ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

13

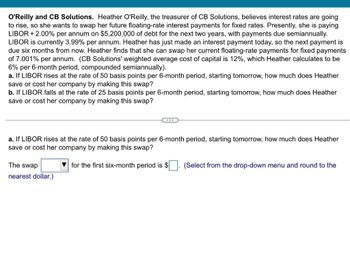

Transcribed Image Text:O'Reilly and CB Solutions. Heather O'Reilly, the treasurer of CB Solutions, believes interest rates are going

to rise, so she wants to swap her future floating-rate interest payments for fixed rates. Presently, she is paying

LIBOR +2.00% per annum on $5,200,000 of debt for the next two years, with payments due semiannually.

LIBOR is currently 3.99% per annum. Heather has just made an interest payment today, so the next payment is

due six months from now. Heather finds that she can swap her current floating-rate payments for fixed payments

of 7.001% per annum. (CB Solutions' weighted average cost of capital is 12%, which Heather calculates to be

6% per 6-month period, compounded semiannually).

a. If LIBOR rises at the rate of 50 basis points per 6-month period, starting tomorrow, how much does Heather

save or cost her company by making this swap?

b. If LIBOR falls at the rate of 25 basis points per 6-month period, starting tomorrow, how much does Heather

save or cost her company by making this swap?

a. If LIBOR rises at the rate of 50 basis points per 6-month period, starting tomorrow, how much does Heather

save or cost her company by making this swap?

The swap

for the first six-month period is $

(Select from the drop-down menu and round to the

nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- There is a bar on Off‐Main Street called the Rock‐n‐Roll Bar. All the people that go to that bar like to listen to rock‐n‐roll music, and they love live bands. If the bar owner brings bands in to play music on a Saturday night, she will make a lot of money. However there are tenants in this building who get annoyed by the loud music. The benefits/costs to the owner/tenants of having zero, one, two or three bands on a Saturday night are listed below. Assume the bar owner has the right to hire as many bands as she likes. Iftransaction costs were $90, split between the bar owner and the tenants, how manybands would play? What would social welfare be? A. Three bands would play and social welfare would be ‐100.B. Two bands would play and social welfare would be 75.C. Two bands would play and social welfare would be ‐15.D. No bands would play and social welfare would be 0.E. Three bands would play and social welfare would be ‐190arrow_forwardPLS HELP ASAP ON BOTHarrow_forward1arrow_forward

- 3 Calculate the income taxes that a person has to pay considering the table below- If a person's income is $6,500, how much does he pay in taxes? If a person's income is $13,500, how much does she pay in taxes? (a) (b) Taxable Up to $5,000 $5,001-$10,000 $10,001-$15,000 Income Taxes 10% of taxable income 14% of taxable income 16% of taxable incomearrow_forwardOutput TFC 0 $500 2 500 4 CO 00 6 8 10 500 500 500 500 TVC $0 200 340 590 1000 1650 TC $500 700 840 1090 1500 2150arrow_forwardplease fill out a-narrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education