVF, single payment, 10%, 6 periods, 0.5645What amount of lease liability should ABC record on Jan. 1, 2022?arrow_forwardEd acquired all the assets and assumed all the liabilities of JP for P2,500,000. On theacquisition date, JP's net identifiable assets and liabilities have fair values ofP3,500,000 and P1,200,000, respectively.Additional Information:● JP has an unrecorded patent with a fair value of P120,000● JP has Research and Development projects with a fair value of P80,000. JPcharged the cost as an expense when incurred.● Ed is renting out a property to JP under the operating lease. The terms of thelease compared to the market terms are unfavorable. The fair value of thedifferential is P50,000.Compute for the Goodwill.arrow_forwardOn January 1, 2022, P Company acquired 80% of S Company forP2,000,000. The fair value of identifiable net assets is P1,800,000. NCI ismeasured at fair value. During 2022, P Company ships merchandise to SCompany costing P1,000, 000 at 20% above cost. Additional data are asfollows:P Company S CompanySales 5,500,000 2,500,000Cost of Sales 3,200,000 1,600,000Operating Expense 650,000 300,000The ending inventories of S Company includes merchandise from PCompany amounting to P60,000. Impairment of goodwill is P20,000.How much is the consolidated gross profit?arrow_forward

- Sky Co. acquired 100% interest in Star, Inc.'s net identifiable assets with a fair value of P600,000 for P800,000. The valuation of the consideration transferred includes the following: P30,000 reimbursement for appraisal fees incurred by Star in valuing a patent. P50,000 fair value of a trade secret that Sky will grant Star after the business combination. The trade secret has a carrying amount of P40,000 in Sky's books Requirement: Compute for the goodwill.arrow_forwardPurple Corp. purchased all of the listed assets and liabilities of Sudden Corp. for $1,600,000. The following assets and liabilities were purchased:Book Value Fair MarketValueAccounts receivables $ 140,000 $ 140,000 Inventory 168,000 256,000 Property, plant, and equipment (net) 820,000 1,040,000 Patent 0 276,000 Liabilities (170,000 ) (170,000 )________________________________________ Required:1. What is the appropriate amount that would be recorded for goodwill? 2. Prepare the journal entry for the acquisition. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardkai.9arrow_forward

- On January 1, 2025, Henderson Company purchased 100% of the common stock of Caramel Company for $590,000 cash. Fair values differed from book values as follows: Fair value Land 100,000 Patent 250,000 Bonds Payable 105,000 The trial balances of the companies at the acquisition date are as follows: Trial Balance Account Titles Henderson Caramel Cash 650,000 65,000 Land 120,000 30,000 Buildings, net 250,000 180,000 Goodwill 400,000 200,000 Current Liabilities 170,000 75,000 Bonds Payable 500,000 100,000 Common Stock 70,000 30,000 APIC 350,000 70,000 Retained Earnings 330,000 200,000 Which of the following is not one of the eliminations and adjustments included on the consolidation worksheet at the acquisition date? Question 9Answer a. Debit to Common Stock for $30,000 b. Credit to Goodwill for $200,000 c. Credit to Investment in Sub for $590,000 d. Debit to Land for…arrow_forwardOn January 1, 2025, Henderson Company purchased 100% of the common stock of Caramel Company for $590,000 cash. Fair values differed from book values as follows: Fair value Land 100,000 Patent 250,000 Bonds Payable 105,000 The trial balances of the companies at the acquisition date are as follows: Trial Balance Account Titles Henderson Caramel Cash 650,000 65,000 Land 120,000 30,000 Buildings, net 250,000 180,000 Goodwill 400,000 200,000 Current Liabilities 170,000 75,000 Bonds Payable 500,000 100,000 Common Stock 70,000 30,000 APIC 350,000 70,000 Retained Earnings 330,000 200,000 The amount reported for Cash on the consolidated balance sheet at the acquisition date is Question Answer a. $125,000 b. $650,000 c. $65,000 d. $715,000arrow_forwardS acquired 100 percent of F for P275,000. At the date of acquisition, F had the following book and market values: (see image below) What is the amount of the “Investment in F” account on S’s financial records at the acquisition date?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you