ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

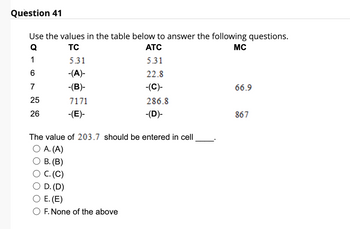

Transcribed Image Text:Question 41

Use the values in the table below to answer the following questions.

Q

TC

ATC

MC

1

6

7

25

26

5.31

-(A)-

-(B)-

7171

-(E)-

5.31

22.8

-(C)-

286.8

-(D)-

The value of 203.7 should be entered in cell

O A. (A)

B. (B)

. (C)

D. (D)

E. (E)

O F. None of the above

66.9

867

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Amex Toy Makers, Inc. markets toys they know pose a possible serious hazard to children under certain circumstances. Does Amex have an ethical duty to remove the toys from the market, even if the injuries only occur in a limited number and only when misused? Why or why not? Explain your answr.r.arrow_forwardPlease do not give solution in image format thankuarrow_forward(1) (33) 02 Refer to the above to answer this question. Which flow is involved if you collect dividends from shares you own in a company? None of these above. Business Sectorarrow_forward

- 1. Two profit-maximising firms call them firm 1 and firm 2- compete in quantities. Before the firms choose their quantities, firm 1 has the option to spend money on advertising, which allows differentiating the two products. That is, firm 1 chooses a € [0, 1] (i.e., 0≤ a ≤ 1) and pays ca, with c> 0. The two firms then face the following inverse demand functions: P₁ = 1-q₁ (1-a)q2 and p2=1-92-(1-a)9₁. There is no cost of production so the profit of firm 1 is #₁ = pigi - ca and the profit of firm 2 is #2 = P292. (a) (c) (d) (b) Without doing any calculation, briefly explain what the market struc- ture would be if firm 1 one chose not to advertise at all (a = 0) and if it chose the maximal amount of advertising (a = 1). [max: 50 words] For any value of a € [0, 1], calculate the equilibrium quantities. Calculate the optimal level of advertising for firm 1. Briefly provide intuition for your results. [max: 50 words] And here is an example. When solving for the question given above, You can…arrow_forwardNumber of wells Total water output (in 1000s of liters/day TR TC AVR Profit 0 0 0 0 0 0 10 100 10000 600 1000 9400 20 200 20000 1200 1000 18800 30 280 28000 1800 933.3 26200 40 340 34000 2400 850 31600 50 380 38000 3000 760 35000 60 400 40000 3600 666.7 36400 70 400 40000 4200 571.4 35800 80 380 38000 4800 475 33200 90 340 34000 5400 377.8 28600 Use your graph and the data in your table to identify the economically efficient numberof wells (Hint: What is the profit maximizing number of wells?)arrow_forwardK L Q MPL APL (Q/L) VML (MPL*P) FC VC (L*150) TC 5 0 0 0 0 5 1 50 50 50 50 25 150 175 5 2 125 75 62.5 150 25 300 325 5 3 225 100 75 200 25 450 475 5 4 375 150 93.7 300 25 600 625 5 5 450 75 90 150 25 750 775 5 6 450 0 75 0 25 900 925 5 7 400 -50 57.14 -100 25 1050 1075 5 8 425 -75 53.12 -150 25 1200 1225 5 9 450 -25 50 -50 25 1350 1375 5 10 500 -50 50 -100 25 1500 1525 5 11 525 25 47.7 50 25 1650 1675 Define the Firm’s Variable Costs. Next, what is the VC in the Table above?arrow_forward

- 48 44 40 36 32 28 24 20 16 12 8 4 100 0 0 Ⓒ (b) $25 (c) $10 (d) $27 (e) $18 4 8 a 12 16 38. What would this firm charge if it wanted to minimize production costs? (a) $5 b. MR 20 MC d 24 28 ATC- AVC- D 32 BENTONGarrow_forwardpls helparrow_forwardK L Q MPL APL (Q/L) VML (MPL*P) FC VC (L*150) TC 5 0 0 0 0 5 1 50 50 50 50 25 150 175 5 2 125 75 62.5 150 25 300 325 5 3 225 100 75 200 25 450 475 5 4 375 150 93.7 300 25 600 625 5 5 450 75 90 150 25 750 775 5 6 450 0 75 0 25 900 925 5 7 400 -50 57.14 -100 25 1050 1075 5 8 425 -75 53.12 -150 25 1200 1225 5 9 450 -25 50 -50 25 1350 1375 5 10 500 -50 50 -100 25 1500 1525 5 11 525 25 47.7 50 25 1650 1675 Define firm’s fixed costs. Next, what is Firm’s FC in the Table above. Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education